Despite global economic instabilities, Norfund’s Business Support portfolio has steadily grown and diversified, providing value beyond capital to our investees. In 2024, Business Support approved 21 new projects, reaching 59 active projects divided into five thematic areas.

Active projects per thematic area

Climate

Climate change poses a significant threat to global development, disproportionately impacting developing countries. In response, Norfund has advanced its commitment to supporting the transition to net zero. All new financing shall be aligned with the objective of the Paris Agreement, the portfolio shall be aligned with net-zero pathways, and all new investments shall be assessed for climate risks and opportunities. Business Support has been and will be a key tool for operationalizing efforts and ambitions related to climate, and we have seen an increase in these types of projects. The ambition for the facility in 2024 was to reach even more investees with climate-related projects, but it has taken more time than expected to understand what initiatives are effective and to scale on best practices, hence we have not managed to build up a sizable portfolio. Further, due to the reduction in funding for the facility, Norfund has not been able to prioritize this as planned.

The climate-related projects we have supported include assessing climate risk and implementing plausible adaptation and resilience measures. Further, we have supported some selected investees on measuring and understanding their carbon footprint and implementing emission reduction initiatives.

Read more about Business Support's effort on climate through the BECIS case

assessments conducted

staff members trained

on climate and environment. These assessments, procedures and trainings are interventions ranging from carbon footprint measurement, net-zero strategies and climate risks assessments. This will enable investees and indirect investees in Norfund’s portfolio to take more informed decisions regarding their climate risks and climate footprint.

E&S/OHS

Supporting direct and indirect investees on projects covering Environmental and Social (E&S) aspects of their business, or Occupational Health and Safety (OHS) continues to be a key thematic area for the Business Support Facility, accounting for 41% of the active portfolio. These projects result in better E&S management of the investee, with stronger processes and procedures, that in turn improve employee safety, reduces work-place risks, and create better and safer working conditions. Examples of this include supporting the development of Environmental and Social Management Systems (ESMS) for several of our investees, such as TransAfrica, Banco Cuscatlan, and Banco BDI, and several more indirect investees. As a result, our investees have not only enhanced their compliance with regulatory requirements but also improved their overall operational efficiency and stakeholder relations, contributing to long-term positive impacts on both the environment and society.

procedures implemented

staff members trained

related to E&S/OHS. These projects mainly focuses on Environmental and Social Management Systems (ESMS) in line with the IFC Performance Standards. Consequently, how the companies work with and manage E&S risks in their companies has been strengthened, both at individual- and company level.

Gender Equality

Gender equality is not only a fundamental human right, but also a necessary component to achieve a sustainable future. Overcoming gender barriers enables access to untapped pools of talent and resources, and studies show that companies with gender diversity are 21% more likely to outperform their peers. Additionally, companies with the greatest proportion of women on executive committees earns a 47 percent higher rate of return on equity than companies with no women executives.

To address the gender gap, Norfund is committed to addressing gender equality in our investments and we use active ownership to promote equal opportunities for men and women across all levels in our portfolio companies. Business Support can be a driver for this, for instance, by providing leadership training for female staff in our portfolio companies. Furthermore, during 2024, Norfund, in collaboration with other DFI’s, kicked off a training focusing on Gender Based Violence and Harassment (GBVH) for our investees.

Read more about Business Support's effort on gender equality through the GBVH case

assessments conducted

staff members trained

linked to gender equality for our direct and indirect investees. Topics such as inclusion, gender bias, gender lens investing and gender-based violence and harassment (GBVH) has been covered in the assessments, procedures and trainings.

Corporate Governance

Good corporate governance is essential for Norfund to achieve financial, sustainability and development goals. It refers to the structures and processes for the direction and control of companies. Sound corporate governance adds value to investments and reduces the risks for other investors. As part of this, Business Support has assisted assessments and reviews of corporate governance, which also include Business Integrity (BI) reviews and strengthening of investees procedures and processes on topics like Know Your Customer (KYC) and Anti-Money Laundering (AML).

active projects

in 2024 targeted Anti-Money Laundering risk assessments and Know-Your-Customer/Business Integrity reviews. As a result, our investees are better equipped to comply with sound corporate governance practices.

Operational Improvements

The thematic area Operational Improvements cover a wide range of projects that enhances the development effects of Norfund’s direct and indirect investees, but that are more linked to the operation of the company. Examples can amongst others include digitalisation processes and leadership trainings. It also includes support to Technical Assistance Facilities (TAF) in Norfund’s fund investments, and projects that aim to build capacity and train staff in the portfolio companies. For more information about our support to TAFs, see our case on AFMF's Business Improvement Facility.

Projects that are targeting local communities surrounding Norfund’s investments and projects targeting value chains with smallholder farmers that are linked to Norfund’s portfolio companies are also included under this thematic area.

smallholder farmers reached

with capacity building, training, and other inputs. These farmers have increased their productivity and have increased livelihoods.

Creating Value Beyond Capital

Norfund’s Business Support portfolio is diverse in types of projects and what results they deliver. The composition of the projects in the portfolio depends on new investments, and emerging themes and focus areas of Norfund’s fund managers, investees and other stakeholders. Despite challenging years marked by the pandemic, inflation and debt crises, Norfund’s committed portfolio has seen steady growth and had an increase of 19 percent in 2024. Norfund’s Business Support portfolio has followed, and is experiencing increased demand for supporting new projects, assisting in enhancing the development effects of our investees. The results for 2024 are as expected, and similar to previous years, and we have not been able to scale the facility, its reach and results due to reduction in funding to the facility. Business Support continues to be an important tool for value additionality, assisting Norfund in providing non-financial value to investees that capital markets cannot, resulting in improved development outcomes.

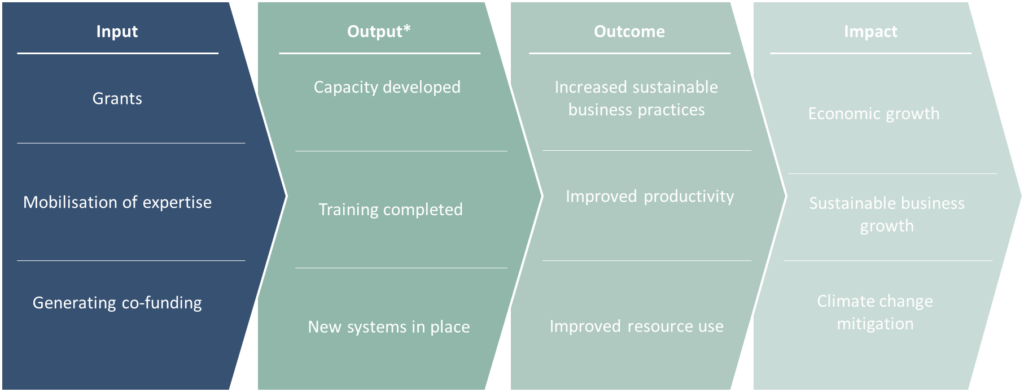

Business Support's Simplified Theory of Change on Enhancement of Development Effects