Climate change significantly threatens global development, with developing countries bearing the burden of its impact. In response, Norfund is strengthening its commitment to supporting the transition to net zero across the portfolio.

In 2024, we made significant progress in implementing our Net zero strategy. We increased climate finance, improved climate competence by training investment teams, and developed tools to assess climate risk and Paris alignment in our investment process.

Supporting the transition towards net zero

Our Net zero strategy (2024-2030) describes the role Norfund plays in the net zero transition in developing countries. We need to focus on transitioning sectors with high emissions (such as cement and paper manufacturing), alongside supporting the sectors that are providing climate solutions (such as renewable energy).

These are the concrete steps we are taking:

- Invest heavily in climate finance: Step up annual investments in climate finance and seek to invest in climate projects across all investment areas.

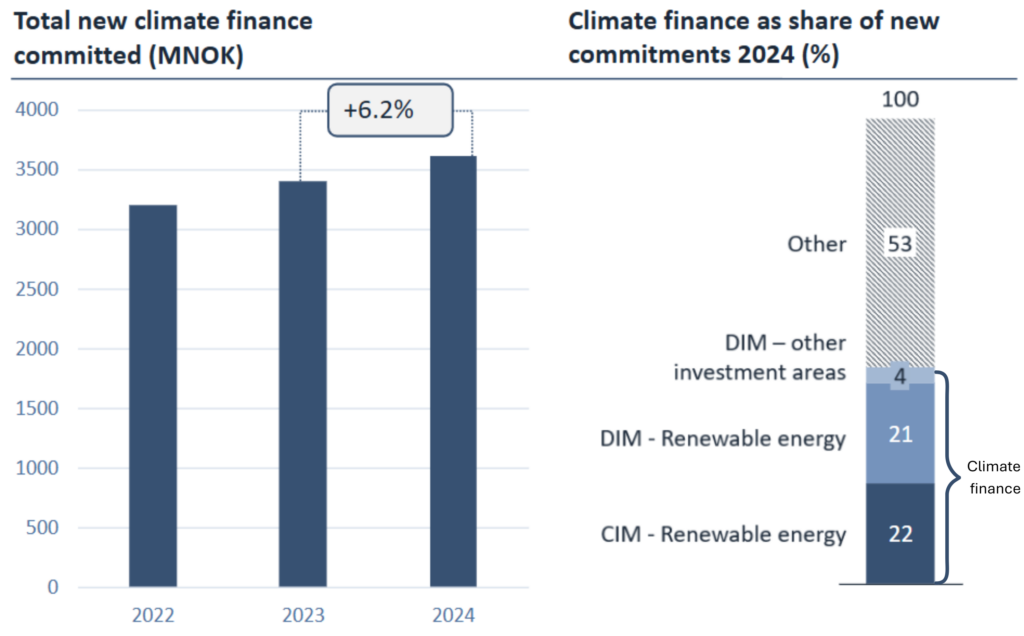

Progress: Climate finance refers to the financial investments to support climate change mitigation and adaptation projects, to reduce emissions and adapt to climate impacts. The criteria used to assess climate finance at Norfund are defined in the IDC/MDB’s Common Principles for Climate Mitigation Finance Tracking, and The MDB’s Joint Methodology for Tracking Climate Change Adaptation Finance. In absolute figures, Norfund increased its climate finance commitments in 2024 by 6.2% compared to 2023, totaling to 3.6 billion NOK. However, relative to new investments, the share fell to 47%, from 52% in 2023, and a step-up is needed to reach the ambition of 64% climate finance as set out in the Net Zero strategy. Renewable energy (both development mandate and climate mandate) represents most of the climate finance, while the other investment areas accounted for 3.5 % of total new investments. Additionally, Norfund mobilized 5.87 billion NOK in private capital in the climate finance commitments in 2024.

2. Support transition to low-carbon economy: Several high-emitting sectors are essential for development in emerging and developing markets. Thus, investing in emission reduction initiatives in such sectors is crucial to contribute to a ‘just transition. Supporting the transition also entails applying decarbonization measures in existing portfolio companies with medium and high emissions.

3. Ensure all new investments are Paris-aligned over time:

Apply Paris alignment methodology to new investments and work actively with investees in the ownership phase.

We strive to support our investees in the transition to net zero, minimize transition risks and reduce stranded asset risk, ensuring our portfolio supports a sustainable and climate-resilient future.

Paris alignment assessments are done through our climate assessment tool (see box).

4. Limit portfolio exposure to fossil fuels: Transitioning away from fossil fuels is essential to limit emissions. Norfund has low exposure to fossil fuels and does not make new investments in the fossil fuel value chain except in special circumstances and in line with the Paris agreement.

Norfund and the other European Development Finance Institutions (EDFI) have identified a list of sectors and activities in which we do not invest in (the EDFI Fossil Fuel Exclusion List). Norfund has further strengthened its approach to fossil fuels with the Norfund Fossil Fuel Standard.

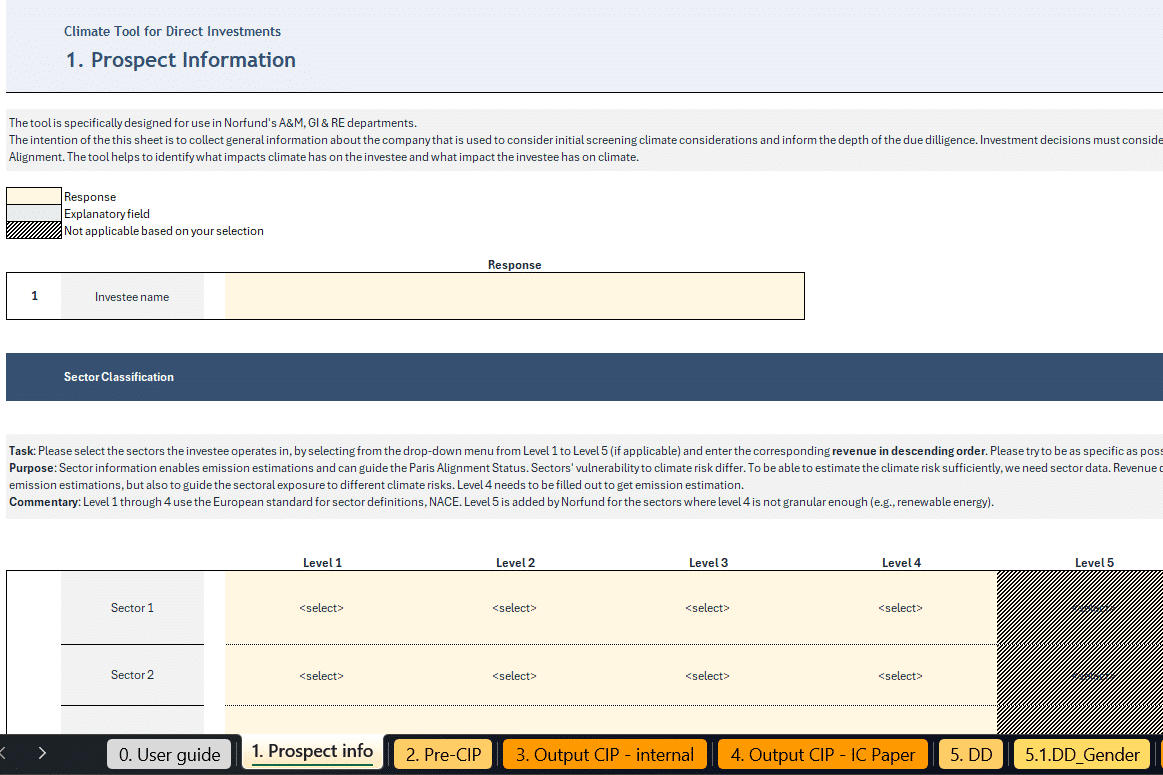

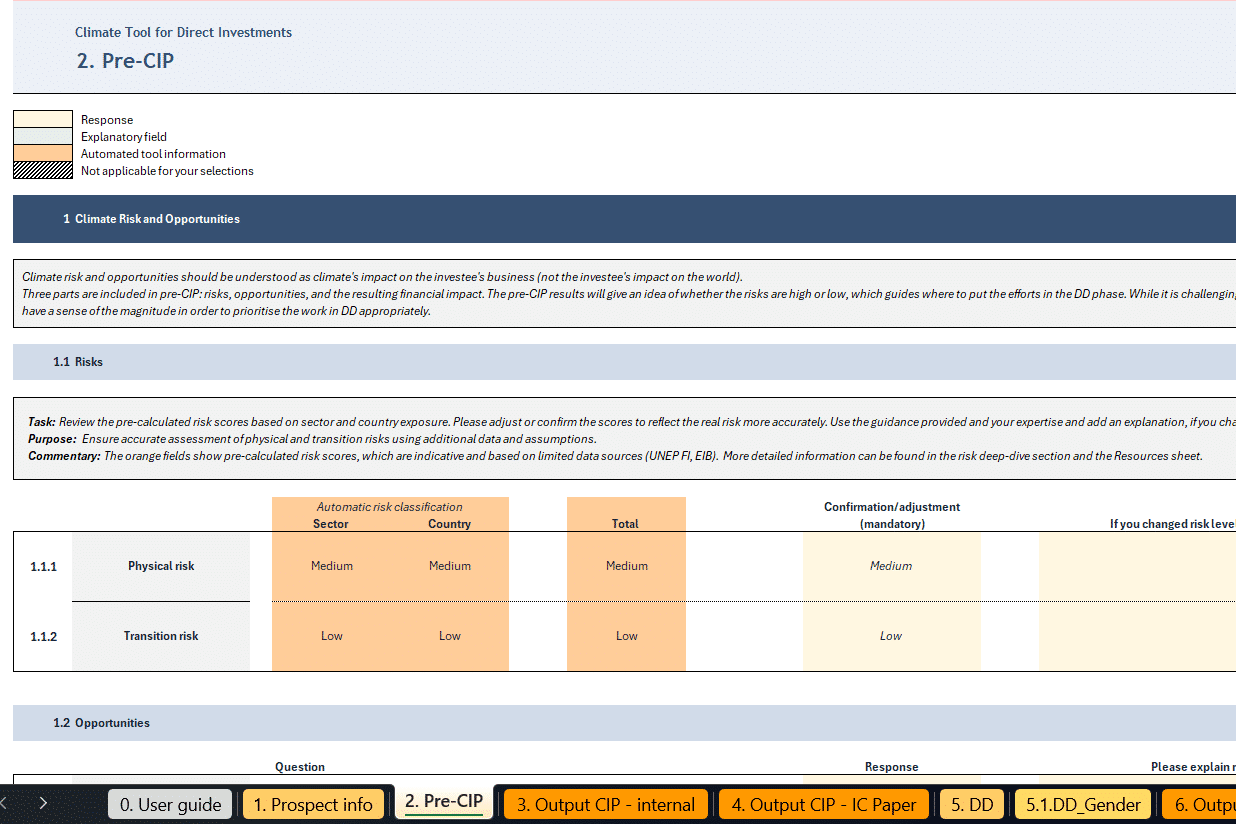

Climate assessment tool

Norfund has developed a climate tool to do climate assessments in the investment process. The purpose is to make better and more climate-informed investment decisions, as well as future-proofing and professionalizing investees on climate by identifying opportunities and ways to reduce risk.

In this tool we address Norfund’s climate objectives and cover:

- Climate risk and opportunities assessment

- Climate maturity assessment

- Paris alignment assessment

- Fossil fuel standard check

- High-level emissions estimation

It also includes guidance and recommendations for investment teams.

There are three slightly different tools for a) direct investments, b) financial institutions, and c) fund investments, as they all have somewhat different approaches to climate risk and Paris alignment.

Climate-related risks and opportunities

Norfund is subject to a range of climate-related risks, with substantial exposure to regions and sectors vulnerable to the physical impact of climate change, while also opening up for opportunities. Climate risks and opportunities have a large potential impact on the viability of the businesses in Norfund’s portfolio. Therefore, climate risk and opportunity assessments are incorporated into our investment process. We continue to improve tools and procedures to assess climate risk and enable the investees to reduce climate risks.

Norfund has disclosed our exposure, strategy, targets, and governance related to climate risk in accordance with recommendations from the Task Force on Climate-Related Financial Disclosures (TCFD) in our 2024 report in the link below.

Norfund’s financed emissions

The largest share of Norfund’s GHG emissions stem from the operations of our investees, also known as financed emissions, or Category 15 – Emissions from investments in the GHG protocol. Our approach is to support our investees to reduce their emissions, rather than focusing on divestment or portfolio reallocation. We work with investees to increase their capabilities in understanding their own emissions, how they can reduce them, and report on them. With this approach, we expect to have a higher real-economy impact on emission reductions.

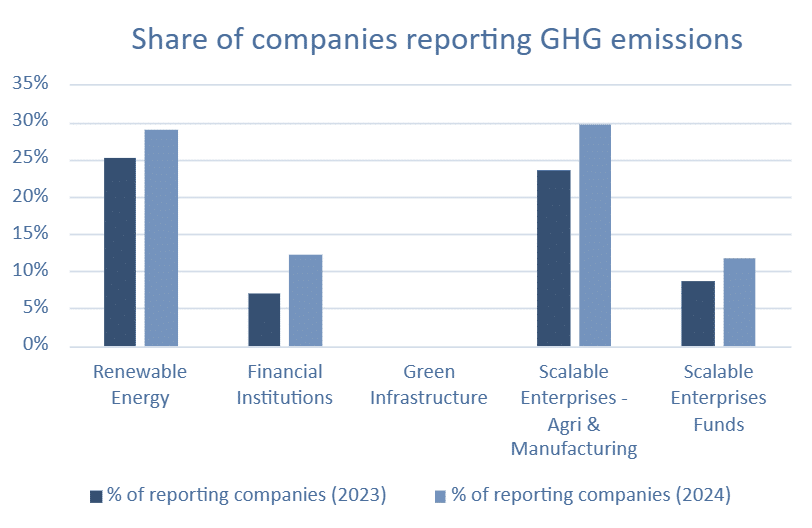

In 2024, Norfund saw a 34% increase in the number of companies reporting GHG emissions. Of the 213 companies that reported emissions for 2024, 24% of companies reduced their emissions compared to 2023 numbers. Still, there is a need to increase the share of companies reporting emissions.

We aim to align with the PCAF standard by 2026, as data quality continues to improve.

Responsible workplace – climate & environment

Beyond our climate-related activities in our investment, we also strive to minimize the footprint of and work to improve our internal operations in Norfund.

Norfund’s Oslo office was certified as an Eco-Lighthouse (Miljøfyrtårn) in 2022 and is in the process of recertifying this year. We use this framework to advance our internal environmental and social performance. As part of the framework, Norfund reports operational emissions annually.

Operational emissions per year

*For 2019, we reported emissions from air travel, waste and energy for the Oslo office

*For 2021, we reported emissions from air travel, waste and energy for the Oslo office

*For 2022, we reported emissions from air travel for all Norfund offices, waste and energy for the Oslo office

*For 2023, we reported emissions from air travel, employee commute and energy for all Norfund offices, waste and water for the Oslo office

*For 2024, we reported emissions from air travel, employee commute, and energy for all Norfund offices, and waste for the Oslo office

The decrease from 2023 to 2024 is mostly due to a reduction in emissions from air travel. Total CO2e per FTE per year has gone down from 7,61 in 2023 to 5,95 in 2024.

Air travel accounts for almost 95% of Norfund’s operational emissions. According to Norfund’s travel guidelines, we always assess the need to travel for physical meetings, and whether digital meetings could be a suitable option.

We work continuously to build more responsible operations and better working environments, and we yearly identify measures to be implemented and followed up within the organization.

Norfund’s 2024 operational emissions, by scope

Scope 1

Scope 2

Scope 3

Category 1-14

Total

* Scope 2 includes emissions from energy for all Norfund offices. Scope 3 emissions within category 1-14, includes emissions from air travel and employee commute for all Norfund offices, and emissions from waste for the Oslo office.