Organisation

Norfund has its head office in Oslo and regional offices in Africa, Asia, and Latin America.

Governance structure

Norfund’s governance structure defines how the Fund is managed, supervised, and held accountable – ensuring that our operations align with our mandates and the instructions by the Norwegian Parliament.

Offices

With headquarters in Oslo and regional offices in Bangkok, Nairobi, Cape Town, Accra and San José, we stay close to the markets where we invest. Our local presence enables us to identify new opportunities, monitor existing investments, and provide sector teams with on-the-ground insight into local business environments and political contexts.

Country focus

East Africa

Particular focus on Kenya, Uganda, Tanzania, Rwanda, Cameroon, and Ethiopia. Can also invest in Somaliland, Southern Sudan, the DRC, and Burundi.

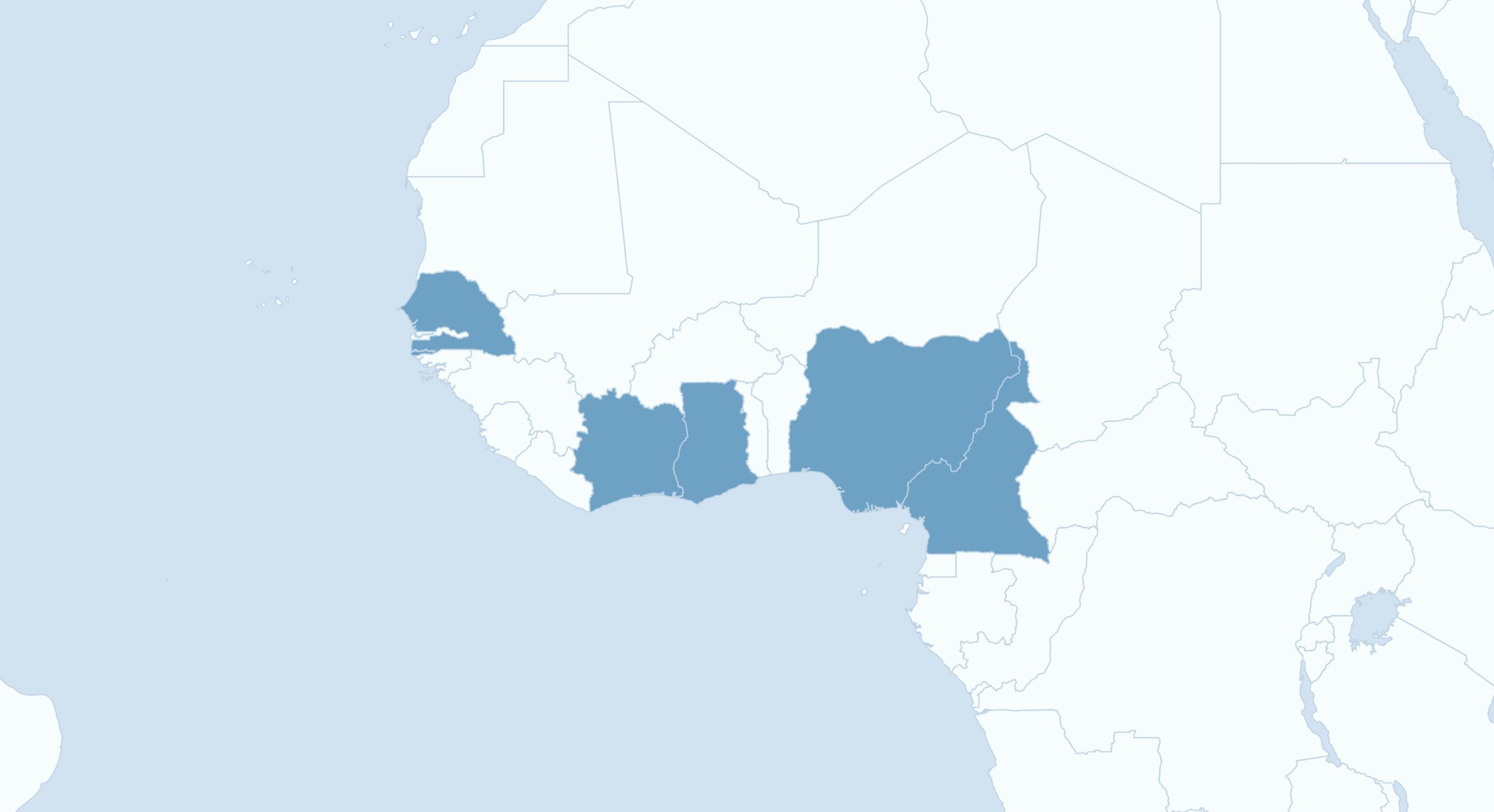

West Africa

Particular focus on Ghana, Nigeria, Côte d’Ivoire, and Senegal. Can also invest in other countries in West Africa in partnership with other investors and funds.

Southern Africa

Particular focus on South Africa, Mozambique, Zambia, Zimbabwe, Malawi, and Namibia.

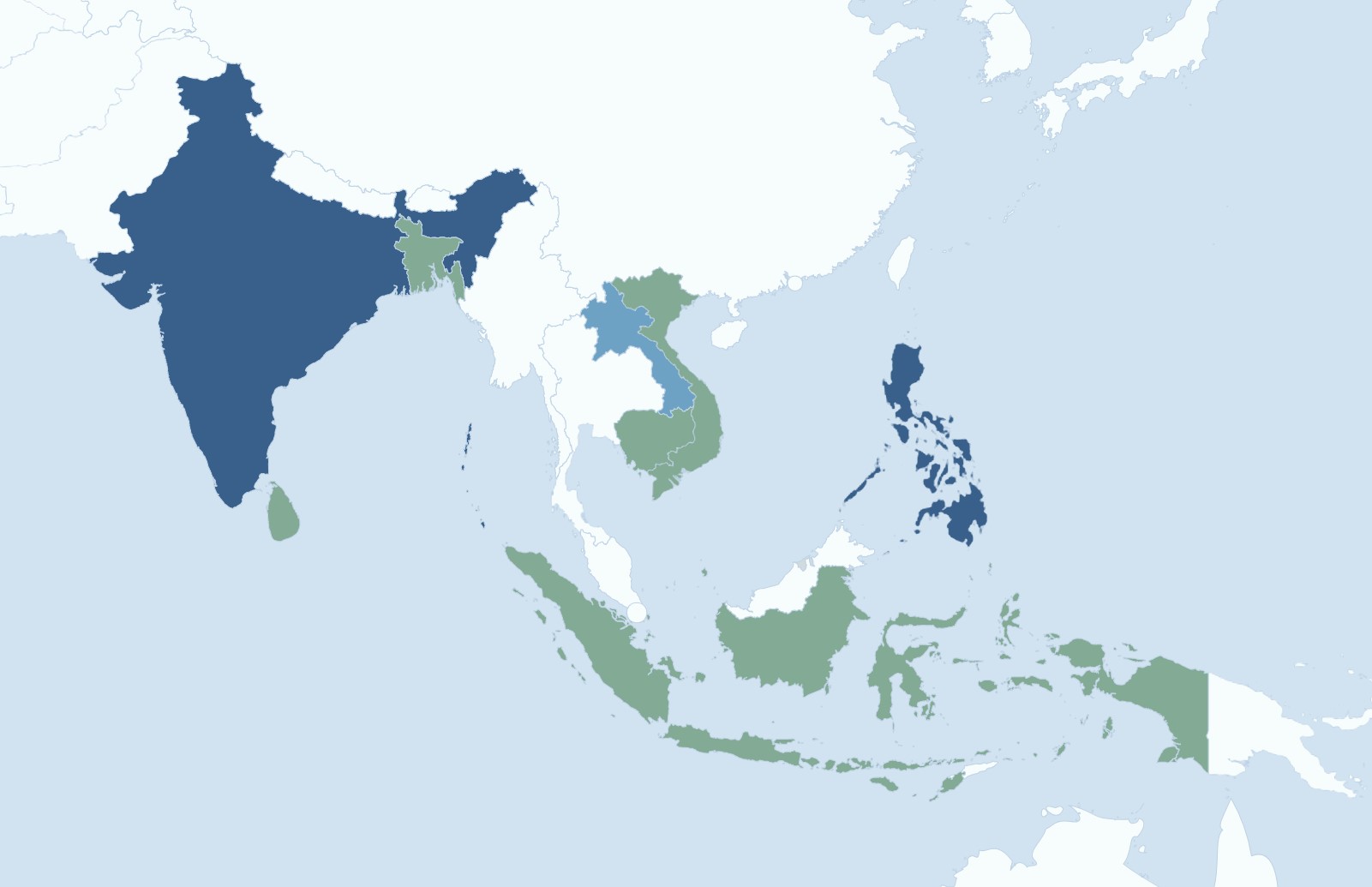

Asia

Particular focus on Vietnam, Indonesia, Bangladesh, Sri Lanka, Cambodia, Laos and Myanmar. We can also invest in the Philippines, India and Nepal in partnership with our strategic co-investors.

Latin America

The targeted countries in the region is Colombia, Guatemala, Honduras, Nicaragua, Ecuador, El Salvador and the Dominican Republic.

Management

Responsible for ensuring that operations align with Norfund’s mandate and investment policies. Oversees day-to-day activities, and ensures that Norfund’s portfolio delivers sustainable development impact and sound financial returns.

Board of Directors

The Board ensures that the Fund operates in accordance with the Norfund Act of 1997 and the Fund’s statutes. The Board defines Norfund’s strategy and approves individual investments exceeding specified thresholds. Other investment decisions are delegated to the CEO.

Norfund’s Board of Directors are appointed by the General Assembly. The General Assembly is constituted by the Norwegian Minister of International Development who governs the state’s ownership in Norfund.

Departments

Norfund has four sector based investment departments, where we follow projects through all the phases of the investment process. This includes dedicated employees dealing with environmental and social issues (E&S).

The Strategy and Communication department at Norfund leads strategy development and implementation, analyses development effects and additionality. The department also works with gender, media, and climate. Finally, they manage stakeholder relations and communication, as well as dialogue with Norfund’s owner, the Norwegian Ministry of Foreign Affairs.

The Finance, IT, Risk and HR department is responsible for Norfund’s accounts, financial analysis and portfolio reporting, as well as for recruitment, skills and staff development. This department is also responsible for Enterprise Risk Management, IT, the Business Support scheme and the Project Development and Risk Mitigation Facility.

The Legal department is responsible for legal and compliance issues.

Investment committee

Norfund’s Investment Committee (IC) is led by the CEO, has eight members, whereof two are external. While the Management Team decides on investments up to USD 4 million, the IC is mandated to decide on investments between USD 4 – USD 20 million and commercial exits. The IC reviews investment proposals above USD 20 million, but final approval is to be made by the Board of Directors.