Norfund is investing in B5 Plus Limited, one of Ghana’s largest steel manufacturers. The investment in sustainable and local steel production will help create thousands of jobs and support Ghana’s transition to cleaner energy.

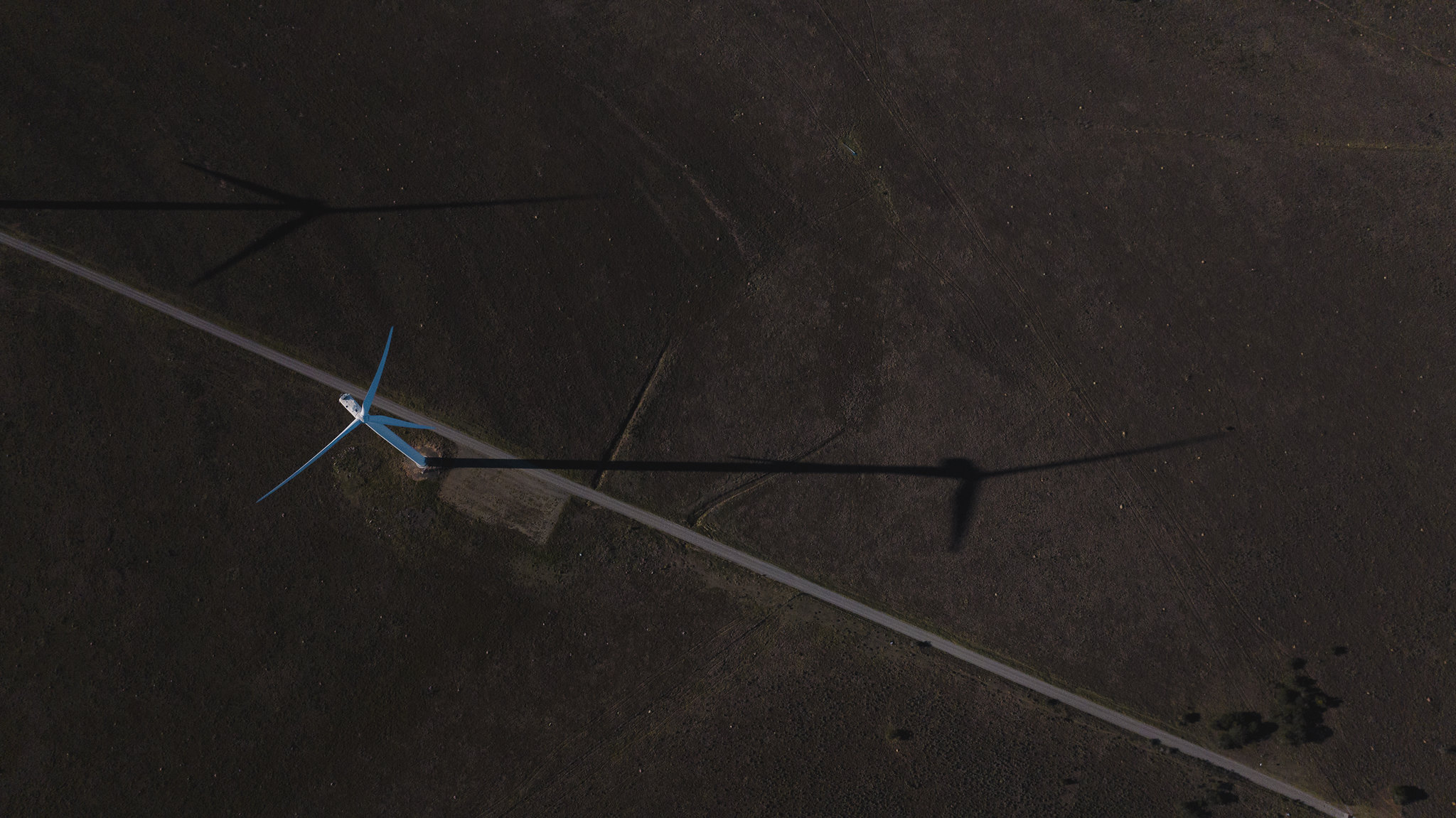

B5 Plus Limited is recognized for its ISO 9001:2015 certification and adoption of Kaizen continuous improvement practices. Norfund’s investment is in the form of a USD 15 million loan. The capital will be used to refurbish a recently acquired steel plant in Ghana’s Tema Freezone and build a 16 MW solar power facility at B5 Plus’ site in Prampram. It will also strengthen the company’s operations through modernization and improved efficiency.

“This investment aligns with our mandate to create jobs and improve lives, and it helps reduce the carbon footprint of the supply chain and production processes, including through increased use of scrap metal and integration of renewable energy. It also strengthens the company’s competitiveness and contributes to green industrial growth in Ghana”, says Naana Winful Fynn, Norfund’s Regional Director for West Africa.

The project is expected to create 1,800 direct jobs and contribute to an additional 10,000 indirect jobs. Demand for construction materials like steel is rising in line with economic growth in Ghana and the region.

“We are honored by the partnership of Norfund, which reflects confidence in B5 Plus Group’s sustained growth and Africa’s industrial future. Our greatest asset has always been our people — their talent, dedication, and resilience drive our success — and we are equally committed to giving back through education, skills development, and community-focused CSR initiatives. This collaboration goes beyond finance; it is about building resilient industries, empowering communities, and shaping a future of inclusive and sustainable progress for Africa and beyond.”

Mr. Mukesh Thakwani, Executive Chairman of B5 Plus

“Local and competitive steel production is essential to support infrastructure development and the industrial growth needed to create the jobs that are key to driving development in Ghana”, says Fynn.

Steel production is a major source of global greenhouse gas emissions, averaging 1.92 tons of CO₂ per ton of steel (World Steel Association – CO₂ Data). B5 Plus already primarily relies on recycled steel, and by further increasing this usage in combination with investing in solar energy, the company is taking important steps to ensure that Ghana’s growth happens with as low emissions as possible.