Kontakt oss

Samarbeid med oss

Norfund investerer på kommersielle vilkår. Vi er en aktiv investor som tilbyr tålmodig og langsiktig kapital.

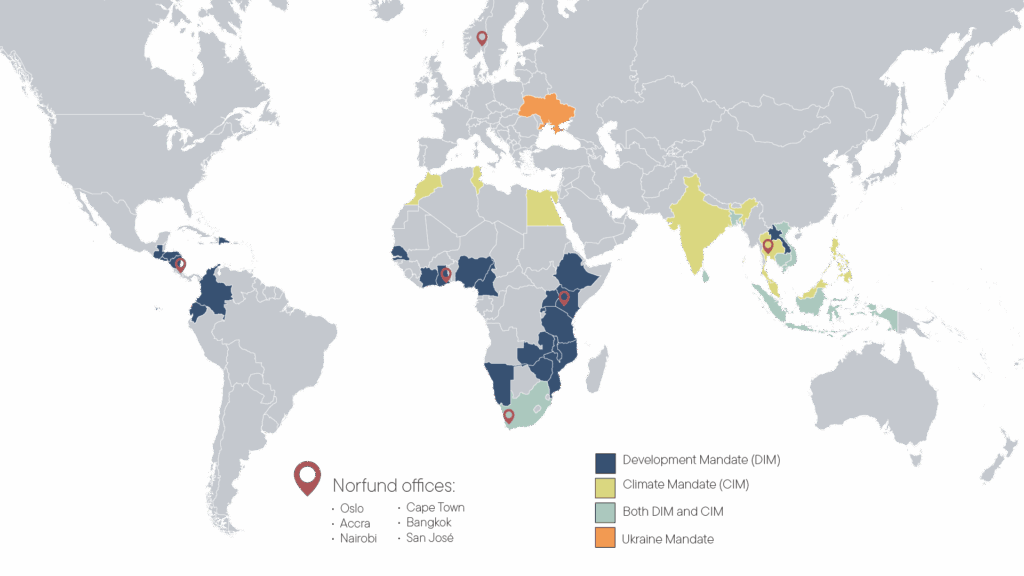

Norfund investerer i bærekraftige og lønnsomme private selskaper og prosjekter i utviklingsland (ODA-godkjente), innenfor våre prioriterte sektorer og geografier.

Gjennom lokal tilstedeværelse søker vi løsninger som er tilpasset landene vi investerer i. Som minoritetsinvestor har vi som mål å mobilisere kapital og tiltrekke andre kompetente investorer til prosjektene våre.

Norfund invests in sustainable and profitable private companies and projects in developing countries (ODA-eligible), operating within our defined sectors and geographies.

Vi bistår porteføljeselskapene våre med å nå høye standarder for styring, samt miljø- og sosial ytelse.

Vi jobber for å være smidige og effektive, med korte beslutningsprosesser.

Hvor vi investerer

Kapitalproduktene vi tilbyr

Egenkapital

- Investeringsstørrelse mellom 5 og 50 millioner USD, med en maksimal eierandel på 35 prosent

- Aktivt eierskap, ofte med styreplass, samt tilgang på fagkompetanse og støtte

- Investeringshorisont på fem til ti år

Mezzaninfinansiering

- En hybrid mellom egenkapital og lån, med fleksible tilbakebetalingsvilkår

Lån

- Senior- og juniorlån fra 5 millioner USD

- Løpetid fra 3 til 10 år, i USD, EUR eller lokal valuta

Fond

- Større, ofte pan-regionale fond som investerer i relativt store selskaper

- SMB-fond

- Impact- og venturefond

- Investeringshorisont på om lag ti år

Business Support

Norfund gir ikke tilskudd. Vi kan likevel tilby teknisk bistand gjennom vårt Business Support-program til selskaper vi allerede har investert i, for å styrke bærekraften og utviklingseffektene av investeringene. Porteføljeselskapene dekker normalt 50 prosent av prosjektkostnadene.