Appropriate Environmental & Social (E&S) measures reduce risk to workers, the environment and local communities and provide business benefits which increase our impact. The management of environmental and social risks is therefore an integral part of Norfund’s investment process.

Revised policy for Environmental & Social (E&S) sustainability

A significant milestone in 2024 was the Board’s approval of our revised Policy for E&S Sustainability. To ensure a comprehensive and inclusive approach, we conducted a thorough desktop mapping exercise and engaged key internal and external stakeholders in discussions regarding the policy’s scope and structure. This revision incorporates Norfund’s commitment to new standards and principles, addresses emerging expectations, and defines our E&S objectives.

ENVIRONMENTAL AND SOCIAL OBJECTIVES

Through our investment activities, Norfund seeks to strengthen investees’ E&S performance and avoid adverse environmental and social impacts. Our approach is risk-based, adjusted to the nature, size, and profile of each investee and guided by the following objectives:

- Promote resource efficiency and reduce pollution

- Support climate change mitigation and adaption

- Promote protection of biodiversity and ecosystems

- Respect human rights and promote decent work

- Enc ourage diversity and gender equality

- Seek positive community outcomes

- Protect clients and consumers

Enhanced training programme

Our Environmental and Social Management System (ESMS) outlines roles and responsibilities related to E&S risk management, covering governance, oversight, and day-to-day practices. Our training programme for investment staff includes comprehensive modules on the ESMS, the IFC Performance Standards (PS), and identifying environmental, health, and safety issues during site visits. In 2024, new modules were introduced to address critical issues such as Gender-Based Violence and Harassment, and Client Protection Principles, in line with the priorities outlined in our revised policy. We also organised E&S training for board members of companies in which Norfund is invested.

Integrated part of the investment process

E&S risk management is an integrated part of our investment process and specific actions are required for each step of the project cycle: initial screening, due diligence, investment agreements and monitoring.

Understanding the risk profile of portfolio companies

During the initial screening phase, we assess each project against the EDFI Exclusion Lists and conduct a high-level evaluation of key E&S risks. Based on this assessment, projects are assigned an inherent risk category, which determines the required level of due diligence and the extent of E&S expert involvement.

This categorisation reflects the potential environmental and social impacts of the financed business activities but does not yet consider the client’s capacity and commitment to managing these risks—an aspect we evaluate later in the investment process. Norfund categorises risk as high, medium-high, medium, or low, in alignment with EDFI E&S Standards. In 2024, 57 per cent of projects fell into the two highest risk categories, requiring detailed due diligence and the involvement of E&S experts.

Assessing E&S risks and impacts

Once our investment/credit committee approves a project, we initiate comprehensive E&S due diligence. This process involves detailed assessments of E&S risks and performance, which include document reviews, site visits, and interviews with relevant stakeholders. It helps identify relevant IFC Performance Standards and evaluate the potential client’s capacity and commitment to effective E&S risk management.

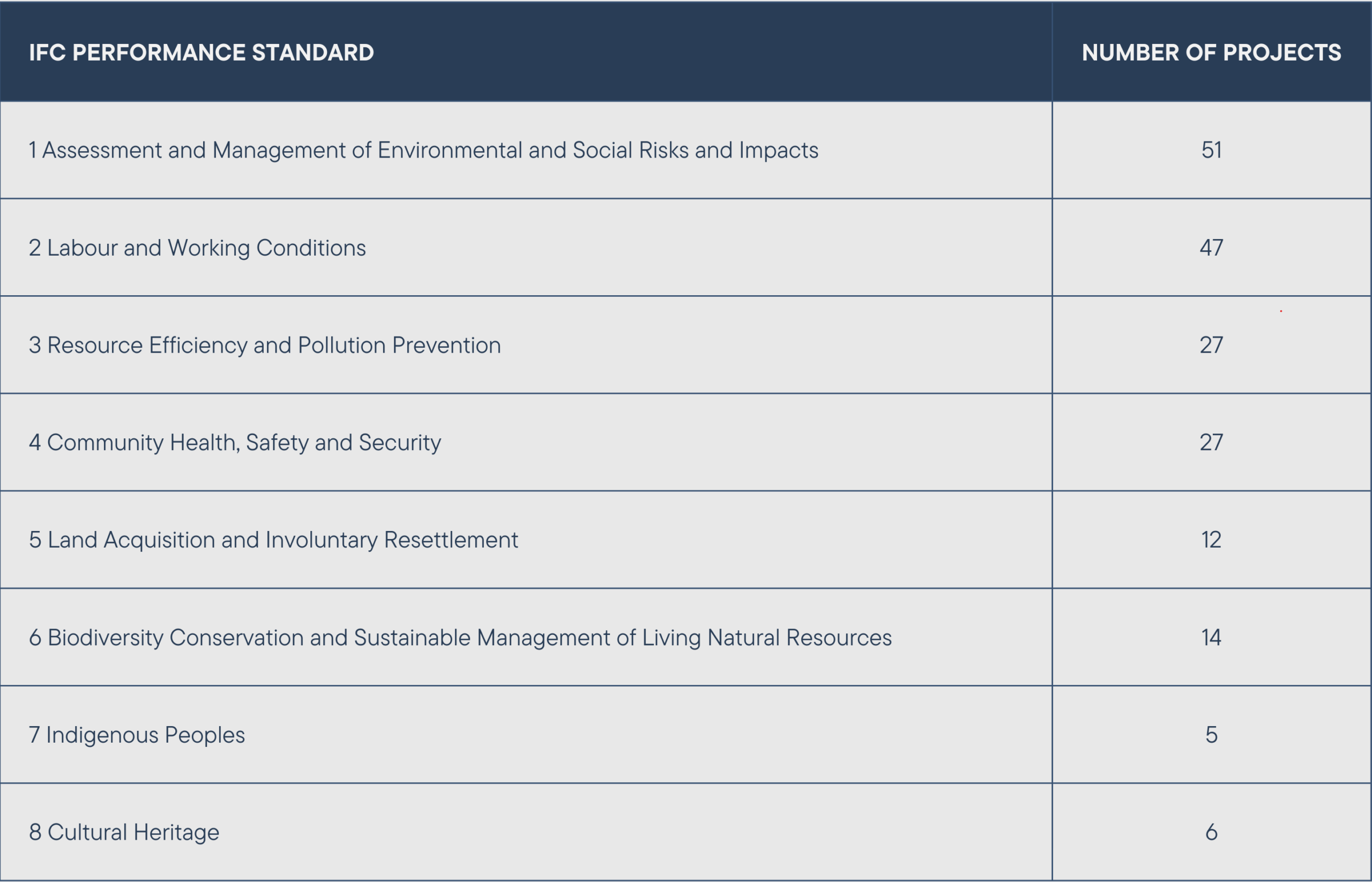

IFC PERFORMANCE STANDARDS

The IFC Performance Standards for Environmental and Social Sustainability and the World Bank Group Environmental, Health and Safety Guidelines are the main standards for operationalizing Norfund’s sustainability commitments. These standards are globally recognized benchmarks for environmental and social risk management in the private sector. The standards are used by development finance institutions, commercial banks and other similar institutions. The table below outlines the eight Performance Standards and the extent to which they were triggered by the projects we invested in during 2024.

Requiring alignment with recognized standards

Any gaps or improvement opportunities identified during due diligence are addressed through an Environmental and Social Action Plan (ESAP), which is incorporated into the investment agreement. In 2024, 78 per cent of investments included an ESAP. Our portfolio companies must comply with national laws and regulations as well as international standards such as IFC Performance Standards and World Bank Group Environmental, Health, and Safety Guidelines. This includes a requirement to develop an ESMS, encompassing an E&S policy, procedures for managing risks, adequate organisational capacity, emergency preparedness measures, and stakeholder engagement processes.

Monitoring compliance and supporting capacity building

As a responsible investor, Norfund actively monitors portfolio companies’ compliance with our E&S requirements. Investees are required to report annually on their E&S risk management performance. Our business support facility plays a critical role in enhancing E&S capacity within portfolio companies, often focusing on strengthening their ESMS and providing targeted training.

Transparent reporting

Norfund seeks to be transparent about our approach to risk management. As a signatory of the UN Principles for Responsible Investment and the Operating Principles for Impact Management, we annually report on our progress and how we integrate these principles into our investments.

UN Principles for responsible investment

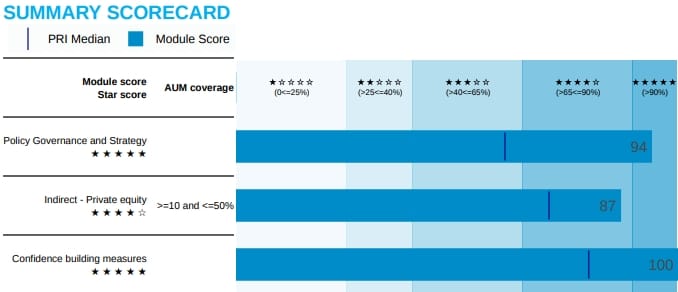

Norfund has been a signatory of the UNPRI since 2017. These six principles emphasise the importance of environmental, social, and governance (ESG) factors in investment decisions. Norfund’s annual report to PRI reflects how we adhere to these principles. Our performance is consistently above the median across all three assessment modules, showing significant progress in 2023.

UNPRI score 2024