Despite the challenging circumstances due to COVID-19, Norfund made record high investments in 2020. Our role as a countercyclical investor is more important than ever.

While foreign direct investment in developing countries fell by 12% in 2020, Norfund increased investments by 20%, to a record of NOK 4.8 billion.

committed in 2020

Despite travel restrictions and other extraordinary challenges when preparing and negotiating new investments in 2020, Norfund investment staff found ways to conduct solid due diligence processes remotely. In some countries, Norfund is in the fortunate situation of having staff on the ground. In other instances, we combined digital meetings with assistance from local consultants.

Contracted economy in all Norfund regions

COVID-19 aggravated an already fragile situation in most of Norfund’s markets. In many cases the economic decline in 2020 has undone growth that will take several years to regain. The pandemic has also resulted in unplanned government expenditure at a time when a reduction in tax receipts is anticipated.

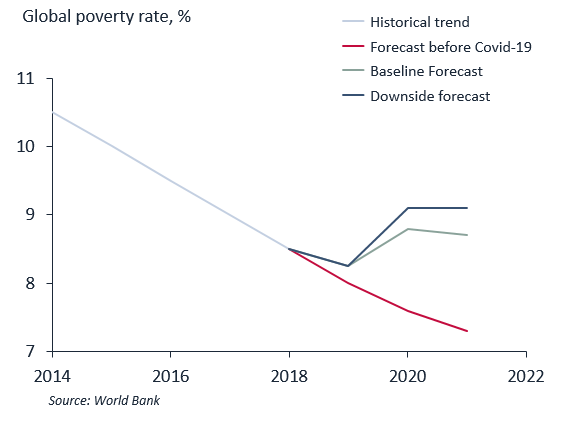

Halted progress towards Sustainable Development Goal 1 – No Poverty

Among Norfund’s regions, Latin America had the sharpest average fall in GDP, contracting by 6.9% (Source: OECD, IIF).

Asia was also deeply affected, with some countries suffering significant output losses, led by the Philippines (-8.1%). The economic growth in Asia is anticipated to rebound moderately, but output is expected to remain 7.5% below pre-pandemic projections by 2022, although with significant cross-country differences.

In Sub-Saharan Africa, the full effect of the economic setback following the pandemic cannot yet be seen. It is expected that it will push millions of people back into extreme poverty, but with large cross-country differences.

Revenue decrease and job losses in portfolio companies

Most of Norfund’s portfolio companies have been affected by the pandemic directly or indirectly.

A survey including half of the portfolio companies indicates that 65% of the companies have experienced revenue decrease as a direct or indirect consequence of COVID-19. Only 32% report a negative impact on jobs, suggesting that many companies have been able to keep employees despite revenue decrease.

Women and young people hardest hit

Women and young people have borne a disproportionate share of job losses, as have lower income households (ILO Monitor). Although there is high awareness of the risk of getting COVID-19, many people have little choice but to go out and look for work.

We often forget the relatively high cost of COVID prevention for poor people; currently buying a disposable face mask and 50 ml of hand sanitiser costs the same as half a litre of milk and a loaf of bread – I won’t even touch on the cost of going for a test, self-isolating or not being able to attend work.

SimbaH Mutasa, Norfund Regional Director, Southern Africa

of surveyed portfolio companies experienced revenue decrease

of surveyed portfolio companies reported job losses

NOK 836 million in COVID-19 support

Since the outbreak in March 2020, Norfund has monitored developments and supported those investee companies hardest hit with capital and other assistance. During the year, 14 investee companies received ‘emergency relief funding’ in the form of additional loans. The majority of the investments in COVID-19 support were within the Financial Institutions and Scalable Enterprises investment areas.

Investments in COVID-19 support 2020, MNOK

Regional distribution of Norfund's Covid-19 support

| Investment | mNOK | Sector | Country |

|---|---|---|---|

| European Financing Parnter (EFP) | 270 | SE | Regional (LatAm + Africa) |

| LAAD | 136 | FI | Latin America |

| Banco Promerica | 92 | FI | Costa Rica |

| Desyfin | 79 | FI | Costa Rica |

| FDL | 53 | FI | Nicaragua |

| NMI Fund II | 57 | FI | Regional (Africa + Asia) |

| Marginpar | 48 | SE | Kenya, Ethiopia |

| Asilia | 43 | SE | Tanzania, Kenya, Uganda |

| Prospero | 27 | FI | Regional (Equador) |

| Cambodia Myanmar Development Fund | 8 | SE-Funds | Regional (Asia) |

| Nordic Microfinance Initiative | 8 | FI | Asia |

| ACRE | 3 | SE | Mozambique |

| Basecamp | 3 | SE | Kenya |

| Sunshine | 2 | CE | LatAm |

In addition, NOK ~4.5 million was invested in Covid related support through Business Support – all allocated to Sub-Saharan Africa.

Adaptation and resilience

Although the year has been challenging for all our investees, many have also demonstrated their resilience. Several investees report that through hard work and an impressive ability to adapt to changing circumstances, they have overcome the crisis so far without having to reduce staff numbers.

DFIs joined forces to respond to COVID-19

Development Finance Institutions (DFIs) have been working together to help resolve the negative economic effects of COVID-19. Focus has been on liquidity issues in the financial sector, supporting existing investee companies impacted by the virus and promoting new investments in goods and services necessary for global health, safety and economic sustainability.