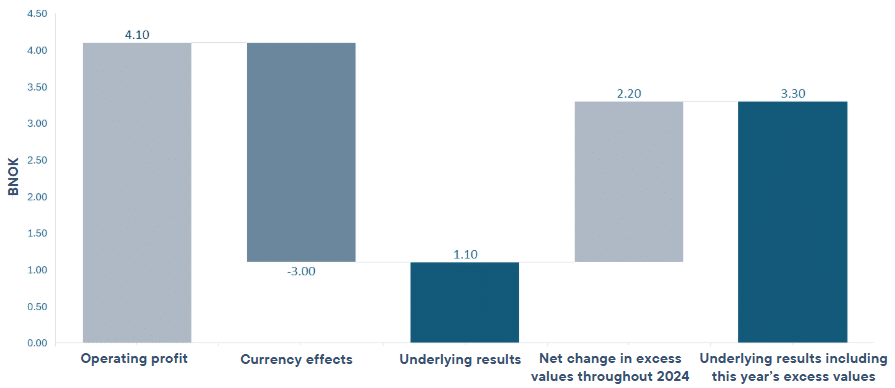

Norfund ended 2024 with an operating revenue of NOK 2,1 billion and a profit after tax of NOK 4,1 billion. The result was significantly impacted by currency effects due to a weaker Norwegian krone (NOK) against Norfund’s primary currency, the US dollar (USD). Currency effects in the profit amounted to NOK 3 billion, compared with NOK 0,5 billion in 2023.

Excluding currency effects, the result for 2024 is NOK 1,1 billion, a reduction of NOK 0,3 billion compared to 2023. The negative change in underlying results is mainly driven by higher write-downs and lower realized gains and losses, somewhat offset by increased income from dividends and interest.

Norfunds principle of recording investments at the lower of historical cost and fair value entails that the portfolio can have unrealized effects that are not recorded. If Norfund had recorded the investments at fair value, the 2024 value increase would have been an additional NOK 2.2 billion, giving an annual result of NOK 3.3 billion.

Operations in 2024

Total revenues increased by 7% i 2024, to NOK 2,086 million. The increase comes from both interest income and dividends from investments, offset by less realized gains from exits of investments.

Norfund’s interest income stems from investments through loans and liquidity placements, where the latter includes a bond portfolio in foreign currency. The increase is mainly explained by an extension in the loan portfolio by 17 percent from NOK 8,147 million in 2023 to NOK 9,537 million in 2024. In addition, a weakened Norwegian krone against the US dollar by 11.6 percent compared to 2023 increases the values in NOK per year end 2024.

Realized gains from the portfolio amounted to NOK 109 million, of which NOK 45 million are realized positive currency effects.

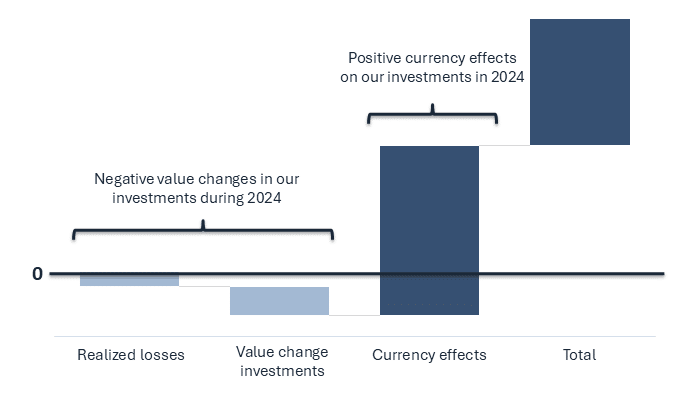

On the cost side, the 2024 numbers are highly impacted by a positive value change* for investments and receivables at year end. Including a negative effect from realized losses of NOK 226 million, the total effect from realized losses and value changes from the portfolio was still positive with NOK 1,929 million, compared to NOK 167 million in 2023.

The main driver of these effects is currency. The underlying value changes excluding currency effects were negative NOK 454 million, compared to negative NOK 227 million in 2023. Total currency effects related to value changes in 2024 were positive NOK 2,609 million, compared to positive NOK 514 million in 2023.

*Value changes consist of impairments and reversals of impairments, in addition to currency effects related to investments in loans, shares, funds, liquidity placements and receivables.

Other operational costs increased by 15%, driven equally by personnel and other costs. Norfund’s operating result in 2024 ended at NOK 3,586 million, compared to NOK 1,748 million in 2023.

Norfund’s financial results amounted to NOK 514 million, compared to NOK 148 million in 2023. This stems from interest rents and currency effects on the company’s bank deposits.

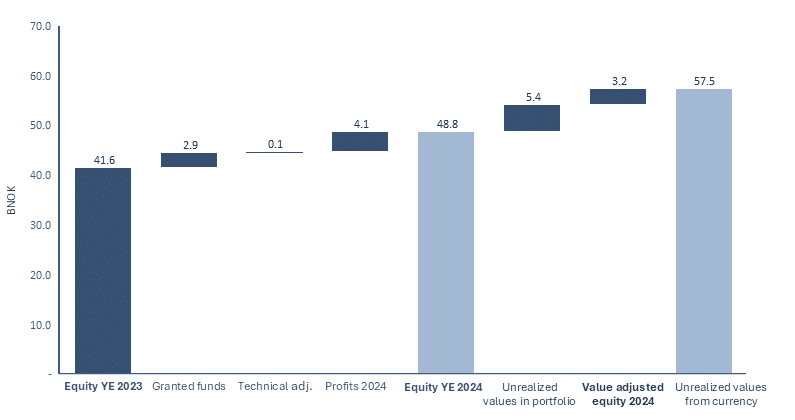

Norfund’s equity

Norfund’s total balance as of the end of 2024 was NOK 49,119 million. The balance increased by NOK 7,077 million from 31.12.2023, of which the earned result added to equity amounted to NOK 4,099 million and the year’s capital contribution from the state budget amounted to NOK 2,928 million. The value-adjusted equity based on estimated market values for Norfund’s portfolio was NOK 57,460 million as of 31.12.2024.

*Adjusted for unrealized gains in the portfolio.

Internal rate of return (IRR)

In 2024 Norfund had an Internal Rate of Return (IRR) for the development mandate calculated in investment currency of 8.3%, compared to 1.8 % in 2023. Calculated in NOK, Norfund obtained an IRR of 19.7 % during 2024, compared to 4.1 % in 2023.

As there are significant annual variations, the return on our investment is better reflected in IRR calculations since inception. As of year-end 2024, the IRR since inception for Norfund’s development mandate, calculated in investment currency, was 5.1 % (compared to 4.8% in 2023). Calculated in NOK, the IRR since inception was 8.6 % (compared to 7.8% in 2023).

IRR for 2024 (investment currency)

IRR since inception (investment currency)

Internal Rate of Return (IRR) in investment currency

| Since inception | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Renewable Energy | 6.1 | 7.8 | -3 | 11.3 | 0 | 2.8 | 7.4 | 7.1 | 19.5 | 2.6 | 2 | -9 | -4 | 12 |

| Financial Inclusion | 6.5 | 14.6 | 6.6 | 0.2 | 10.2 | -2.2 | 7.1 | 3.3 | 5.8 | 7.3 | 12 | 6 | 4 | 9 |

| Scalable Enterprises Direct | -1.1 | -0.6 | 3.8 | 6.9 | 6.6 | -9.8 | 3.3 | -5 | 4.1 | -5.2 | -4 | -10 | -4 | -10 |

| Scalable Enterprises Funds | 0.2 | 0.1 | -0.6 | 1.8 | 5.6 | -12.2 | -7.4 | -14.4 | -4 | -0.4 | 0 | -3 | 12 | 9 |

| Green Infrastructure | -7.0 | -12.2 | -1.4 | 12.2 | 8.7 | |||||||||

| Total | 5.1 | 8.3 | 1.8 | 5.1 | 5.2 | -0.1 | 6.3 | 4.6 | 14 | 1.6 | 3.5 | -6 | -1 | 8 |