In 2024, the Climate Investment Fund gained revenues of NOK 66 million, primarily interest income. The operating results ended at NOK 56 million. The Fund has rounded its third year, and by the end of 2024, a total of NOK 5.59 billion have been committed.

On the cost side, the 2024 numbers are impacted by a positive value change for investments and receivables at year end of NOK 34 million, compared to negative NOK 14 million in 2023. The remaining costs for the climate investment fund are mainly related to management fees based on the fund’s portfolio share of Norfund’s total portfolio.

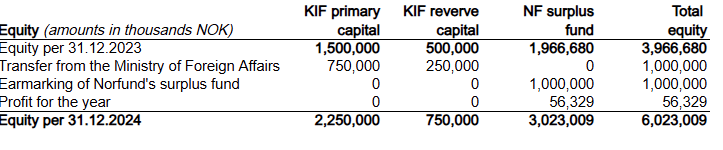

The Climate Investment Fund’s equity

The fund’s total balance as of the end of 2024 was NOK 6 billion. The balance increased by NOK 2,056 million from 31.12.2023, of which the earned result added to equity amounted to NOK 56 million. The remaining increase came from this year’s capital contribution from the state budget and allocation from Norfund, both amounting to NOK 1 billion each.

Internal rate of return (IRR)

In 2024, the Climate Investment Fund (climate mandate) delivered an estimated return measured by Internal Rate of Return (IRR) of 9.3 % in investment currency and 18.2 % in NOK.

As there are significant annual variations, the return on our investment is better reflected in IRR calculations since inception. Since inception, the portfolio has had an IRR of 14.4 % in investment currency and 19.0 % in NOK. The return figures should be viewed in light of the fact that the fund is relatively new with still few investments and no realizations.

IRR for 2024 in investment currency (18.2% in NOK)

IRR since inception in investment currency (19% in NOK)

At the end of 2024, the committed portfolio totaled NOK 37.6 billion.

Financial statements

| Income Statement | ||||

|---|---|---|---|---|

| (Figures in 1000s of NOK) | Note | 2024 | 2023 | |

| Interest income | 2 | 55.484 | 0 | |

| Dividends received | 2 | 8.363 | 7.682 | |

| Realized gains | 3 | 0 | 4.872 | |

| Other operating income | 2.087 | 0 | ||

| Total operating income | 65.935 | 12.554 | ||

| Operating expenses | ||||

| Value changes investments and receivables | 34.179 | -14.024 | ||

| Realised losses | 0 | 0 | ||

| Total realized losses and value change | 34.179 | -14.024 | ||

| Payroll expenses | -100 | -15 | ||

| Management costs | 4 | -29.983 | -16.792 | |

| Other operating expenses | -13.578 | -8.859 | ||

| Total operating expenses | -43.661 | -25.666 | ||

| Operating results | 56.454 | -27.137 | ||

| Other financial income | 3 | 2 | 20 | |

| Other financial expenses | -126 | -1.364 | ||

| Net financial items | -124 | -1.345 | ||

| Profit before tax | 56.329 | -28.481 | ||

| Taxes | 0 | 0 | ||

| Profit for the year | 56.329 | -28.481 | ||

| Allocations | ||||

| Transferred to / from surplus fund | 5 | 56.329 | -28.481 | |

| Total allocations | 56.329 | -28.481 | ||

| Balance Sheet | |||

|---|---|---|---|

| (Figures in 1000s of NOK) | Note | 2024 | 2023 |

| ASSETS | |||

| Total receivables | 487 | 259 | |

| Investments | |||

| Investments in equities and funds | 6 | 2 728 430 | 1 694 299 |

| Loans to investment projects | 6 | 778 184 | 392 194 |

| Total investments | 3 506 613 | 2 086 494 | |

| Bank deposits | 2 516 547 | 1 879 927 | |

| Total current assets | 6 023 647 | 3 966 680 | |

| Total assets | 6 023 647 | 3 966 680 | |

| EQUITY AND LIABILITIES | |||

| Equity | |||

| Called and fully paid capital | |||

| Primary capital | 5 | 2 250 000 | 1 500 000 |

| Reserve capital | 750 000 | 500 000 | |

| Total called and fully paid capital | 3 000 000 | 2 000 000 | |

| Retained earnings | |||

| Surplus fund | 5 | 3 023 009 | 1 966 680 |

| Total retained earnings | 3 023 009 | 1 966 680 | |

| Total equity | 6 023 009 | 3 966 680 | |

| Liabilities | |||

| Other current liabilities | 637 | 0 | |

| Total liabilities | 637 | 0 | |

| Total equity and liabilities | 6 023 647 | 3 966 680 | |

Note 1

The financial statements for the Climate Investment Fund (KIF) follow the same accounting principles as Norfund’s annual financial statements.

Note 2

Dividends received from Norfund’s investment in H1 Capital South Africa amounts to TNOK 8363. Interest income of NOK 55 484 is primarily related to Norfund’s investment in H1 Kenhardt.

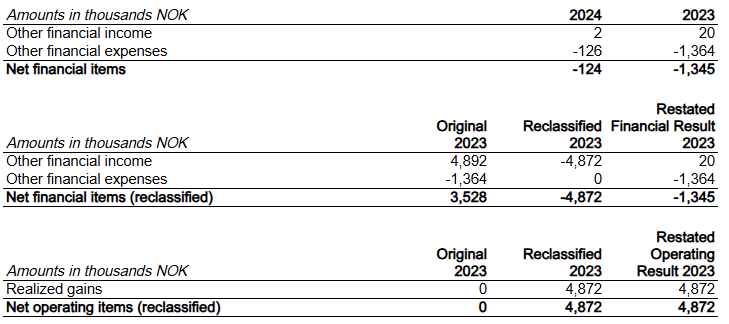

Note 3

In 2024, Norfund has decided to reclassify currency effects on all investments from financial to operating results. The table below shows the figures for 2023 that have been restated in accordance with the changed reclassification. The reclassified amount is shown in the table under the columns “Restated Operating Result 2023” and “Restated Financial Result 2023”

Note 4

The management fee is calculated based on the Climate Investment Fund’s (KIF) portfolio share of Norfund’s total portfolio, and Norfund’s total costs. The portfolio share is based on the historical book value of the investments. The management fee is allocated quarterly, and at the end of 2024, KIF accounted for 10.4% of Norfund’s total investments. For further details, please refer to the discussion in the board’s report under the chapter on organization and efficient operations.

Note 5

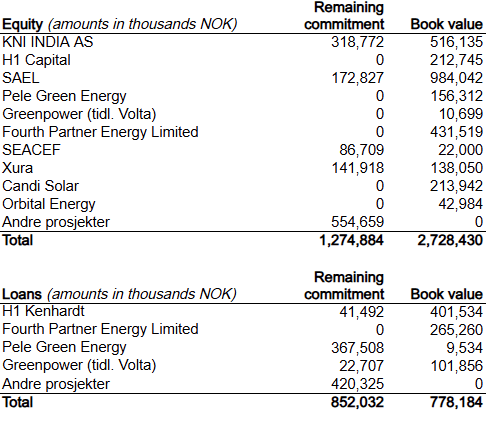

Note 6

The Climate Investment Fund (KIF) has the following investments with remaining commitments and book value at the end of 2024. Further information can be found in the Climate Investment Fund’s activity report.