Norfund is the Norwegian Investment Fund for developing countries, investing to create jobs, improve lives and support the transition to net zero.

Norfund is owned and funded by the Norwegian Government and is the Government’s most important tool for strengthening businesses that create jobs and reduce poverty in developing countries.

We invest for impact on commercial terms, as a responsible minority investor working closely with partners. Through local presence we seek solutions designed for the countries in which we invest.

Norfund’s mandates

Norfund’s overall mandate is defined by the Norfund Act of 1997. The Act states that Norfund’s role is to assist in building sustainable businesses and industries in developing countries by providing equity capital and other risk capital.

Norfund has three investment mandates:

- Development: Create jobs and improve lives by investing in businesses that drive sustainable development

- Climate: Investing in the transition to net zero in developing countries

- Ukraine: Supporting the country’s reconstruction and building a resilient economy

The Climate Mandate is undertaken through the Climate Investment Fund, which you can read more about here. The Ukraine Mandate is undertaken through the Ukraine Investment Fund, which you can read more about here.

Investing where others may not

To fulfil our mandates effectively, we focus on countries and investment areas where we can make a difference and our development impact is likely to be strong.

The extent to which an investment contributes to an outcome that would not have happened otherwise is referred to as ‘additionality’. Additionality is high where capital is scarce and investors are reluctant to invest because of high levels of real or perceived risk. Norfund is willing to assume more risk than most other investors.

Our preferred instrument is direct equity, but we also offer loans and invest through funds.

Being additional also means adding non-financial value in the form of expertise and active ownership to the investments we make, improving both profitability and development impact of the companies.

Investing for development

Norfund invests in companies that will contribute to economic and social development impact through:

- the direct and indirect jobs they provide and the income these give

- the goods and services they offer

- the taxes they pay

Norfund also enhances the development effects through business development support.

Investing in the transition to net zero

Through the Climate Investment Fund we invest in renewable energy in emerging markets/developing countries with extensive emissions from fossil fuel-based energy production, with the goal of contributing to the net zero transition.

Our investment regions

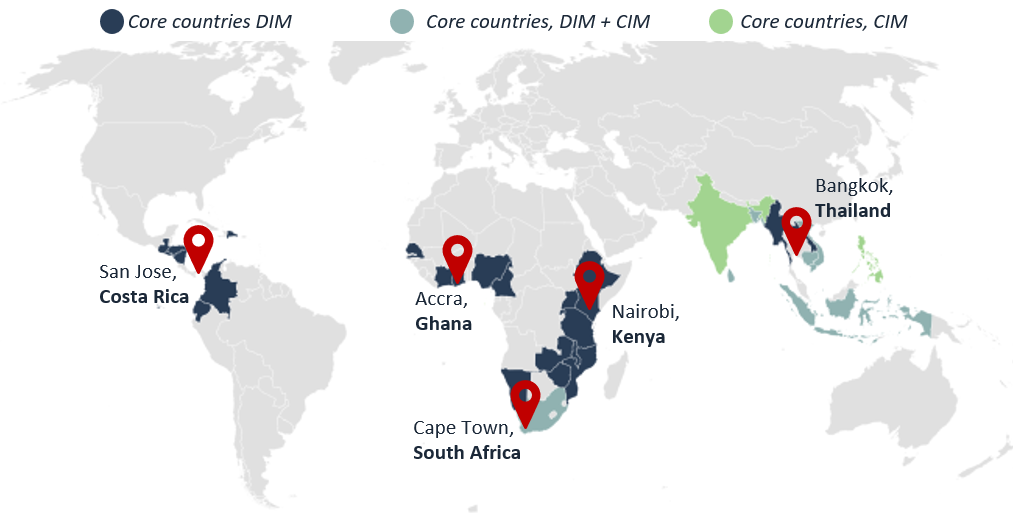

Norfund’s development mandate targets 30 core investment countries, primarily in Sub-Saharan Africa in addition to selected countries in Asia and Latin America. Under the climate mandate, Norfund prioritizes eight countries: South Africa, India, Sri Lanka, Vietnam, the Philippines, Cambodia, Indonesia, and Bangladesh.

Our investment areas

Responsible investor

Norfund adds value by helping our investees to achieve high standards of governance and strong environmental and social performance. We believe that high Environmental, Social and Governance (ESG) standards are prerequisites for succeeding at delivering on our mandate.

Profitability is a precondition

Companies only survive if they are profitable over time, so profitability is essential for the creation of sustainable jobs and lasting development effects. Delivering positive returns is also important for Norfund to be catalytic, mobilizing private investors to invest with us – or inspired by us. We aim to exit our investments when we are no longer needed, enabling us to recycle the capital into new investment opportunities.

A member of EDFI

Norfund is part of EDFI, the Association of European Development Finance Institutions, which was established in 1992 to support and promote the work of bilateral Development Finance Institutions (DFIs).