While total foreign direct investment to developing countries fell last year, Norfund committed almost NOK 6.5 billion, mirroring our record investment from the previous year.

2023 is the second year Norfund reports on both the Development Mandate and the Climate Mandate. For some key figures such as commitments and investments, we present both here, while on others such as certain development effects we report only on the Development Mandate, due to the current relatively small size of the Climate Mandate.

For more detailed reporting on each mandate refer to their individual sections in the content menu above.

New commitments

Development Mandate

billion NOK in 2023

Excluding Business Support and Frontier Facility

Climate Mandate

billion NOK in 2023

Total commitments

Development Mandate

billion NOK in portfolio

Climate Mandate

billion NOK in portfolio

Investments

Development Mandate

New/follow-on investments in 2023

Climate Mandate

New/follow-on investments in 2023

Companies

Development Mandate

total direct/indirect investees in the portfolio

Climate Mandate

total direct investees in the portfolio

Committed investments per year (MNOK)

Jobs

Jobs

in Norfund portfolio companies under Development Mandate

Jobs created

new jobs created (net) in portfolio companies under Development Mandate

Female employees

in Norfund portfolio companies under Development Mandate

Avoided emissions

Development Mandate

CO2e emissions avoided annually from greenfield projects in 2023 portfolio

Climate Mandate

CO2e emissions avoided annually from greenfield projects in 2023 portfolio

Climate Mandate

CO2e expected annual avoided emissions from projects financed in 2023

New electricity capacity

Development Mandate

financed in 2023

Climate Mandate

financed in 2023

Development Mandate

electricity produced in portfolio companies

Climate Mandate

electricity produced in portfolio companies

Access to finance

New clients

offered financial services in 2023

under the Development Mandate

Total clients

offered financial services in 2023

under the Development Mandate

Increased lending

increase in total lending volume

under the Development Mandate

Internal rate of return

IRR in 2023

in investment currency (4.1 % in NOK)

Development Mandate

IRR since inception

in investment currency (7.8 % in NOK)

Development Mandate

IRR in 2023

In investment currency (17.8% in NOK)

Climate Mandate

IRR since inception

In investment currency (20.4% in NOK)

Climate Mandate

Commitments per investment area

Total portfolio (MNOK)

In 2023 (MNOK)

Commitments per region

Total portfolio (MNOK)

In 2023 (MNOK)

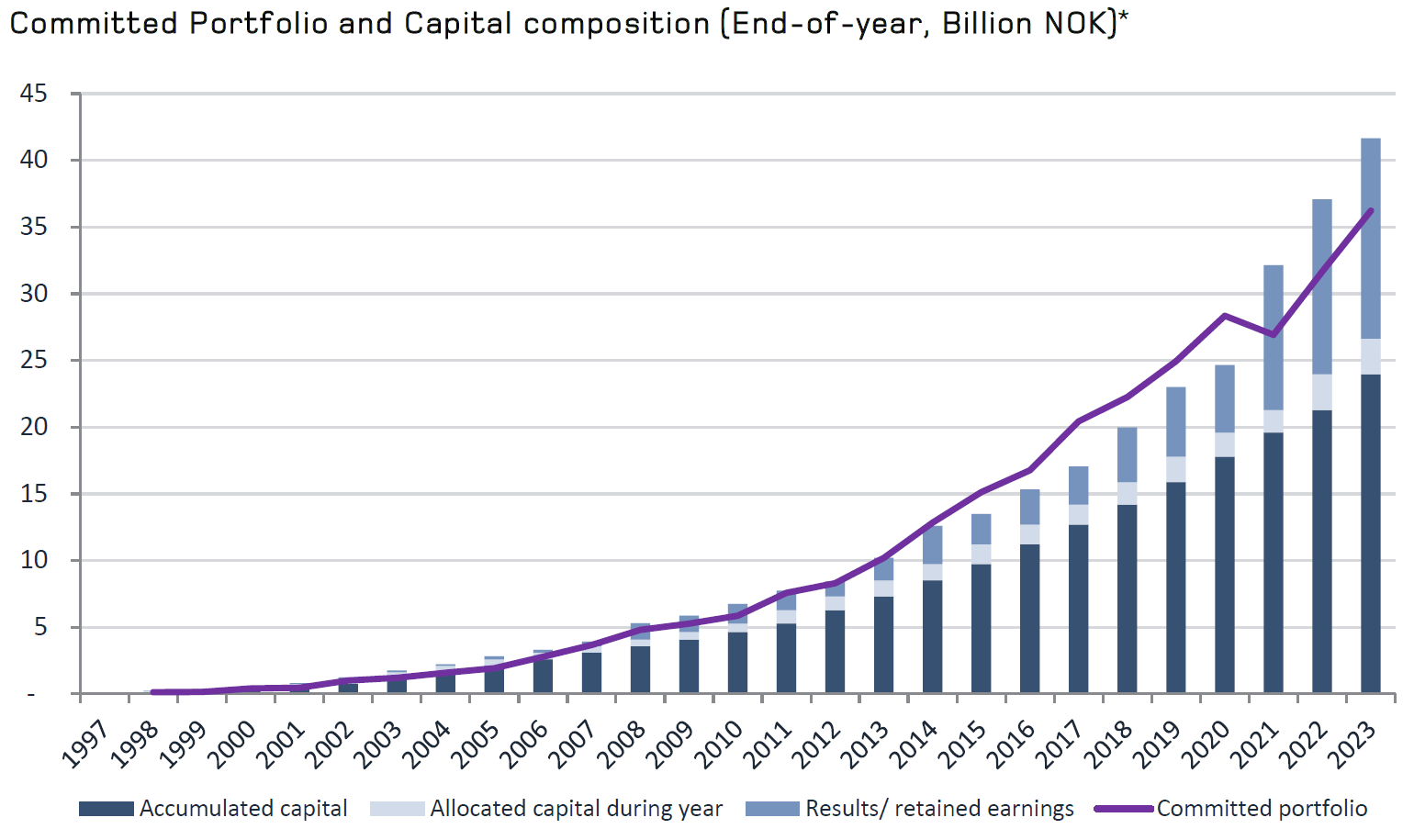

Portfolio since inception

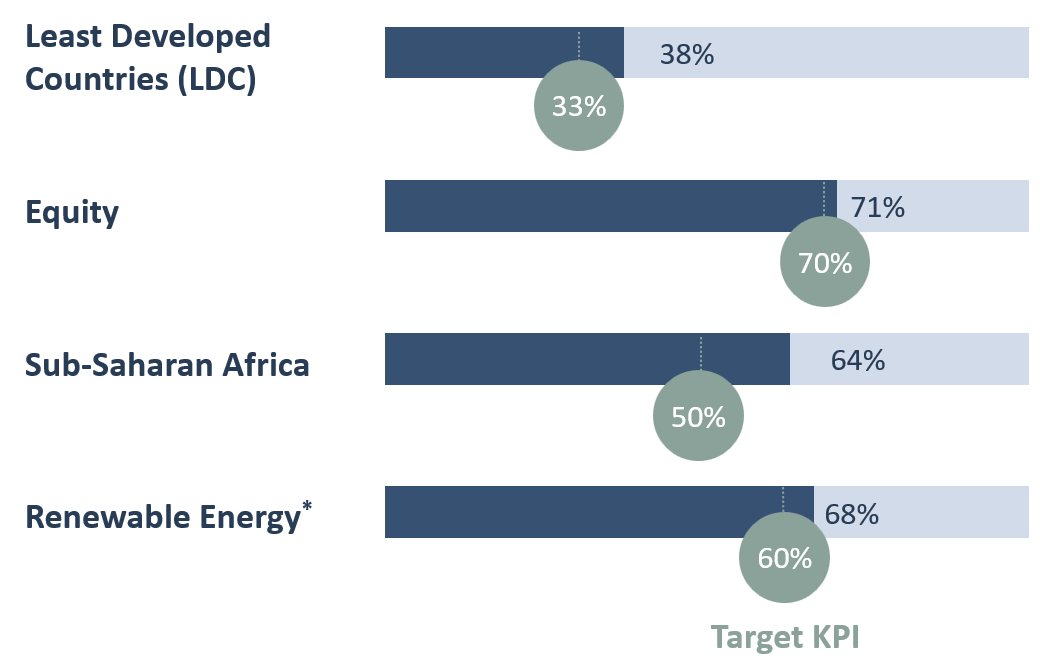

Norfund Key Performance Indicators

Development Mandate

Four key performance indicators (KPIs) are developed as a tool to secure that the portfolio develops according to Norfund's mandate. The KPIs are all measured at the portfolio level, though also monitored year by year (see table below).

*The RE KPI was new for 2022 and is different from the other portfolio KPI’s. The RE KPI is defined as total RE-commitments (at commitment date fx-rate) divided by total allocation from MFA, starting from 2022. This should over time be at least 60%.

Gender equality in Norfund's investees 2023

Gender equality in Norfund 2023

Key figures per year

| Key figures | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|

| Climate and Development Mandates | ||||||||

| Committed portfolio (MNOK) | 16 762 | 20 439 | 22 253 | 24 944 | 28 352 | 26 924 | 31 650 | 36 225 |

| New investments (MNOK) | 2 784 | 3 600 | 3 511 | 4 015 | 4 839 | 5 320 | 6 513 | 6 487 |

| Number of direct investments in portfolio | 124 | 136 | 149 | 163 | 170 | 198 | 226 | 230 |

| Capital allocated by the owner (MNOK) | 1 478 | 1 500 | 1 690 | 1 905 | 1 820 | 1 680 | 2678 | 2 678 |

| Number of employees in Norfund | 69 | 71 | 75 | 82 | 96 | 111 | 113 | 134 |

| Development Mandate | ||||||||

| Committed portfolio (MNOK) | 16 762 | 20 439 | 22 253 | 24 944 | 28 352 | 26 924 | 29 516 | 32 468 |

| New investments (MNOK) | 2 784 | 3 600 | 3 511 | 4 015 | 4 839 | 5 320 | 4 540 | 4 873 |

| Return on invested capital (IRR) (inv. currency)* | 2.9% | 14% | 4.6% | 6.3% | -0.1% | 5.2% | 5.1% | 1.8% |

| Number of direct investments in portfolio | 124 | 136 | 149 | 163 | 170 | 195 | 219 | 219 |

| KPI: Share of investments in least developed countries | 33% | 36% | 41% | 40% | 39% | 40% | 37% | 38% |

| KPI: Share of investments in Sub Saharan Africa | 52% | 50% | 55% | 53% | 53% | 65% | 63% | 64% |

| KPI: Share of equity and indirect equity | 85% | 85% | 81% | 79% | 79% | 75% | 74% | 71% |

| KPI: Renewable energy share of allocated capital >50% (ended 2021) | 62% | 145% | 60% | 55% | 54% | 40% | - | - |

| KPI: Renewable energy share of allocated capital >60% | 64% | 68% | ||||||

| Number of jobs in portfolio companies | 276 000 | 292 000 | 304 000 | 380 000 | 377 000 | 452 000 | 514 000 | 625 000 |

| Taxes paid by portfolio companies (BNOK) | 10.9 | 9.3 | 13.9 | 14.1 | 16.9 | 16.9 | 23.2 | 33 |

| Climate Mandate | ||||||||

| Committed portfolio (MNOK) | - | - | - | - | - | - | 2 135 | 3 757 |

| New investments (MNOK) | - | - | - | - | - | - | 2135 | 1 614 |

| Number of direct investments in portfolio | - | - | - | - | - | - | 7 | 12 |