The Climate Investment Fund and KLP are investing NOK 850 million in the establishment of a new platform with ambitious plans for renewable energy development in South Africa. The investment is partly financed by capital from exiting one of the fund’s first investments in the same country.

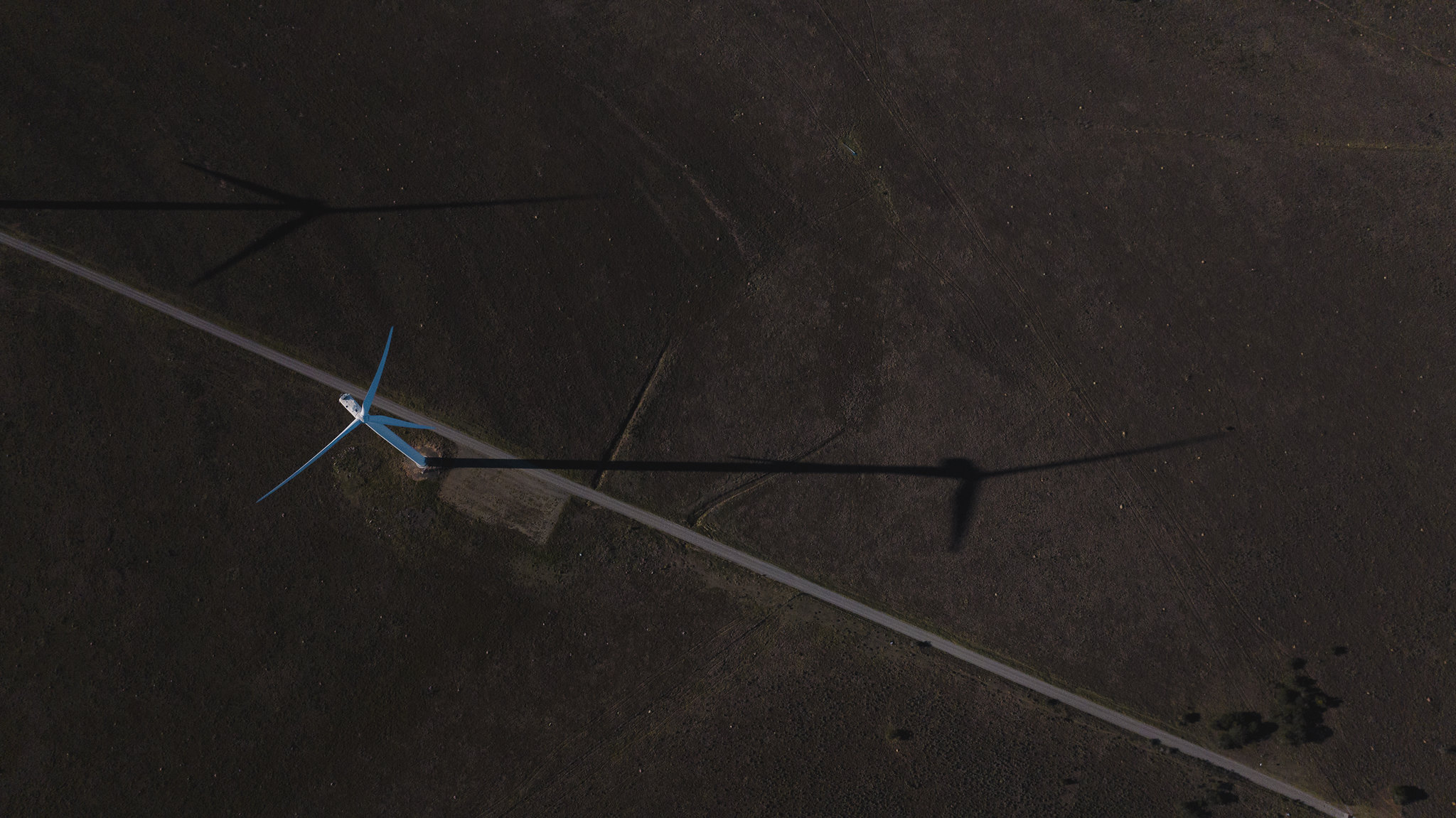

The new platform, called “Anthem”, has a secured portfolio of more than 2.7 GW across 17 operating wind and solar projects of over 1GW, four projects under construction of 445MW, three projects in financial close of 1.2GW, and a further 11 GW pipeline under development.

For comparison, Norway’s entire power supply has a capacity of 40 GW.

“These are the kinds of contributions needed to accelerate the transition to renewable energy in countries like South Africa, which today is dependent on coal power,”

Åsmund Aukrust

Minister of International Development

Born from the integration of African Clean Energy Developments (ACED) and EIMS Africa under the African Infrastructure Investment Managers (AIIM) managed IDEAS Fund as shareholder, Anthem combines deep development, asset management and operational expertise to deliver clean, reliable and cost-effective power to Eskom, large private offtakers, and the region’s growing energy market. Mahlako Energy Fund, an investment and advisory firm owned 100% by Black South African women, is also joining as an investor.

The Climate Investment Fund is investing NOK 685 million directly, while KLP Norfund Invest (KNI) is investing NOK 170 million. KNI is the joint investment company of KLP and Norfund, owned 51% by Norfund and 49% by KLP.

“Anthem will be a key investment in The Climate Investment Fund’s efforts to support the transition to renewable energy in South Africa, making a significant contribution in terms of avoided emissions, while also ensuring the country has reliable access to the energy needed for growth out of poverty,” says Bjørnar Baugerud, Head of The Climate Investment Fund at Norfund.

“We firmly believe that the investment in Anthem will deliver solid returns for KLP’s owners, while also contributing to increased renewable energy production in South Africa. This aligns with KLP’s role as a long-term and responsible investor,” says Eric Nasby, Investment Analyst at KLP.

Reinvesting capital from The Climate Investment Fund first investments

This investment comes a week after The Climate Investment Fund exited one of its first investments. The investment in Scatec’s pioneering solar and battery project Kenhardt is now being taken over by South Africa’s Standard Bank, freeing up NOK 440 million for new investments. The investment yielded an annual return of 13% in South African rand.

“As many countries are now cutting funding for aid and development, mobilising private capital is a prerequisite for success, and The Climate Investment Fund does this both by investing alongside private actors and by allowing private capital to take over when possible,” says Aukrust.

Becoming a key player in South Africa’s renewable energy development

From its inception, Anthem will be one of South Africa’s largest renewable energy companies.

“Access to capital on competitive terms is crucial for us to realise our ambitious plans for renewable energy development in South Africa, and we are therefore very pleased to have Norfund and The Climate Investment Fund on board,” says James Cumming, the CEO of Anthem.

For renewable energy, almost the entire cost comes at the time of investment. This means that high capital costs, due to higher risk in developing countries, can hinder the transition from coal to renewables, which require less investment but are more expensive to operate.

South Africa has one of the world’s highest shares of coal in power production, at over 80% (IEA). The climate benefits are therefore substantial if new renewable production can be realised.

Standard Chartered Bank was Norfund’s financial advisor in the deal.