The Norfund-managed Climate Investment Fund’s is investing USD 75 million in Mulilo, a leading South African developer of renewable energy projects and Independent Power Producer.

“This investment shows how Norway is helping to reduce emissions, create jobs, and build a more sustainable future,” says Norwegian Prime Minister Jonas Gahr Støre in a press release.

South Africa is in the midst of a serious energy crisis, and 85 percent of the country’s energy comes from coal. The transition to renewable energy is crucial to reduce emissions, ensure a stable electricity supply, and create jobs. Norway is a partner in this transition.

“The world must triple the production of renewable energy by 2030. To succeed, it is crucial that we also include the African continent. There is a lot of sun here, but investments in renewable energy have long been insufficient. The Norwegian Climate Investment Fund is a powerful tool to accelerate the energy transition in developing countries,” says Prime Minister Jonas Gahr Støre in the press release.

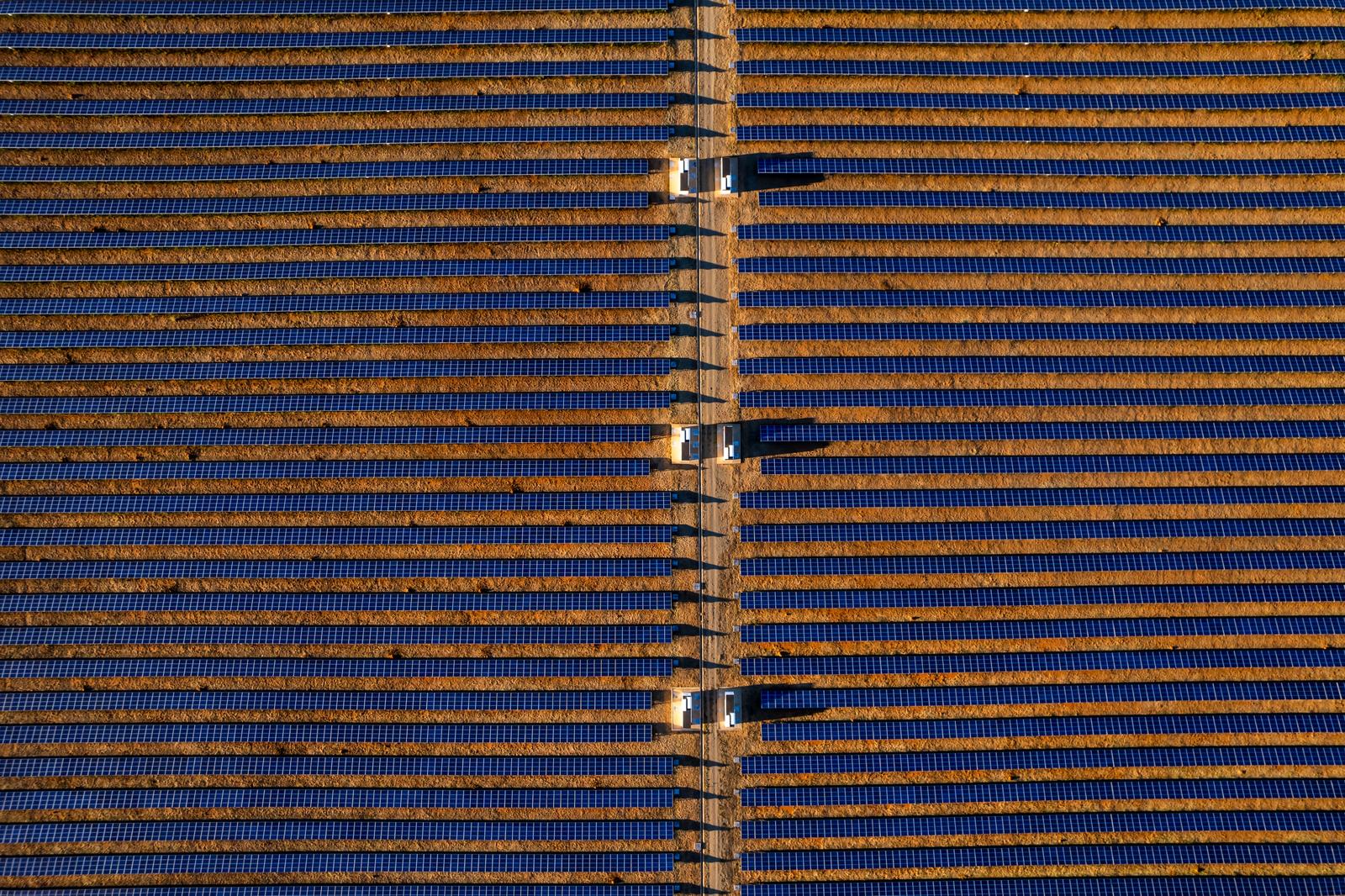

The Climate Investment Fund’s investment of around NOK 760 million in the company Mulilo will be used to build wind, solar, and battery projects that will supply both the national grid and large commercial customers. Mulilo already has 765 MW under construction and and plans to add a further 1 GW to its construction portfolio in 2026.

“South Africa is a key country for the global energy transition. Through the Climate Investment Fund, we provide risk capital that helps meet energy needs with renewable energy,” says Tellef Thorleifsson, CEO of Norfund.

Norfund manages the Climate Investment Fund. Norfund has invested a total of NOK 3.4 billion in renewable energy in South Africa, and NOK 1.9 billion of this is through the Climate Investment Fund.

Copenhagen Infrastructure Partners (CIP) and the investors in its New Markets Fund I (CI NMF I) remains a key shareholder in Mulilo.

“We are very pleased to welcome Norfund as a strategic minority investor in Mulilo. This partnership is a testament to the strength and potential of Mulilo, and the progress achieved. Norfund’s investment not only provides valuable growth capital but also brings a highly reputable, government-backed partner with deep experience in the South African energy sector. Together, we will continue to accelerate the energy transition, support local communities, and deliver strong value for our investors.” says Robert Helms, Partner in CIP.

The renewable projects in South Africa that Norfund has invested in helped avoid 4.3 million tons of CO₂ emissions last year – equivalent to nine percent of Norway’s annual emissions.

“Norfund is proud to join forces with Copenhagen Infrastructure Partners and Mulilo’s founders and local partners in this landmark investment that will accelerate the deployment of renewable energy across South Africa. Our commitment of USD 75 million reflects our confidence in the platform’s ability to deliver large-scale renewable energy projects that support the transition to net zero,” says Tellef Thorleifsson, CEO of Norfund.