In 2024, Norfund delivered a total return of 8.4 percent in local currency and 19.6 percent in NOK. By the end of the year, the committed portfolio amounted to NOK 43.2 billion, with NOK 7.7 billion committed to new investments during the year. The companies in Norfund’s portfolio employed a total of 712,000 people, with 41,400 new jobs created throughout the year. By the end of 2024, the Climate Investment Fund had financed 7.9 GW of renewable capacity, which will avoid 17.6 million tons of CO2e annually when the power plants are operational.

2024 was a year of great uncertainty. Inflation and rising debt costs have affected wallets and state finances. In many of Norfund’s markets, economic growth is hampered by conflict, uncertainty, climate change, and power shortages.

In October, the World Bank stated that the goal of eradicating extreme poverty by 2030 is out of reach. Over the past five years, there has been virtually no progress due to several shocks to the global economy, such as the COVID-19 pandemic, high inflation, and increasing conflict and vulnerability. The Bank warns that the period 2020-2030 is likely to be a lost decade in the fight against poverty, which is entrenched in developing countries with weak economic growth.

Entering the year, inflation remained high in many countries, and central banks around the world kept interest rates up. Since then, inflation has significantly reduced in most Western countries, and interest rates are on their way down. In their World Economic Outlook from October 2024, the IMF estimates inflation for developing countries as a group to be around 4.2 percent, which is nearly double that in the eurozone. Countries in Sub-Saharan Africa continue to have high inflation, with an average of 12.2 percent. The World Bank warns in its International Debt Report 2024 that the cost of servicing public debt in the poorest countries (IDA countries) has risen to the highest level since 2002, estimated at 1.2 percent of GDP.

The global economy had stable but historically weak growth in 2024, estimated at around 3.2 percent by the IMF. The IMF estimates that the economy in developing countries grew by 4.2 percent in 2024. However, growth is very unevenly distributed. In Asia, large developing countries such as India, Indonesia, and the Philippines all had strong growth, while in Africa, the large economies of Nigeria and South Africa both grew slower than the global growth of 3.2 percent. The World Bank points out that growth in most developing countries is not sufficient to catch up on the lost progress since 2020, especially for the least developed countries and countries in conflict.

A strong dollar, macroeconomic instability, and increasing debt burdens increased the risk for investors in many of Norfund’s markets. A strong US dollar made loans more expensive and weakened local currencies. A rising debt burden made it challenging to maintain growth and attract foreign investments. UNCTAD points out that investments in sectors related to achieving the Sustainable Development Goals fell by as much as 11 percent in 2024, and that investments in food systems, infrastructure, and water and sanitation in 2024 remained at a lower level compared with 2015 when the goals were adopted.

In a challenging 2024, there was also positive progress. Central banks and governments have, in most of Norfund’s markets, succeeded in controlling galloping inflation. Several countries implemented reforms aimed at increasing private investments, such as in Ethiopia, where authorities have taken steps to open up to international investments to increase companies’ access to capital. For many African countries, the entrepreneurial spirits of a growing young population a promising source of economic growth and attention far beyond the African continent. One area where this is already happening is in music, where Afrobeats, with artists like Burna Boy and Ayra Starr, have gained global attention through streaming platforms and social media. The African CEO Forum estimates that creative industries in Africa can create up to 20 million jobs and contribute export revenues equivalent to 4 percent of Africa’s GDP by 2030.

Around 3 billion people had the opportunity to go to the polls in 2024, more than ever before. For many countries, the elections have brought about new vitality and rejuvenation. In Senegal, Bassirou Diomaye Faye was elected president, becoming the youngest elected leader in Africa, while in Sri Lanka, old political elites that have led the country into economic chaos were ousted in favor of an outsider. There have also been cases of elections leading to increasing national tensions and polarization, such as in Mozambique, where BMI Research estimates that the economy shrank by as much as 4.9 percent due to unrest following the election in October.

An increasingly larger part of global aid is being diverted away from long-term development and poverty alleviation in favor of dealing with the consequences of war and conflict and combating climate change. This means that relatively fewer funds are available for aid to job creation and poverty alleviation. The development is further reinforced by aid freezes in the USA and the announcement of new cuts in aid budgets in several European countries.

The EU’s Copernicus program reports that 2024 was the first year with sustained temperatures 1.5 degrees Celsius above pre-industrial levels. According to researchers, this means it is very likely that the Paris Agreement’s ambition to limit warming to 1.5 degrees Celsius will be breached. At COP29 in Baku, a new climate financing goal of 300 billion USD was adopted to combat climate change. The goal is to triple climate finance, and corresponds to 150 percent of the total aid from OECD countries in 2023, and will be dependent on mobilizing substantial private capital in order to achieve the goal.

Transfers from the national budget to Norfund’s development mandate have been stable in nominal terms (NOK) for several years, and in the period 2019-2024. Norfund’s share of the aid budget has thus decreased from 5.2 percent to 3.1 percent (excluding transfers to the Climate Investment Fund). The weakening of the NOK exchange rate against the USD from 2019 to 2024 has further weakened the value of transfers to Norfund by about 20 percent measured in Norfund’s investment currency.

Despite a challenging backdrop, Norfund increased its total investments for the two mandates to 7.7 billion kroner in 2024, up from 6.5 billion kroner in 2023. In 2024, Norfund received 1.7 billion kroner over the state budget for the development mandate and 1 billion kroner for the Climate Investment Fund, as well as 250 million kroner for the newly established Investment Fund for Ukraine. A higher commitment level is possible thanks to available capital from the sale of SN Power (completed in 2021), a recycling of capital through the sale of investments and loan repayments.

About Norfund

Norfund’s mandates and strategy

Norfund was established in 1997 as Norway’s most important tool for promoting investments in developing countries. The fund’s purpose is to contribute with equity and other risk capital, as well as provide loans and guarantees for the development of sustainable business activities in developing countries. The aim is to establish viable and profitable businesses that would not otherwise be initiated due to high risk.

Norfund is a responsible owner that adapts its ownership to the sector, instrument, and risk. For some investments (e.g., equity investments with a significant minority share), the fund will have an active role, while for others (e.g., loans to banks), it is natural to be less active. However, Norfund is always a responsible owner that sets high ethical standards. Norfund aims to sell its stake when the fund is no longer necessary for the investment, so that the capital can be recycled and put to work in new investments.

Since 2022, Norfund, has also been responsible for managing the Climate Investment Fund, which builds on Norfund’s long experience with investments in renewable energy. In December 2024, Norfund was also tasked with managing the Investment Fund for Ukraine as a separate mandate.

For the development mandate, Norfund aims to create jobs and improve living conditions by investing in businesses that contribute to sustainable development. Norfund has four investment areas: Financial Inclusion, Renewable Energy, Green Infrastructure, and Scalable Enterprises. Each of the four investment areas has ambitions that directly and measurably contribute to achieving the UN’s Sustainable Development Goals. Under the development mandate, Norfund prioritizes investments in countries with limited access to capital, particularly the least developed countries (LDCs) and Sub-Saharan Africa, in addition to equity as the preferred instrument. The Ministry of Foreign Affairs decided in 2022 that approximately 60 percent of capital contributions from the state budget over time should be invested in renewable energy.

For the climate mandate (Climate Investment Fund), the goal is to promote the transition to net-zero emissions in emerging markets. Under the climate mandate, Norfund mainly invests in the production and development of renewable energy, as well as areas closely related to this. Norfund prioritizes equity investments for this mandate as well. The climate mandate is primarily aimed at middle-income countries where the opportunities to reduce or avoid greenhouse gas emissions are significant.

The Ukraine mandate (Investment Fund for Ukraine) was established in December 2024 and aims to contribute to the development of sustainable business activities and job creation in Ukraine. The fund will support investments that would not otherwise be carried out due to the high risk in Ukraine. The fund will contribute to mobilizing private capital by having private investors invest alongside the fund or be inspired by the fund. Since its inception, Norfund has been working to identify potential investments, and the ambition is to commit the first investments during 2025.

Financing

Norfund is financed through annual capital contributions from the state, as well as profits from investment activities. In 2024, capital contributions from the state amounted to 1,678 million kroner under the development mandate (including 25 million kroner allocated to the Frontier Facility, 1,000 million kroner under the climate mandate, and 250 million kroner for the Ukraine mandate (allocated in December 2024). In addition to capital contributions, Norfund received 10 million under the “Business Support” grant scheme.

Returns in the form of interest and dividends from investments, loan repayments, and the realization of previous investments constitute an increasing share of the fund’s available investment capital, allowing Norfund to invest far more than the capital provided over the state budget and thus contribute to even greater impact on development and climate.

Additionality

Most countries where Norfund invests are perceived as less attractive to international investors because the risk is considered too high. Norfund’s expertise, willingness, and ability to manage risk are therefore important for providing capital to these countries and succeeding with investments. Norfund aims to be additional in all investments. The fund is financially additional by providing capital that businesses would otherwise find difficult to access due to capital scarcity and high risk. Norfund is value-additional by providing value beyond capital by being an active owner, strengthening the sustainability of the business, and contributing to business improvements. Norfund is a minority investor and thus also helps to mobilize capital from other investors both in Norway and internationally. Norfund’s expected additionality is assessed before each investment and reported to the OECD’s Development Committee and on Norfund’s website.

The OECD requires that all investments made by development finance institutions must be additional. In 2024, Norfund underwent an “ODA eligibility assessment” conducted by the secretariat of the OECD’s Development Assistance Committee. Norfund achieved a full score in this assessment, which means that our systems and reports comply with all requirements.

External evaluation of renewable energy investments

In 2024, Norfund was subject to an external evaluation conducted by KPMG Norway on behalf of the Department for Evaluation of Norwegian Development Cooperation. The evaluation covered investments in renewable energy under Norfund’s development mandate from 2015-2023, and under the Climate Investment Fund from 2022-2023.

The report shows that Norfund’s investments have contributed to increased electricity production, better access to renewable energy, and avoided greenhouse gas emissions in developing countries. In the years covered by the evaluation, Norfund has contributed to financing more than 11 GW of new renewable capacity and to over 7 million households gaining access to electricity. An important finding is also that Norfund’s requirements for profitability and economic sustainability in investments, along with efficient operations in its own organization, are important contributions to the good results.

Norfund will in 2025 assess how the recommendations in the evaluation report are best followed up and keep the Ministry of Foreign Affairs informed through the regular ownership dialogue.

Norfund’s total portfolio in 2024

In 2024, the portfolio (development mandate and climate mandate) delivered a return measured by IRR (internal rate of return) of 8.4 percent in local currency and 19.6 percent in NOK. The Norwegian krone weakened by 10.7 percent against the USD during the year, which is reflected in the IRR figures in Norwegian kroner. Since its inception, the portfolio has an IRR of 5.2 percent in local currency and 8.7 percent measured in Norwegian kroner.

As of 31.12.2024, Norfund’s committed portfolio totaled 43.2 billion kroner. During 2024, the fund committed 7.7 billion kroner. The results for the Development Mandate and Climate Mandate are described in more detail below.

Development Mandate – portfolio in 2024

In 2024, the development mandate delivered a return measured by IRR of 8.3 percent measured in investment currency and 19.7 percent measured in NOK. Since its inception, the portfolio has had an IRR of 5.1 percent measured in investment currency and 8.6 percent measured in NOK. At the end of 2024, the committed portfolio was 37.6 billion kroner.

Norfund committed 6 billion kroner under the development mandate in 2024, distributed across 23 new and 19 follow-up investments. The commitments for the year were broadly distributed among the investment areas, with 2.6 billion kroner to Financial Inclusion, 1.6 billion kroner to Renewable Energy, and 1.6 billion to Growth-Oriented Businesses. Green Infrastructure committed 234 million kroner.

The committed portfolio in LDCs (least developed countries) accounted for 34 percent of the portfolio at the end of 2024, while Sub-Saharan Africa accounted for 64 percent. Equity accounted for 73 percent of the portfolio at year-end. The target for renewable energy ended at 68 percent at the end of 2023. Norfund’s portfolio is thus in line with the targets set by the board that the portfolio should have at least 33 percent in LDCs and 50 percent in Sub-Saharan Africa, 70 percent in equity, as well as the statutory target that approximately 60 percent of capital contributions to Norfund over time should be invested in renewable energy .

Norfund prioritizes investment areas where there is an opportunity to contribute to significant development effects. Each investment area has a theory of change that shows how Norfund’s capital and expertise contribute to development effects and the achievement of the UN’s Sustainable Development Goals. For the development mandate, these are SDG 1 (No Poverty), 7 (Affordable and Clean Energy), 8 (Decent Work and Economic Growth), and 9 (Industry, Innovation, and Infrastructure).

Norfund annually collects data on development effects from portfolio companies (both direct investments and indirectly through platforms and funds). At the end of 2024, there were a total of 712,000 jobs in the companies Norfund is invested in, of which 699,000 jobs were in companies under the development mandate. About three-quarters of these jobs are permanent. A full 64 percent of the jobs are in Africa, and 27 percent are in LDCs.

To be able to say something about development over time, data from companies that have reported for two consecutive years are analyzed. Net (the balance between lost and new jobs), 41,400 jobs were created in companies Norfund is invested in. Of these, 39,800 jobs were created in companies under the development mandate.

Payment of taxes and fees is an important contribution to the countries Norfund invests in. In 2024, companies in the development mandate’s portfolio paid a total of 41.2 billion kroner in taxes and fees, of which 30 billion in Africa. Furthermore, 64 billion in wages were paid in the companies Norfund is invested in, also mainly in Africa.

Quantified ambitions have been set for each investment area that reflect accumulated organic growth (i.e., development in the companies after Norfund became an investor) on sector-relevant parameters. The ambitions are set for the entire strategy period (2023-2026) and not for individual years.

Halfway through the strategy period, investments in Renewable Energy under the development mandate are approaching the goal of increased financed capacity but are significantly below the target for households that have gained access to electricity. In Financial Inclusion, investments are well on their way to reaching the goal of an increased customer base but are still some way off the goal of increasing outstanding loan volume. Direct investments in Growth-Oriented Businesses have already met both goals for the strategy period, while indirect investments through funds are well-positioned to reach the goal of increased company revenues but are somewhat behind the expected level for job creation. The data reported is not attributed, meaning it shows the total effect of the portfolio companies and does not take into account Norfund’s ownership share. More detailed information about Norfund’s development effects is available in the annual report.

Frontier Facility – portfolio in 2024

Frontier Facility is a facility managed by Norfund for project development and risk mitigation and is intended to take higher risks compared to Norfund’s ordinary mandates. The facility receives earmarked funds over the state budget. Through the scheme, Norfund contributes to project development and risk mitigation at an early stage. The portfolio consists of ten projects, with a total commitment of 183 million kroner.

In 2024, Frontier Facility published its first status report, which evaluated goal achievement from 2019 to 2023 on the indicators provided by the Ministry of Foreign Affairs. The results from the status report show that Frontier Facility has had good goal achievement and mobilized private capital by initiating investments that would not otherwise have happened, as well as reducing risk for private actors in challenging markets. The facility has invested in early-stage project development and risk mitigation measures within Norfund’s investment areas.

Climate Investment Fund – portfolio in 2024

In 2024, the Climate Investment Fund (climate mandate) delivered a calculated return measured by IRR of 9.3 percent in investment currency and 18.2 percent in NOK. Since its inception, the portfolio has had an IRR of 14.4 percent in investment currency and 19.0 percent in NOK. The return figures must be seen in light of the fact that the fund is relatively new with still few investments and no realizations.

At the end of 2024, the committed portfolio was 5.6 billion kroner. In 2024, the fund made its first investment in Indonesia through the company Xurya, which provides renewable energy solutions directly to businesses. Norfund also launched a new platform for investments in power grids in India together with IndiGrid and British BII. There is a great need for investments in transmission in India to handle the growth in renewable variable power such as wind and solar power. The majority of the fund is invested in India and South Africa, and work is therefore underway to expand the portfolio geographically.

Also, for the climate mandate, Norfund’s investments directly contribute to the UN’s Sustainable Development Goals. These are SDG 13 (Climate Action), 7 (Affordable and Clean Energy), and 8 (Decent Work and Economic Growth). For 2024, Norfund’s new commitments contributed to financing 1,250 MW of renewable energy and to estimated ex-ante avoided greenhouse gas emissions of 2.9 million tons annually. This is lower than previous years due to several investments in transmission, which do not count towards the ambitions.

The Climate Investment Fund is on track to exceed the goals set for the fund’s first strategy period (2022-2026) of 9 GW of renewable energy financed and 14 million tons of avoided greenhouse gas emissions annually. At the end of 2024, the fund has contributed to financing 7.9 GW of renewable capacity, which will contribute to avoiding 17.6 million tons of CO2e annually when the power plants are operational.

In 2024, the greenfield projects that KIF has helped finance produced 3,421 GWh, resulting in 3.4 million tons of avoided CO2e emissions. Capacity under construction or already installed is increasing rapidly from year to year and was 4,643 MW at the end of 2024.

Investment Fund for Ukraine – portfolio in 2024

Norfund was assigned the task of managing the new Investment Fund for Ukraine in December 2024, and no investments were made in the fund in 2024. Norfund has been working to build a pipeline of potential investments. The fund aims to make its first investments in 2025.

Statement on the annual accounts

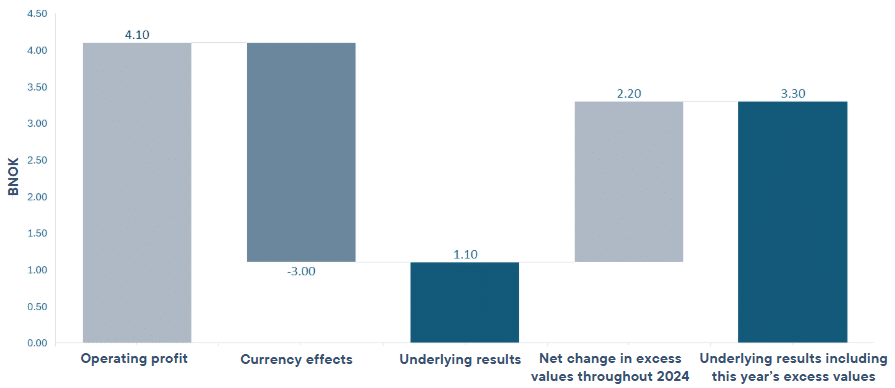

Norfund ended the year with operating revenues of 2,086 million kroner and a positive result after tax of 4,099 million kroner. The result is significantly affected by currency effects due to a weaker Norwegian krone against our primary currency USD. Currency effects in the result amounted to 2,995 million kroner, compared to 472 million kroner in 2023. The currency effects are mainly due to value adjustments of our investment portfolio and our liquidity placements in foreign currency, as well as effects from realized gains and losses.

The historically weak krone gives investments and cash holdings a higher value measured in NOK and shows the strong impact exchange rate fluctuations have on revenues and annual accounts. This effect will be reversed if we have a corresponding strengthening of the Norwegian krone. Nevertheless, for the Board, it is the IRR (return) in investment currency that is the relevant metric as this more accurately reflects Norfund’s underlying results.

Excluding exchange rate effects, the result for 2024 is 1,104 million NOK, a reduction of 320 million NOK compared to 2023. Result effects for each year come directly from revenues and costs, as well as from value changes in existing investments and the realization of investments. The negative change in underlying results in 2024 (compared to 2023) is mainly driven by increased write-downs, as well as lower realized gains and losses, somewhat offset by increased income from dividends and interest.

Interest income from operations has increased from 1,080 million NOK in 2023 to 1,356 million NOK in 2024. Interest income consists of interest income from the loan portfolio and liquidity placements, which include a bond portfolio in foreign currency. The growth in interest income can mainly be explained by an increase in the loan portfolio by 17 percent during the year from 8,147 million NOK to 9,537 million NOK, as well as a weakened Norwegian krone against the US dollar by 11.6 percent compared to 2023. The accounts show realized gains from the portfolio totaling 109 million NOK, of which 45 million NOK are realized positive exchange rate effects. Realized underlying gains excluding exchange rate effects are mainly from Arrend (43 million NOK) and Basecamp (15 million NOK). Furthermore, the company received 578 million NOK in dividends, with the most significant being Agua Imara (179 million NOK), Arise B.V. (140 million NOK), and Klinchenberg (115 million NOK).

Salary costs have increased by 13 percent compared to 2023, to 246 million NOK. Both investment and staff functions were further strengthened throughout the year. This also leads to increases in other cost areas, but overall, within expectations. Operating costs measured as a percentage of committed portfolio remain stable at 1 percent, consistent with the goal that these should be below the average for comparable development finance institutions.

Realised loss and value changes for investments and receivables in 2024 ended at positive 1,929 million NOK compared to positive 167 million NOK in 2023. This consists of realised losses including exchange rate effects of negative 226 million NOK in 2024 and value changes totalling positive 2,155 million NOK.

Value changes consist of write-downs, reversals of write-downs, and exchange rate effects related to investments in loans, shares, and funds, liquidity placements, and receivables in the annual accounts. Total exchange rate effects related to value changes in 2024 were positive 2,609 million NOK compared to positive 514 million NOK in 2023.

Total write-downs for investments and receivables in 2024 excluding exchange rate effects were negative 454 million NOK compared to negative 227 million NOK in 2023. The write-downs are partly due to some companies in the portfolio being burdened by volatile commodity prices and delays in global value chains, among other things as a result of conflicts in the Middle East and the war in Ukraine. The same applies to the situation in Myanmar where conditions continue to be challenging, and some larger value reductions are made here. There is also a risk related to currency in Africa in general and Mozambique in particular through limited access to USD, which poses a challenge when it comes to loan repayments.

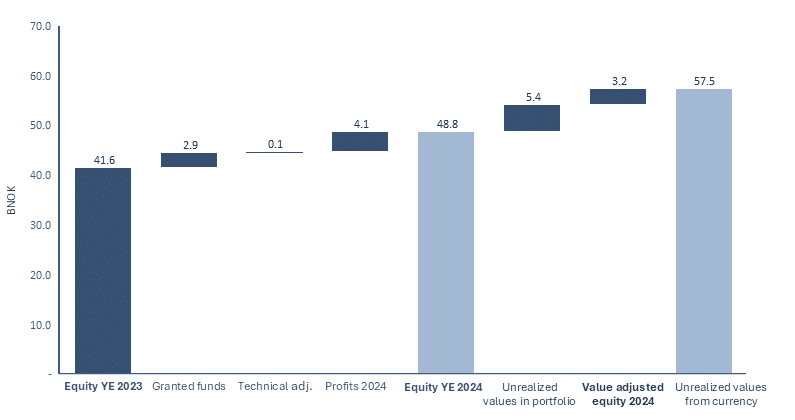

Norfund’s total balance as of the end of 2024 was 49,119 million NOK. The balance increased by 7,077 million NOK from 31.12.2023, of which earned result added to equity amounted to 4,099 million NOK and the year’s capital contribution from the state budget amounted to 2,928 million NOK. Adjusted equity based on estimated market values for Norfund’s portfolio was as of 31.12.2024 at 57,460 million NOK.

At the end of 2024, Norfund had outstanding, unpaid commitments totaling 9,606 million NOK. The cash balance was at the same time 6,457 million NOK in addition to liquidity placements of 8,357 million NOK. Of the liquidity holdings, 2,000 million NOK is earmarked for the Climate Investment Fund, which will be invested in the period 2025-26. As a result of a growing capital base, it was decided in 2024 to strengthen liquidity management. This was done through increased staffing and the decision to establish a separate treasury mandate. The board considers liquidity to be good and confirms that the prerequisites for continued operations are in place. In the board’s opinion, the annual accounts for 2024 provide a true and fair view of Norfund’s financial position.

Organization, environment, and responsible business tax

Corporate governance

The general assembly is Norfund’s highest authority. Governance is exercised through general meeting decisions, including the establishment and amendment of Norfund’s articles of association. In 2024, an extraordinary general meeting was held in connection with the establishment of the Investment Fund for Ukraine and the determination of compensation for the newly established compensation committee. The Ministry of Foreign Affairs receives quarterly reports, and regular contact meetings are held throughout the year.

Norfund’s board is elected by the general assembly. Two members are elected by and among the fund’s employees. The board consists of nine members. The Risk and Audit Committee (RRU) consists of the committee chair and two members elected from the board’s members. In 2024, the board established a Compensation Committee consisting of three members. In 2024, the board had a total of seven board meetings and six meetings in the RRU. Norfund has taken out liability insurance with AIG that covers the board’s members and externally appointed board members in portfolio companies.

Norfund has a framework of governance documents that covers everything from the Norfund Act, the articles of association, and overarching frameworks adopted by the board to administration-adopted guidelines for important subject areas and routines and procedures for carrying out and following up on investment activities. The structure and guidelines are regularly updated and adapted to Norfund’s operations. The Investment Committee reviews investment proposals and contributes to quality assurance. In 2024, the committee consisted of nine people, three of whom are external. The Credit Committee reviews and approves loans to financial institutions and consists of five members, (including one external member). Both committees review individual investments between USD 4 million and USD 20 million, and the investments are approved by the managing director. Both committees must also give their recommendation on investments over USD 20 million, but these are approved by the board. Smaller investment decisions are also raised with the board when necessary, for example, if there are elements with particularly high risk or reputational sensitivity. Investments up to USD 4 million are reviewed and approved by the administration.

Data, risk management, and internal control

Taking risks is at the core of Norfund’s mandate. What risks Norfund has and how these are managed are described in Norfund’s risk appetite statement, adopted by the board. The statement describes two risk categories. The first concerns where and in what Norfund invests (such as markets, instruments, and currency risk). These risks are managed through Norfund’s market insight, local presence, and portfolio diversification. The second category is risk related to how the company selects investment partners and how Norfund carries out investments and operates the organization (e.g. partner and corruption risk, environmental and social conditions, and HSE). The risks can be minimised by designing and implementing appropriate systems and regular training, contractual terms, internal control, and compliance.

The Enterprise Risk Management framework is a tool used by management and the board to identify, understand, and manage key operational risks. The administration’s proposal for the top ten risk areas is discussed with the risk and audit committee before being presented to the board. Proposals for areas for external internal audit are compared with the risk overview, and the committee gives a recommendation that is reviewed and decided by the board.

Norfund monitors portfolio exposure and country risk exposure. The board has set risk thresholds for exposure to individual countries and groups of countries, which are followed. In 2024, this particularly applied to the climate mandate, which has significant exposure to India and South Africa.

Norfund has zero tolerance for corruption and financial irregularities and has established systems to prevent, detect, report, and handle misconduct cases. In 2024, 15 “Business Integrity Incidents” were reported, of which 12 incidents concerned allegations of financial misconduct in the portfolio. The cases are followed up in accordance with established procedures. One of the cases was of such a nature that it was reported further to the Ministry of Foreign Affairs.

Organization and efficient operations

Norfund has seen significant growth in recent years in terms of increased investment volume, a growing portfolio, and more employees. The external evaluation of Norfund’s investments in renewable energy conducted in 2024 found that Norfund operates very efficiently compared to other European development finance institutions. For 2024, Norfund’s operating costs amount to 1 percent of the committed portfolio, in line with the goal that this should be below the average for comparable institutions within development finance. The board regularly evaluates resources and cost levels to ensure a robust organization adapted to Norfund’s mandate and risk profile.

Increased complexity as a result of the organisation’s growth is a risk. Norfund works systematically with culture to ensure that the organisation develops in a way that allows Norfund’s mission to be carried out in the best possible way. The board regularly evaluates resources and cost levels to ensure a robust organization adapted to Norfund’s mandate and risk profile.

At the end of 2024, Norfund had 157 employees, of whom 149 are permanent positions, and with 30 nationalities represented. About two-thirds of the company’s employees work directly with investments, while one-third are attached to staff functions. In addition to the office in Oslo, Norfund has five regional offices in our markets. Strong regional offices with experienced teams working closely on the company’s markets are crucial for the success of Norfund’s investment strategy.

In 2024, recruitment of new permanent positions primarily strengthened the staff areas and the investment area of Renewable Energy. About 30 percent of the new hires in 2024 belong to one of the regional offices in line with the ambition that the organisation’s growth should happen in our markets.

The gender balance is good with 51 percent female and 49 percent male employees. Within both the company’s top management and the extended management group, the proportion of women is 43 percent. In 2024, 27 new employees started, including 8 on temporary contracts. Measured in permanent positions, Norfund’s turnover in 2024 was 4.1 percent.

Norfund had a sick leave rate of 3 percent in 2024, which is the threshold value Norfund internally has set for sick leave. The board does not find it necessary to implement special measures related to the working environment.

Norfund annually maps salary levels with a particular focus on gender-related salary differences according to the principle of equal pay for equal work. The findings indicate that there is no systematic difference in salary between genders, as can be read more about in the activity and reporting obligation. Norfund should be competitive, but not a leader in terms of salary. Guidelines for executive pay, the executive pay report, and the explanation of work on gender equality and work against discrimination (ARP) are available on Norfund’s website.

Responsible business

Corporate social responsibility is a starting point for Norfund’s operations both for its own operations and portfolio companies. The cross-cutting considerations in Norwegian development policy – human rights, gender equality, anti-corruption, climate, and the environment – are all included in this work. Norfund is a responsible owner that contributes to companies’ value creation. In 2024, the board adopted an updated E&S sustainability policy for our work in the area of environment and social conditions (E&S), climate, and gender equality.

Norfund works systematically with environmental and social conditions through the investment process. IFC’s (International Finance Corporation) standards for environmental and social conditions are used in this work and are adapted to investments in developing countries. By using these standards, Norfund meets the expectations of responsible business in the government white paper on ownership policy, Meld. St. 6 (2022–2023). Norfund’s work is in line with the state’s expectation to carry out due diligence in accordance with recognized methods.

A statement on Norfund’s due diligence in accordance with the requirements of the Transparency Act is available on Norfund’s website.

Norfund has significantly strengthened its work on climate in 2024 and adopted a strategy for climate transition and the shift to net zero. The ambitions and measures reflect that climate can affect each company’s ability to succeed, owners’ expectations, and that Norfund is an investor in developing countries with different challenges and opportunities than those found in more developed markets. Norfund aligns all new investments with the Paris Agreement over time, assesses climate risk for all new investments, and reports on climate risk according to the TCFD framework.

Regarding emissions from the portfolio (Scope 3, category 15), Norfund works with portfolio companies to increase competence and reporting ability, thereby improving the quality of emissions data. This will eventually contribute to more companies being able to map and reduce their own emissions and enable reporting on emissions in the portfolio.

Norfund also has emissions from its own operations. Norfund is certified as an Environmental Lighthouse and uses this framework to improve internal environmental work. Direct greenhouse gas emissions from Norfund’s operations were 1140 tonnes in 2024, with the majority originating from air travel.

Good working conditions are a requirement for all businesses in Norfund’s portfolio. Norfund monitors health, environment, and safety (HSE) in all investments with a particular focus on training and compliance with HSE routines. Reporting of serious incidents, accidents, and deaths is a requirement in investment agreements. In 2024, Norfund regrettably experienced 8 work-related deaths in companies where Norfund is directly invested. Such incidents are reported to the board and in special cases also further to the Ministry of Foreign Affairs. Norfund follows up on such deaths to ensure they are investigated, safety routines are adjusted if necessary, and that the bereaved receive the compensation they are entitled to.

Norfund has clear guidelines for responsible tax comparable to other European development finance institutions. Overall, the use of third countries is relatively high, partly due to significant investments in regional funds and structures where the use of third countries is considered necessary. With assessments of both structure and domicile against Norfund’s tax guidelines, the use of third countries is considered justifiable.

Norfund has a grant scheme financed by the Ministry of Foreign Affairs. The scheme has existed since 2000 but has had significantly reduced funding in recent years. Norfund received 11 million NOK in 2024, down from 32 million NOK in 2021. The purpose of the scheme is to strengthen the development effects of investments. Norfund supports, for example, capacity building and training in climate adaptation and emissions reduction, gender equality measures, and measures to strengthen how companies work with E&S. In 2024, 21 new projects received grants, and 15.8 million NOK went to this portfolio, which consisted of 59 active projects.

In 2024, work continued to strengthen gender equality in individual investments, through tailored programmes for the individual company, as well as through the Female Future programme and The Boardroom Africa, both of which offer leadership development. In collaboration with other development finance institutions, Norfund has rolled out a training programme to combat gender-based violence and harassment (GBVH). Much of this work depends on funding through the grant scheme, which has limited funds. In addition, Norfund participates in 2X Global, an international collaboration on gender equality.

Norfund has regular dialogue and cooperation with civil society organizations and other partners. In 2024, Norfund had thematic meetings on climate, E&S, and gender equality, in addition to the annual dialogue meeting with all interested parties around the launch of the business report in June. Civil society is also a target group at the annual Norfund conference, which has themes of dilemmas and challenges in Norfund’s work.

Looking ahead

The increased geopolitical tensions have marked the beginning of 2025, and international rules-based cooperation is under a historical pressure. There is great uncertainty about the role the US, which has historically been by far the largest aid actor, will play going forward, while aid budgets in many European countries are being cut in favour of military build-up. For the remaining aid, there is an increasing expectation that it will serve national self-interests as much as it will help fight poverty and climate change. Going forward, there will be increased pressure to clearly document the effect and results of aid, as well as to use scarce aid funds in a way that triggers other, particularly private financing sources.

In a world where the law of the strongest prevails, we can assume that weaker actors are at risk of losing. Norfund expects that our markets and investments will feel the geopolitical backdrop in 2025 in new ways. Most estimates indicate that increasing tensions and trade wars will negatively impact Norfund’s markets. The IMF estimates global economic growth of 3.3 percent in 2025, just up from the estimated growth in 2024. Projections for emerging economies are about one percentage point higher, but with significant differences between countries and regions. Asia has the most positive outlook, driven by strong expected growth in large economies (6.5 percent growth in India). In Latin America and the Caribbean, the outlook is much worse, with an estimated growth of 2.2 percent. Growth in Sub-Saharan Africa is estimated at 4.2 percent, which is also the estimated average for emerging economies. However, it is worth noting that the two largest economies in Sub-Saharan Africa, Nigeria and South Africa, are both expected to grow much slower.

The financing gap to achieve the sustainable development goals continues to grow, and the OECD estimates the gap to be USD 6400 billion by 2030 if the world continues on its current course. In July, world leaders will meet for a new “Financing for Development” conference in Seville, Spain, to discuss how to bridge the gap. Private sector investments must play a key role if we are to succeed, both because aid and public financial flows are far from enough to cover the investment needs, but also to contribute to solutions and tax revenues that can help bridge the gap.

2025 is the year the UN’s climate panel has estimated that greenhouse gas emissions must peak if the world is to keep the global temperature increase within the targets of the Paris Agreement of 1.5-2°C. There are significant investment needs if we are to succeed in reducing emissions and transitioning in line with the targets, and we will be dependent on mobilising private actors to reach the climate financing goal from COP29 of USD 300 billion.

Common to the financing gap for the Sustainable Development Goals and the climate financing goal are the high expectations for mobilising private capital. To succeed with the ambitions, it is necessary to scale up measures with documented effect, such as private sector investments. Such investments are still less than 2 percent of total aid from OECD countries. Norfund’s most important contribution will be to continue to be a responsible, long-term investor and take risks where others cannot or will not.

A challenging global landscape creates difficulties for Norfund but also shows the need for a patient and counter-cyclical investor like us. When capital flows out of developing countries, Norfund’s role becomes even more important. High unemployment in many markets requires viable, profitable businesses that can create jobs and a healthy financial sector that can finance these. And these jobs must be created within the limits of what nature and climate can tolerate.

In 2025, Norfund has an ambition to commit NOK 10 billion and have a total portfolio of approximately NOK 50.4 billion by the end of the year. Norfund can invest far more than the NOK 2.9 billion that has been allocated to Norfund over the aid budget, as profitable investments allow the capital to be recycled. However, it is expected that this capacity will be reduced going forward as the funds from the sale of SN Power are fully invested, and continued capital inflow becomes even more important.

Norfund cannot succeed alone. Therefore, cooperation with partners – portfolio companies, co-investors, owners, and other stakeholders – is crucial. The board is grateful for the trust Norfund received in 2024 and will do its best to deliver also in 2025.

The board considers Norfund well-equipped to deliver on the strategy and goals that have been set and thanks the management and employees for important work in a challenging year. Diversity and strong presence in our regions contribute to us being well-prepared for the future. Norfund will continue to be an important player in order to succeed with ambitious policies for development and climate, and to contribute to create jobs and improve living conditions, and supporting the transition to net-zero emissions in developing countries.

Oslo, 26 March 2025

Olaug Johanne Svarva

Jan Tellef Thorleifsson

Martin Skancke

Jarle Kjell Roth

Pablo Alberto Barrera Lopez

Åslaug Marie Haga

Anne Jorun Aas

Brit Kristin Sæbø Rugland

Karoline Teien Blystad

Vegard Benterud

Board Chair

CEO

Board member

Board member

Board member

Board member

Board member

Board member

Board member

Board member