Climate change poses a significant threat to global development, disproportionately impacting developing countries. In response, Norfund has steadfastly advanced its commitment to supporting the transition to net zero.

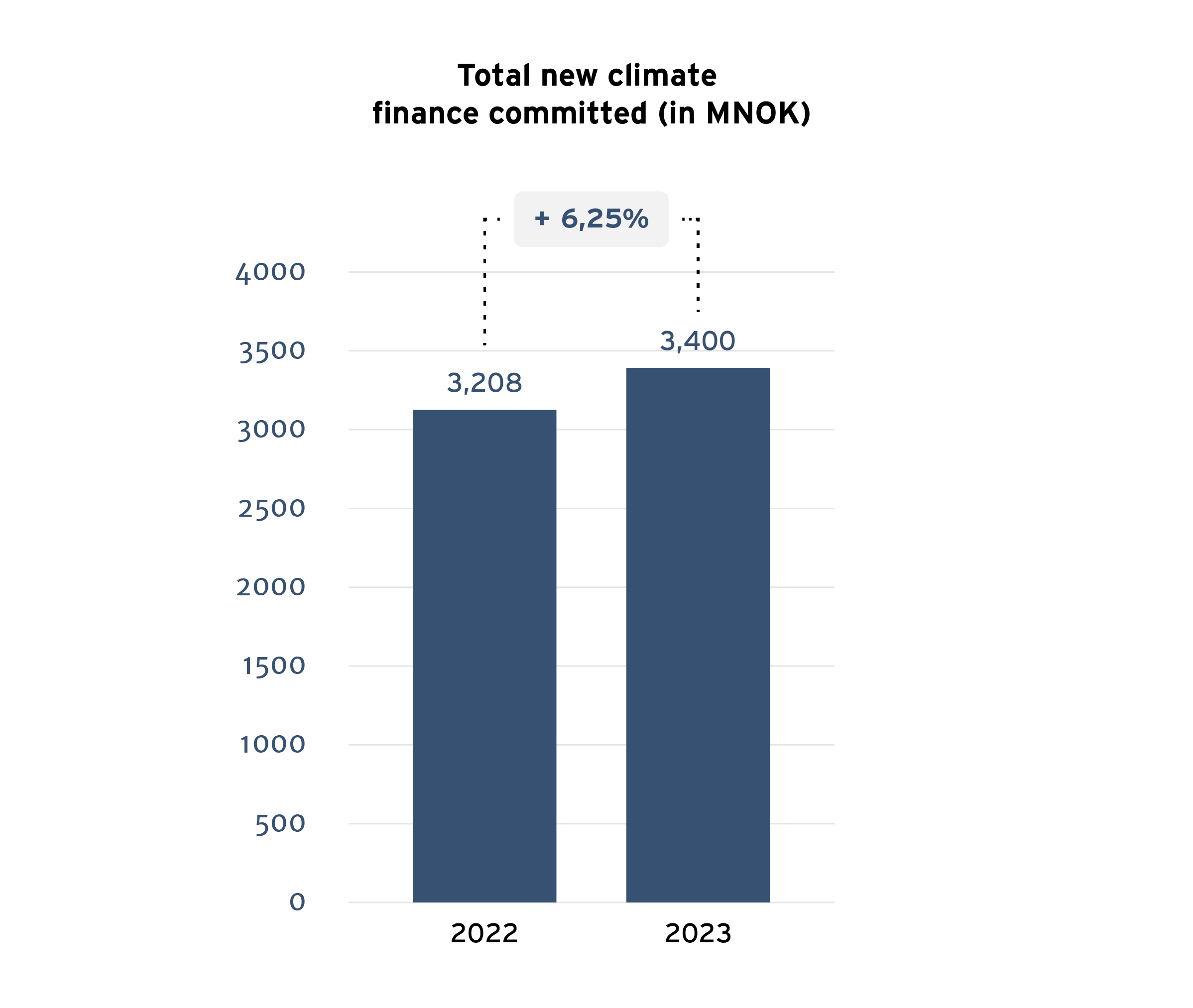

In 2023, we’ve made substantial progress in refining our approach to combating climate change. We have increased climate finance, successfully developed our net zero strategy, updated our stance on fossil fuel exclusion, and achieved considerable improvements in our Paris alignment assessments.

Net zero strategy

Our newly developed net zero strategy describes the role Norfund plays in the net zero transition in developing countries. It has been key to Norfund that the approach makes sense in the developing world context we operate in, as well as the mission we have: Developing countries require significant growth if we are to reach the Sustainable Development Goals, which likely will entail increased emissions. Additionally, there is a lack of decarbonization pathways for the markets we operate in, and investees are often unable to measure and report on emissions.

The strategy focuses on what Norfund will do in the short term and seeks to be actionable in each of the investment areas, despite data challenges. In the coming year, more department and sector specific climate action plans will be developed.

Four principles underpin Norfund’s work on net zero:

- Real-economy decarbonization: Norfund shall aim to foster real-economy decarbonization through emission reductions of investees, rather than reducing portfolio emissions through divestments and reallocations.

- Just transition: Norfund shall adopt a nuanced approach – transition to net zero in our markets should be just and inclusive. This includes investing in sectors essential to development, including hard-to-abate, with the aim of decarbonizing over time.

- Materiality: Norfund shall focus efforts where the climate effects are large, and where Norfund can play a role.

- Investee focus: Norfund shall support and engage individual investees by designing action plans and solutions that fit each investee’s characteristics and climate maturity.

Norfund will contribute to the transition to net zero in developing countries in four ways:

Step-up annual investments in climate finance and seek to invest in climate projects across all investment areas.

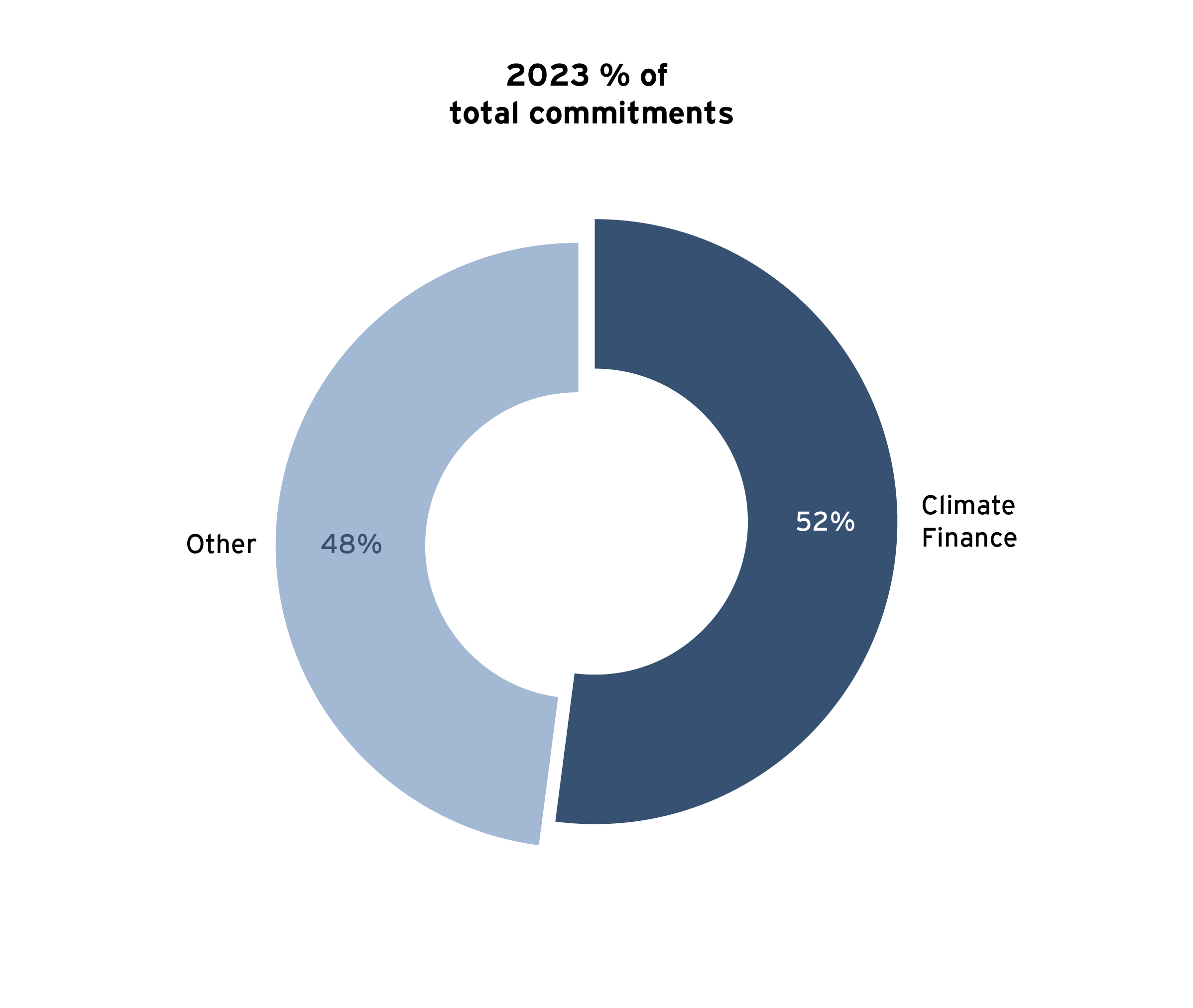

Norfund has set ambitious but realistic ambitions in the short-medium term, including a significant increase in new investments classified as climate finance, aiming for 64% of new investments by 2024-2026 (average over the period) and 66% by 2027-2030.

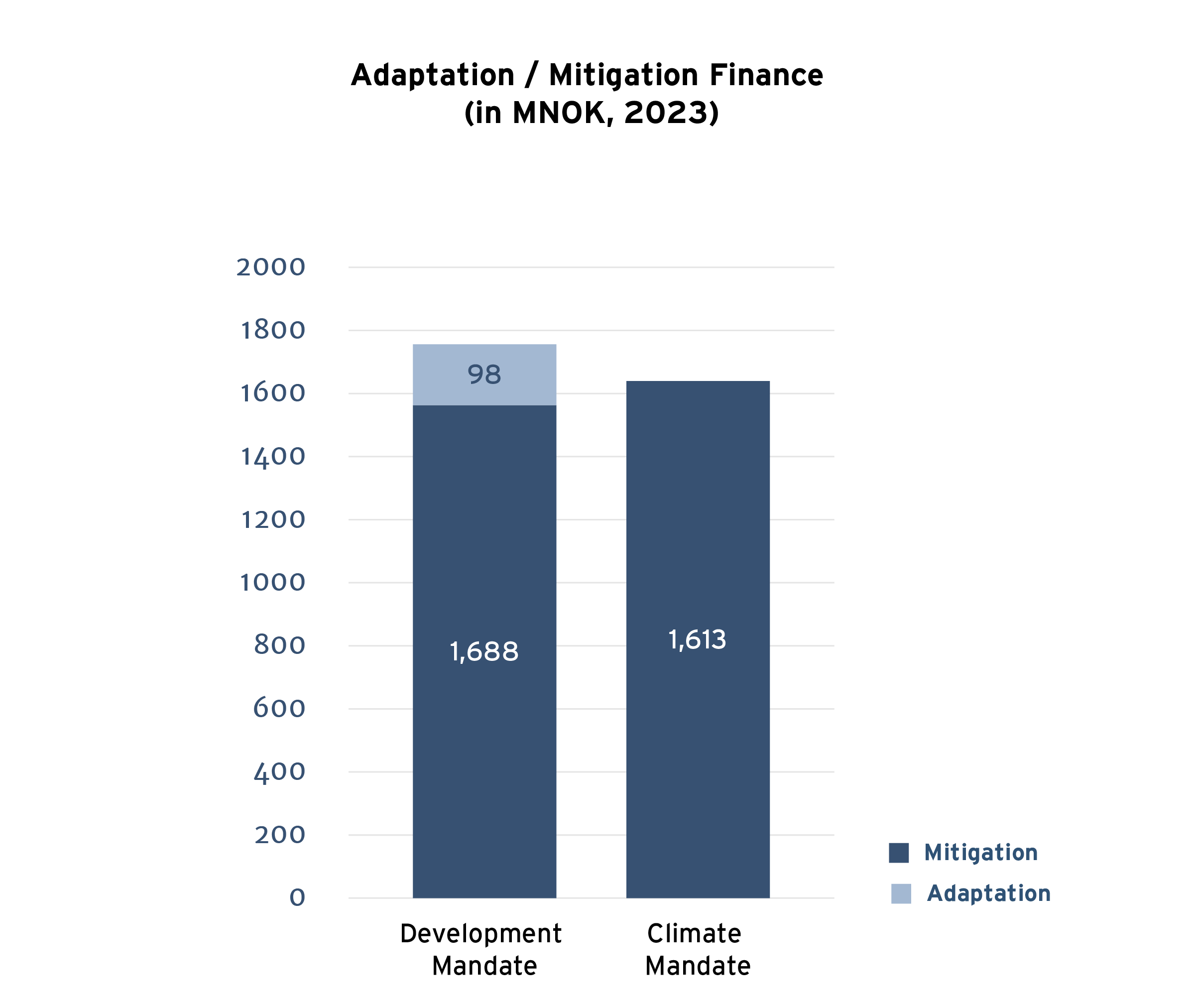

Several hard-to-abate sectors are essential for continued development. Thus, investing in emission reduction initiatives in such sectors is crucial to balance decarbonization and development.

Norfund will apply decarbonization measures for individual investments in portfolio and track the emission reductions, with a particular focus on “transition finance”. The ambition is to have four transition finance investments in portfolio by 2026, and 12 investments in portfolio by 2030.

Apply Paris alignment methodology (agreed among the EDFIs) to new investments and work actively with investees in the ownership phase.

Norfund has committed to aligning all new investments with the objectives of the Paris Agreement and we do that through the harmonized EDFI approach, categorizing them as either automatically aligned, misaligned, or conditionally aligned with the Paris goals. By adopting this methodology, we strive to support our investees in the transition to net zero, minimize transition risks and reduce stranded asset risk, ensuring our portfolio supports a sustainable and climate-resilient future. Read more about our methodology here.

Transitioning away from fossil fuels is essential to limit emissions. Norfund has low exposure to fossil fuels and does not make new investments into the fossil fuel value chain except in special circumstances and in line with the Paris agreement.

Norfund and the other European Development Finance Institutions (EDFI) have identified a list of sectors and activities in which we do not invest in the EDFI Fossil Fuel Exclusion List. In addition to this list, Norfund has further strengthened its approach to fossil fuels with the Norfund Fossil Fuel Standard.

Norfund’s strategy aligns with international frameworks and standards and is informed by peer analysis of other developmental finance institutions. SBTi approaches will likely be applied to select investees that are ready for it. However, specific SBTi approval of Norfund or external verification of targets is currently not planned.

Norfund’s ambitions and actions are informed by an iterative approach that will evolve as data availability, accuracy, and climate standards develop. To improve data quality and climate engagement, Norfund is working towards improving its investees’ capabilities in measuring and reporting emissions.

Climate finance

Climate finance refers to the financial investments mobilized to support climate change mitigation and adaptation projects, aiming to reduce emissions and adapt to climate impacts. The criteria used to assess climate finance at Norfund are defined in the IDC/MDB’s Common Principles for Climate Mitigation Finance Tracking, and The MDB’s Joint Methodology for Tracking Climate Change Adaptation Finance. Norfund increased its climate finance commitments in 2023 by 6.25% compared to 2022 totaling to almost 3,5 billion NOK. As explained above, climate finance is also an integral part of our net zero strategy.

Climate-related risks and opportunities

Norfund is subject to a wide range of climate-related risks, with substantial exposure to regions and sectors vulnerable to the physical impact of climate change, while also opening up for opportunities. Climate risks and opportunities have a large potential impact on the viability of the businesses in Norfund’s portfolio. Therefore, climate risk and opportunity assessments are incorporated into our investment process. Still, we are committed to further enhancing our practices and processes and are working on improving tools and procedures to assess climate risk and enable the investees to reduce climate risks.

Norfund has disclosed our exposure, strategy, targets, and governance related to climate risk in accordance with recommendations from the Task Force on Climate-Related Financial Disclosures (TCFD) in our 2023 report in the link below.

Norfund’s financed emissions

Norfund’s largest emissions are in the activities of the investees we have invested in. Norfund has estimated its portfolio carbon footprint for the first time. While we have encountered various challenges and experienced high data uncertainty, we use this exercise to learn and improve. The methodology is based on the Partnership for Carbon Accounting Financials (PCAF) Global GHG Accounting and Reporting Standard. For Norfund’s operational emissions, read below. This assessment, based on data from 2022 due to issues with retrieving data, covers 71% of Norfund’s portfolio in terms of financial volume.

Methodology & challenges

In alignment with the PCAF standard, there are different data options to assess the emissions of an investee. Each of these options has a corresponding data quality score, which provides an indication of how much uncertainty results carry. The scoring ranges from 1-5 with 1 referring to the highest data quality by using verified emission data from the investee. Across Norfund’s assessed portfolio, 10% of the investees submitted emission data. The remaining were assessed using economic activity input data (e.g., revenues), modelled via the Joint Impact Model, a widely used tool among EDFIs and banks. This results in a relatively low data quality score.

Norfund reports on investees’ scope 1 and 2 this year. The investees’ scope 3 emissions, which among others include emissions from companies that are customers of banks in which Norfund has invested, are expected to be significantly higher than the scope 1 and 2 emissions, and associated with even higher levels of uncertainty.

Norfund presents both attributed and non-attributed emissions results. Other impacts, such as avoided emissions and employment impacts, are presented as non-attributed. This reflects ongoing challenges in aligning attribution practices across different institutions and metrics. In this context, it is important to point out to be careful when comparing avoided emissions with financed emissions. You can read more about it how we contribute to climate action by avoiding emissions here.

| Norfund's 2022 financed emissions, by scope | |||

|---|---|---|---|

| Attributed | Non-attributed | PCAF Data Quality | |

| Financed Scope 1 (tCO2e) | ~220'000 | ~3'500'000 | 3.7 |

| Financed Scope 2 (tCO2e) | ~45'000 | ~620'000 | 3.8 |

| Emission Intensity (tCO2e/MUSD invested) | 136 | – | – |

Despite these various challenges, the analysis has yielded insights that will help Norfund better understand and mitigate its GHG emissions. Future efforts will focus on improving the reliability of footprint calculations and reducing uncertainties in emissions estimations.

Responsible Workplace Climate & Environment

Beyond our climate-related activities in our investment, we also strive to minimize the footprint of and continuously work to improve our operations.

Norfund’s Oslo office was certified as an Eco-Lighthouse (Miljøfyrtårn) in 2022. We use this framework to advance our internal environmental and social performance. As part of the framework, Norfund reports operational emissions annually.

Operational emissions per year

*For 2019, we reported emissions from air travel, waste and energy for the Oslo office

*For 2021, we reported emissions from air travel, waste and energy for the Oslo office

*For 2022, we reported emissions from air travel for all Norfund offices, waste and energy for the Oslo office

*For 2023, we reported emissions from air travel, employee commute and energy for all Norfund offices, waste and water for the Oslo office

The increased emissions are largely due to the introduction of new indicators and reporting emissions on behalf of the whole organization and not only the Oslo office. If we were to report on the same indicators in 2023 as in 2019, the emissions reports for 2023 would be appr. 800 tCO2e.

Air travel accounts for more than 95% of Norfund’s operational emissions. According to Norfund’s business travel guidelines, we always assess the need for physical meetings, and if digital meetings could be a suitable option.

We work continuously to build more responsible operations and better working environments, and we have identified approximately 25 measures to be implemented and followed up within the organization in 2024.Not updated, waiting for Stem:

Norfund’s 2023 Operational Emissions, by scope

Scope 1

Scope 2

Scope 3

Category 1-4

TOTAL

*Scope 2 includes emissions from energy for all Norfund offices. Scope 3 emissions within category 1-14, includes emissions from air travel and employee commute for all Norfund offices, and emissions from waste and water for the Oslo office.