Norfund is committed to making a difference by ensuring that our capital contributes to outcomes that would otherwise not have happened. This is referred to as “additionality” and is a key criterion for Norfund’s investments.

The Norfund Act states that Norfund shall contribute to establishing viable, profitable undertakings that would not otherwise be initiated because of the high risk involved.

Proving the additionality of our investments is challenging because it requires insights into what could have happened had we not invested. Norfund substantiates additionality claims by evaluating all potential investments against our additionality framework. We also have portfolio level KPIs and thresholds that ensure that we allocate capital to instruments and markets with high inherent risk.

What does it mean that an investment is additional?

Financially additionality

An investment is financially additional when the private sector partners are unable to obtain financing from capital markets (local or international) for a specific activity at the necessary terms and/or scale, or where it mobilizes finance from the private sector that would otherwise not have been invested.

Value additionality

An investment is value additional in cases where it mobilizes, alongside its investment, non-financial value to private sector partners that the capital markets would not offer and which will lead to better development outcomes. It is often pursued through active ownerships (e.g. board participation), capacity building activities, advisory services and other technical assistance and other ways.

Development additionality

Development additionality is that the investment will deliver development impact that would not have occurred without the partnership between the official and the private sector.

Ten ambitions on additionality

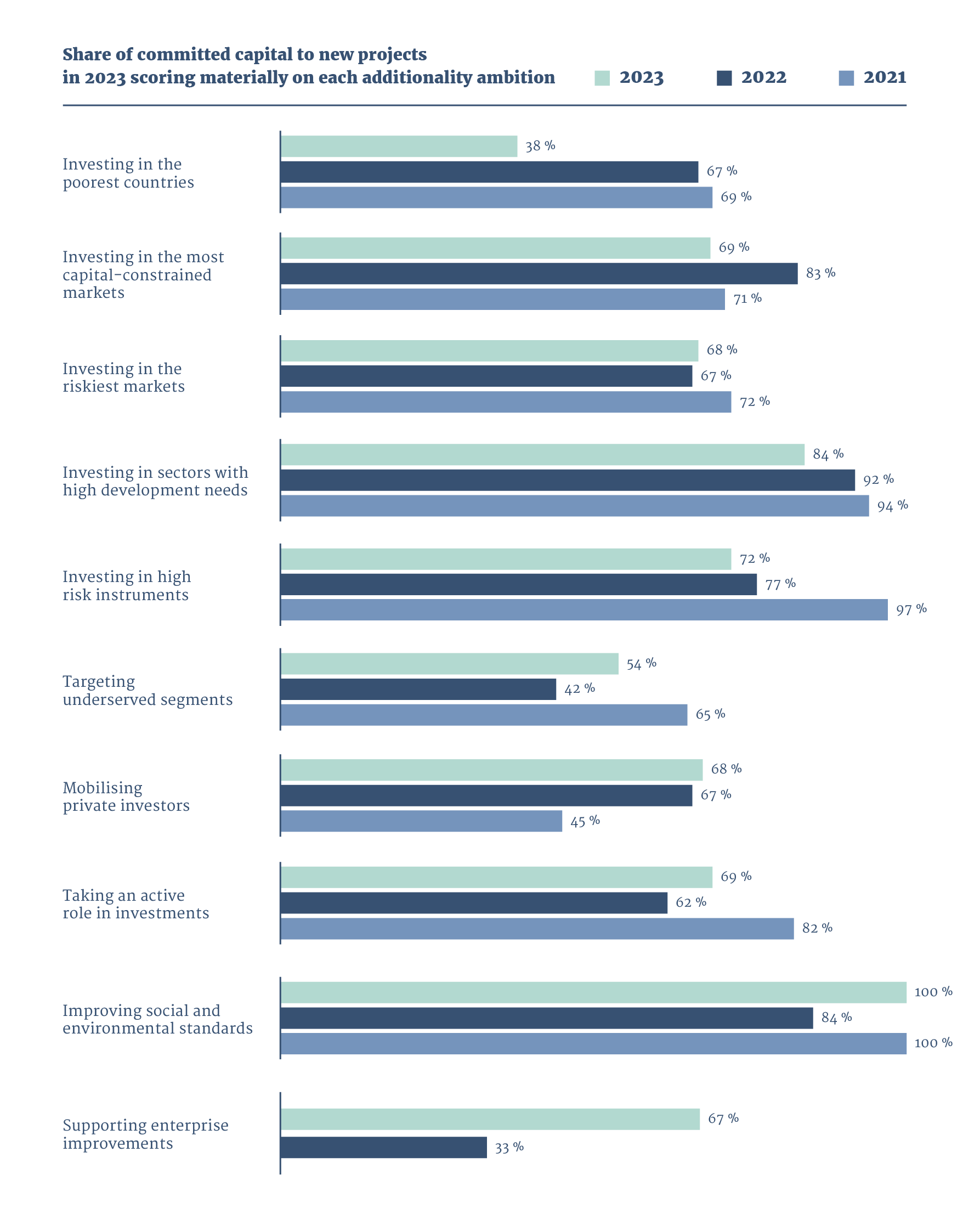

Norfund has a defined additionality framework that helps assess the additionality of our investments and ensure alignment with the OECD definition. This framework consists of ten additionality ambitions (see table below) reflecting both the financial and value additionality of our investments. For each ambition, we have identified relevant indicators to assess the extent to which we meet these ambitions. Investments under the new Climate Investment Mandate are subject to the same additionality assessment. Development additionality is assessed for each new investment by setting baseline and target values for key impact/ climate ambitions, describing what the investment aims to achieve.

Based on our experience with the use of the framework since 2018, the framework has been revised twice to better reflect the markets we operate in. In 2024 Norfund’s framework will be updated to align with the new OECD-DAC Private Sector Instrument requirements for additionality.

Additionality informs our investment decisions

The framework informs our investment decisions and the way we report on additionality. Each new potential investment is assessed against the ten ambitions, explained in the graph below, and is accompanied by a narrative description of additionality. More information on which ambitions each investment is particularly additional on, is listed on the individual investment webpages on the Norfund website.

From the above table you see that the share of committed capital scoring on the ambition “Investing in the poorest countries” has dropped compared to previous years. However, if we look at the number of new committed projects (instead of share of committed capital) we see that 27 out of a total of 45 new project scored on this ambition. This shows that Norfund had a high level of activity towards these countries. This also reflects that average ticket size in least developed countries often is smaller compared to investments in low- and middle-income countries.

More than half of the investments made by Norfund in 2023 were investments that target sector-specific underserved segments, meaning the beneficiary are underserved business types or end-clients. This could for instance be a loan issued to a financial institution that target microenterprises or an investment into a company providing off-grid solutions to poor households.

Case – Sun King Financing

To better illustrate how Norfund assesses our additionality in an investment we can use our recent investment in Sun King Financing as an example. The investments, which was made in 2023, offers a local currency loan that funds a leasing solution (pay-as-you-go model) for customers of the solar home systems sold under the “Sun King” brand in Kenya. The clients of Sun-King are typically low-income households or micro-enterprises.

| Additionality ambitions | Score |

|---|---|

| Investing in the poorest countries | 0.5 |

| Investing in the most capital-constrained markets | 1 |

| Investing in the riskiest markets | 1 |

| Investing in sectors with high development needs | 1 |

| Investing in high risk instruments | 0.5 |

| Targeting underserved segments | 1 |

| Mobilising private investors | 0 |

| Taking an active role in investments | 0.5 |

| Improving social and environmental performance | 0.5 |

| Supporting enterprise improvements | 0 |

| Total | 6.0 |

By providing the loan in Kenya Shilling (giving 0.5 points on “Investing in high risk instrument”), Norfund and the other lenders take on the currency risk which otherwise would be passed on to the client in the form of a premium. This will enable even more low-income households to access this attractive financing option for their solar home system.

Leasing ensures that Sun King’s clients can afford solar home systems without having to put up the up-front payment. The pay-as-you-go model also provides Sun-King clients with added flexibility compared to a fixed monthly lease.