Norfund creates jobs, improves lives and supports the transition to net zero by investing in businesses that drive sustainable development. The establishment and growth of sustainable businesses have been the main drivers of global efforts to reduce poverty over the past 25 years.

Companies create jobs, pay taxes and supply goods and services to communities and businesses.

In most developing countries, the lack of access to capital is the main barrier to the establishment and growth of businesses. The growth of companies in these settings depends on risk-willing, responsible, patient investors.

Norfund contributes to the establishment and growth of sustainable companies that might not otherwise be initiated because of the high levels of risk involved.

Impact at strategy level

Norfund’s approach is to deliver impact through targeted asset allocation.

We select core countries based on:

- financial additionality (scarcity of capital)

- available investment opportunities

- our market knowledge and network

For the climate mandate, we have chosen our core markets based on three criteria: climate impact, additionality and feasibility (read more here).

We select investment areas based on:

- the potential for development impact, in particular job creation and economic growth

- sector specific impacts such as the provision of renewable energy and access to finance

For the climate mandate, we invest in both large and smaller scale renewables, as well as enabling technologies with high climate impact, focusing on verticals where Norfund has strong competences, can be additional and where there are investable opportunities in our markets.

We then optimize for financial returns within these boundaries. A healthy financial return is essential to deliver on our mandate as:

- only profitable companies can grow and deliver impact

- profitable companies generate returns and can be sold, with the proceeds reinvested for more impact

- healthy returns prove the business case and attract more investors and more capital to developing countries

Impact driven asset allocation combined with optimizing for financial returns enable us to deliver on our mission – to create jobs, improve lives and support the transition to net zero by investing in businesses that drive sustainable development.

Impact ambitions – development additionality

For each investment area under the development mandate, we have defined two ‘impact ambitions’ that reflect our aggregate development additionality within our strategy period and quantify how we aim to contribute to the SDGs. For the climate mandate, we have corresponding climate ambitions.

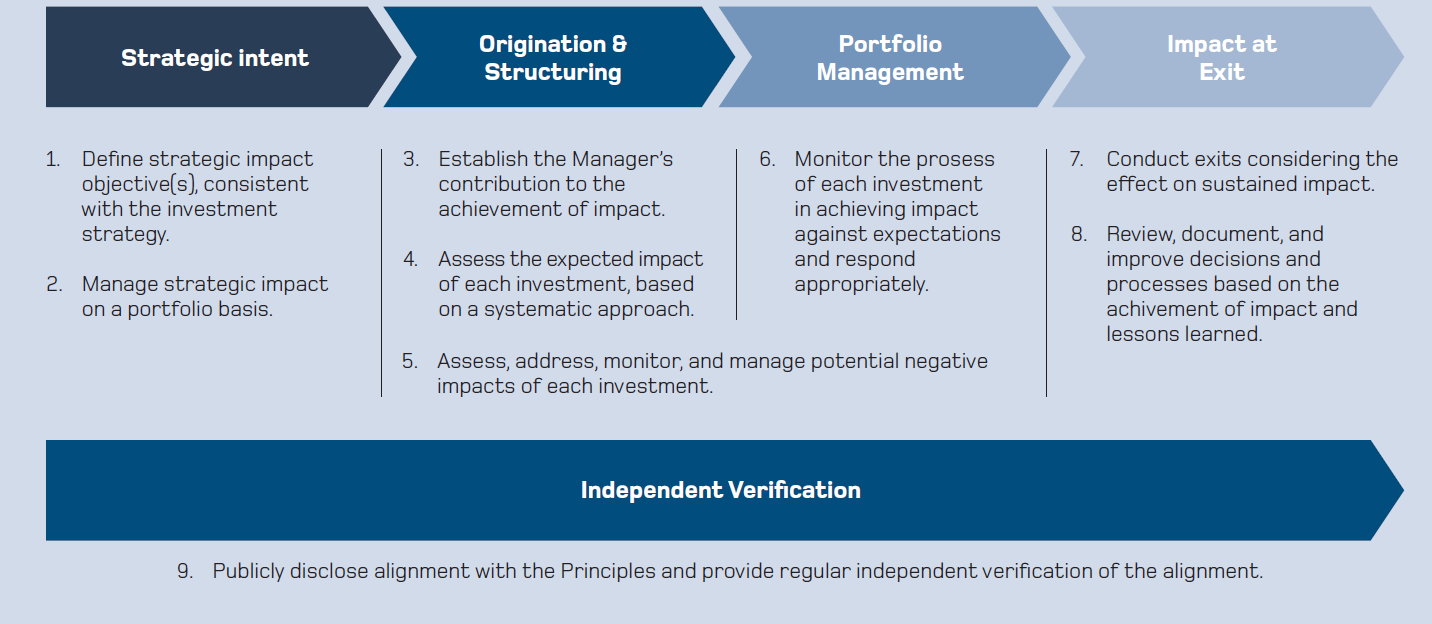

Operating Principles for Impact Management

Norfund’s approach to impact is guided by the Operating Principles for Impact Management, or Impact principles. Norfund is a founding signatory to the Impact Principles. The 9 principles form a framework for investors’ impact management to ensure impact is integrated throughout the investment cycle.

Theories of Change

Norfund has developed Theories of Change for each of our investment areas and for the climate mandate. The theories describe the problem that we aim to help solve and outline how and why the desired impact is expected to happen based on the inputs we provide to investees through causal linkages. It also highlights how we expect to contribute to selected Sustainable Development Goals.

The theories of change are visualized using a diagram containing a problem statement, our inputs to each investment area, outputs, short- and medium-term outcomes and impacts. The theories can be found under each investment area and for the climate mandate.

Additionality

Norfund is committed to making a difference by investing where capital is scarce and through responsible ownership.

The Norfund Act states that Norfund shall contribute to establishing viable, profitable undertakings that would not otherwise be initiated because of the high risk involved.

The extent to which an action contributes to an outcome that would not have happened otherwise is often referred to as ‘additionality’.

Financially additionality

According to the OECD, an investment is financially additional if it supports capital-constrained markets in which private sector partners are unable to obtain commercial financing with similar terms or quantities, or if it mobilizes investment from the private sector that would not otherwise have invested.

Value additionality

An investment is value additional if it provides non-financial value that the private sector is not offering through active ownership, promoting environmental and social standards, or supporting enterprise improvement. Through our value additionality, we contribute to improving both the profitability and the development impact of the businesses in which we invest.

Development additionality

Development additionality is described as the development impact that arises as a result of investments that otherwise might not have occurred.

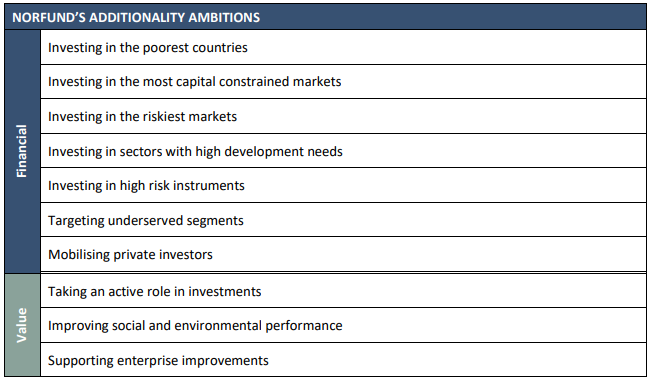

Ten ambitions on additionality

Norfund has a defined additionality framework that helps assess the additionality of our investments and ensures alignment with the OECD definition. This framework consists of ten additionality ambitions reflecting both the financial and value additionality of our investments. For each ambition, we have identified relevant indicators to assess the extent to which we meet these ambitions. Investments under the new Climate Investment Mandate are subject to the same additionality assessment.

Based on our experience with the framework since 2018, we have made some refinements to better reflect the markets we operate in.

Additionality informs our investment decisions

The framework informs our investment decisions and the way we report on additionality. Each new potential investment is assessed against the ten ambitions, explained in the graph below, and is accompanied by a narrative description of additionality.

Development additionality is also assessed for each new investment by setting baseline and target values for the same impact ambitions, describing what the investment aims to achieve.

Impact measurement and monitoring

Development effects reporting

We annually collect and monitor data on the development effects of Norfund’s portfolio companies. The companies report on the direct effects of their operations. These metrics identify both sector-specific effects (for example, energy production, avoided emissions or access to financial services) and portfolio-wide effects (for example jobs, local purchases, and taxes).

Harmonized Indicators for Private Sector Operations

Where available, Norfund applies harmonized indicators to reduce the reporting burden of investees and ensure comparability and transparency in the reported development effects. Where available, Norfund applies indicators covered in the Harmonized Indicators for Private Sector Operations (HIPSO) and EDFI’s Harmonization Initiative.

HIPSO is a collaboration among Development Finance Institutions and International Finance Institutions, initiated in 2008 to identify common development indicators. The first indicators were launched in 2013 and now include indicators on a range of sectors including agriculture, financial intermediation, energy, and waste, water, and sanitation.

In addition, the Joint Impact Indicators, a sub-set of HIPSO indicators and the IRIS Catalogue of Metrics, on Gender, Jobs, and Climate were recently launched in cooperation with the GIIN as further step forward for harmonized impact measurement and reporting.

In addition, Norfund participates in the EDFI Harmonization Initiative on Impact Measurement and Responsible Financing (the Harmonization Initiative), established in 2019 to facilitate consolidated EDFI reporting of key impacts, including open publication of many metrics.

Case studies

Norfund also produces in depth case studies and external evaluation to provide insights into the indirect development effects o our investments, that are difficult to capture through regular monitoring.

Joint Impact Model

Norfund uses the Joint Impact Model (JIM) to estimate the indirect employment effects from our investments and the greenhouse gas emission of their operations. The estimates are calculated using economic modelling and are not actual figures. Nevertheless, they provide insight into the indirect impacts of our investments which we are not able to measure directly.

The Joint Impact Model (JIM) was launched in 2020. The model was developed in collaboration between AfDB, BIO, BII (formerly CDC Group), FinDev Canada, FMO and Proparco with Steward Redqueen.

The JIM combines macro statistics with investee financials to estimate indirect impacts for which observed data is not available. The model is continuously improved and updated when new macro data is available.