Norfund is the Norwegian government’s main instrument for private sector development and for accelerating the energy transition in developing and emerging markets. We invest in businesses that create jobs and drive the shift to renewable energy in high-emission countries—contributing to poverty reduction and avoiding emissions.

Throughout 2024, we continued to invest in regions where access to capital was notably scarce. Our approach includes prioritizing equity investments, mobilizing and circulating capital for greater impact, and meeting high ESG standards.

We maximize developmental impact and additionality in our investments by focusing on selected sectors and countries, with the ambition of contributing to job creation and economic growth in these regions.

Norfund’s strategies towards 2026 are focused on impactful investments in the investment areas Renewable Energy, Financial Inclusion, Scalable Enterprises and Green Infrastructure.

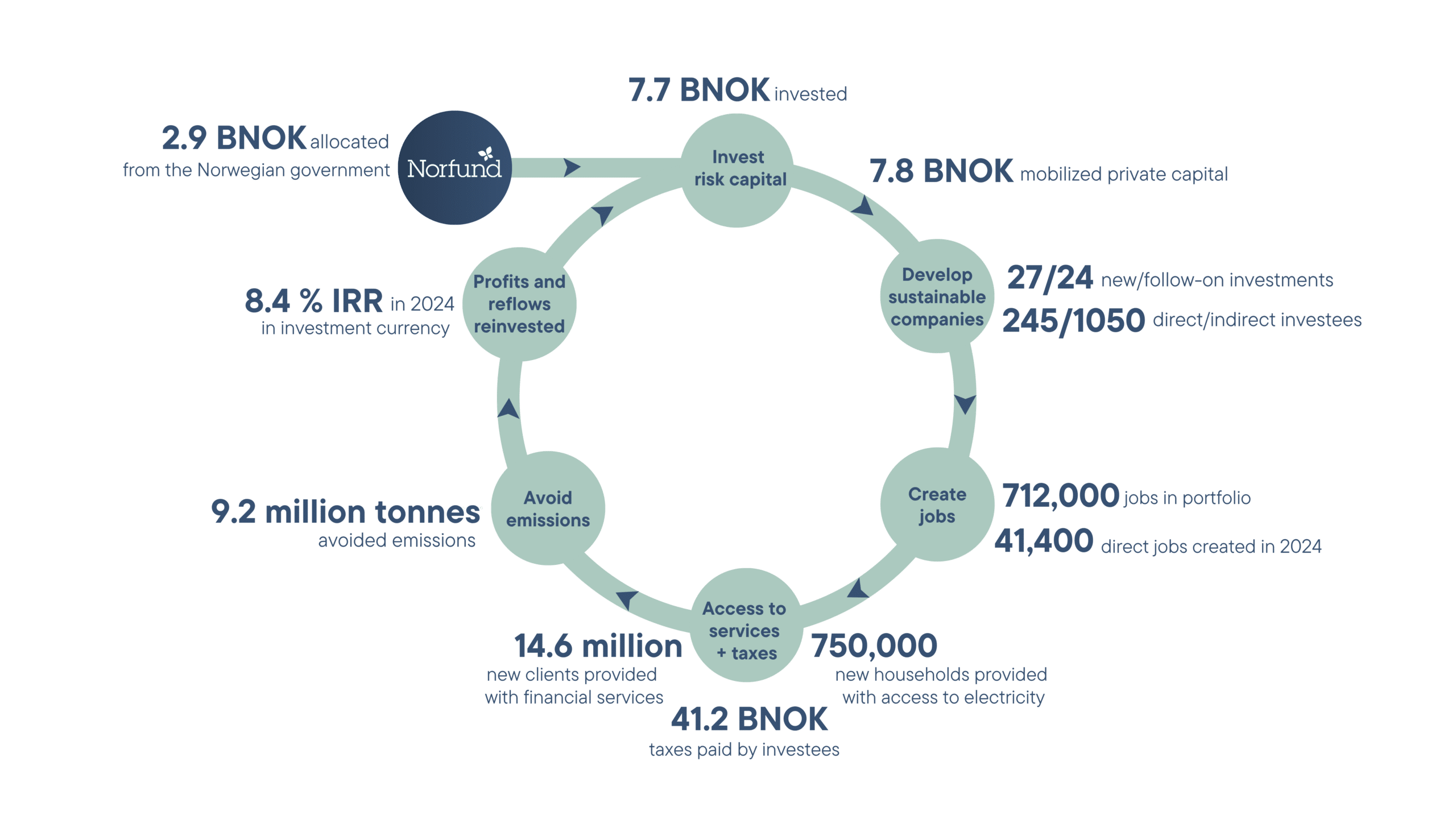

The development wheel

Our operations and impacts for 2024 are illustrated in the wheel below.

The diagram illustrates our operations and impact last year, showcasing the efforts in job creation, climate mitigation, expanding energy accessibility, and advancing financial inclusion. Norfund has theories of change for each investment area, that build on literature and are outlining how we expect our inputs to lead to the desired impact. These theories were updated during 2024.

We exit investments once they no longer require additional support from us, so we can reinvest the proceeds in enterprises that have a greater need for risk capital and mobilise private capital into the markets where we operate. This ensures a continuous cycle of impact and sustainable development in the specified areas.

Norfund’s mandates

Development Mandate

Create jobs and improve lives by investing in businesses that drive sustainable development

Climate Mandate

Investing in the transition to net zero in emerging markets

Ukraine Mandate

Contribute to development of sustainable businesses and job creation in Ukraine

Norfund and the SDGs

The cross-cutting issues in Norway’s development policy – human rights (SDG 8), anti-corruption (SDG 16), gender equality (SDG 5), climate and environment (SDG 13) – are assessed in all our investments.

For the development mandate, Norfund’s mission is to create jobs and improve lives by investing in businesses that drive sustainable development, thereby contributing to SDG 1: No Poverty. Norfund’s investments are concentrated in four investment areas that contribute directly to specific targets of the SDGs: Renewable Energy (SDG 7), Financial Inclusion (SDG 9), Scalable Enterprises (SDG 8) and Green Infrastructure (SDG 11). Additionality and capital mobilisation are key priorities and help to reduce inequalities between countries (SDG 10) and to mobilise funding to developing countries (SDG 17). Norfund is a responsible investor and assesses crosscutting issues such as gender equality (SDG 5) and climate and environment (SDG 13) in our investment process.

A minority investor reliant on partners and co-investors

Norfund is always a minority investor, with ownership normally below 35 percent. It is important to support local ownership and encourage other investors to invest in developing countries.

We meticulously assess potential partners, considering factors such as their expertise, track record, societal roles, and reputation. Co-investing this way enables us to leverage additional capital and to provide the industrial and local knowledge needed for each investment. Equity is our preferred instrument, and we often take up board positions in our portfolio companies.

By mobilizing private capital Norfund can significantly amplify its impact. Getting the private sector on board is key to increasing capital flows to developing countries and bridging the SDG funding gap, as private commercial capital massively outweighs public funds. For this reason, Norfund actively seeks to pave the way for private investors by investing alongside us or after us or by being inspired by us. Norfund tracks and reports on official mobilized private capital on an annual basis according to the definitions outlined by the OECD and the MDBs (Multilateral Development Banks).

A responsible investor

Norfund takes different measures to execute our role as a responsible investor. From management of climate, environmental and social risk to influencing governance, improving gender equality and assisting our investees through our Business Support facility. You can read more about our role as a responsible investor in 2024 across these topics:

- Environmental and social risk management

- Governance and business integrity

- Climate and environment

- Gender equality

- Business Support

Responsible tax policy

Payment of taxes is one of the important ways Norfund´s portfolio companies contribute to sustainable development. Norfund’s approach to tax-related issues and what we expect from our portfolio companies and co-investors are outlined in our Responsible Tax Policy. They include requirements regarding transparency, that Norfund’s investees shall pay taxes to the countries in which they operate and where the income occurs, and that third countries must only be used when necessary to meet the Norfund’s development priority of investing in high-risk markets and to protect the fund’s capital.

Business Support

Norfund’s facility for technical assistance, Business Support, aims to enhance sustainability and development effects of our investments.

The Business Support strategy aligns with our overall strategies, and targets ESG risks and the four cross-cutting issues: human rights, anti-corruption, climate and environment, and gender equality.

Frontier Facility

Projects that have a risk level higher than other investments in Norfund’s core portfolio, and that are in Least Developed Countries and fragile states can be carried out using Frontier Facility. These investments are managed as a separate facility and are not included in our overall portfolio calculations.