One of the important ways Norfund’s portfolio companies contribute to sustainable development is by paying taxes and fees to the countries in which they operate.

Taxes paid in 2023

*In companies with two consecutive years of reporting

Total taxes paid by portfolio companies

Total taxes paid in Africa

Increase in total taxes paid by portfolio companies*

Development rationale

Domestic resource mobilization, where taxation plays a fundamental role, is one of the most important ways to facilitate sustainable development. Tax revenues provide governments with essential resources that can be spent on infrastructure and public services, such as health services, education and protection for its citizens.

Norfund’s investments contribute both directly and indirectly to achieving SDG Target 17.1

Results in 2023

Profitable companies pay taxes to governments in the countries in which they operate. Taxes and fees are paid both by Norfund’s portfolio companies and by the companies in their value chains. This means that company growth can increase the demand for supplies, which in turn can increase tax revenues generated by the suppliers. In this way the company growth contributes to tax generation beyond the tax collected in the company.

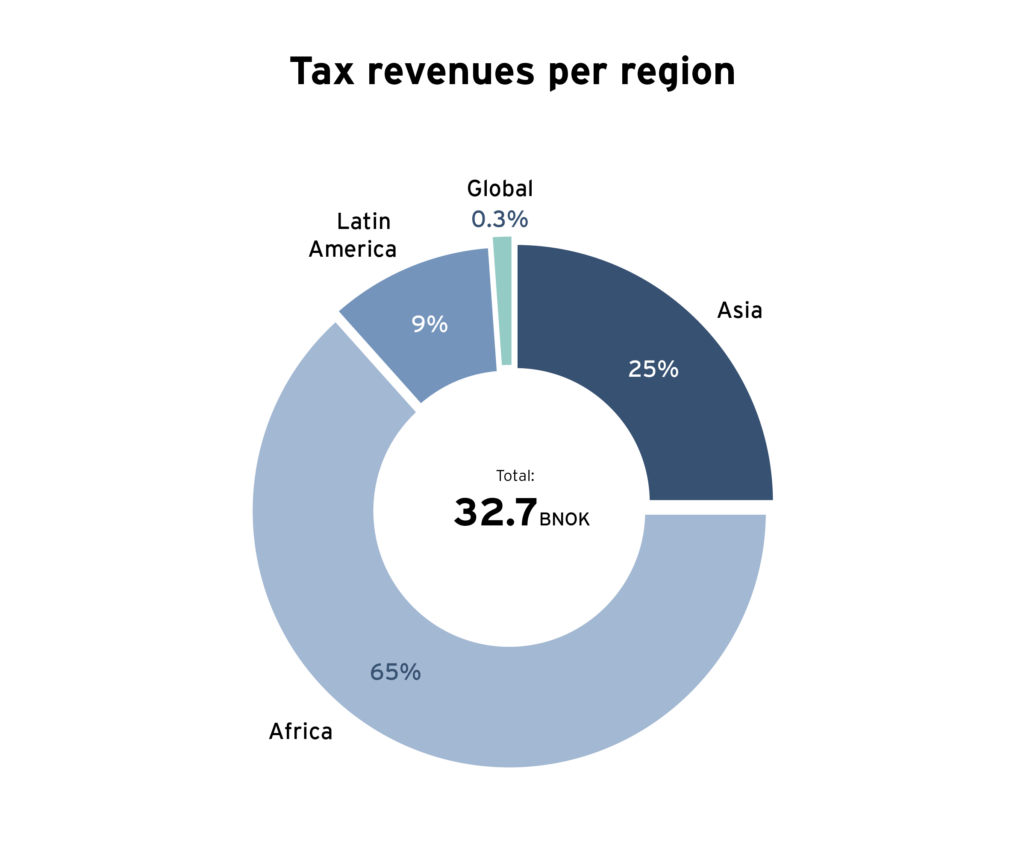

In 2023, an amount equivalent to NOK 32.7 billion was paid in taxes and fees by the companies in which Norfund is invested, both directly and through funds. This corresponds to almost 56 % of the total Norwegian development aid in 2023.

48 % of the total tax was paid as corporate income tax and 52 % was paid as other transfers, such as sales taxes, withholding taxes, net VAT, royalties, license fees and social security payments.

From the end of 2022 to the end of 2023, the total taxes and fees paid by companies with two consecutive years of reporting increased by NOK 3.6 billion.

About 65 % of the taxes and fees paid by Norfund portfolio companies were paid by companies operating in Africa.

Norfund’s tax policy

A responsible tax policy is fundamental to all Norfund’s operations. Our tax policy is based on the principles of the Norfund Act of 1997, Norfund’s statutes and EDFI’s principles for responsible tax in developing countries. The policy sets out the principles that guide our approach to tax-related issues and what we expect from our portfolio companies and co-investors.

The tax policy includes requirements regarding transparency, stating that Norfund’s investees shall pay taxes to the countries in which they operate and where the income occurs, and that use of third countries must only be done when necessary to meet the fund’s development priority of investing in high-risk markets and to protect the fund’s capital.

Norfund regularly updates the investment manual. Based on a review conducted in 2021, operational adjustments, including more focus on tax structure elements and adjustments in the investment manual, were initiated in 2022. These adjustments were implemented in 2023. In addition to the existing guidelines, in 2023, procedures for external structure assessment were introduced for investments through third countries. This is to further ensure responsible taxation of our investments beyond the choice of domicile.