Norfund is committed to making a difference by investing where capital is scarce and through active ownership.

The Norfund Act states that Norfund shall contribute to establishing viable, profitable undertakings that would not otherwise be initiated because of the high risk involved.

The extent to which an action contributes to an outcome that would not have happened otherwise is often referred to as ‘additionality’. Proving the additionality of our investments is challenging because it requires insights into what could have happened had we not invested.

What does it mean that an investment is additional?

Financially additional

According to the OECD, an investment is financially additional if it supports capital-constrained markets in which private sector partners are unable to obtain commercial financing or if it mobilises investment from the private sector that would not otherwise have invested.

Value additional

An investment is value additional if it provides non-financial value that the private sector is not offering through active ownership, promoting environmental and social standards or supporting enterprise improvement. Through our value additionality, we contribute to improving both the profitability and the development impact of the businesses in which we invest.

Ten ambitions on additionality

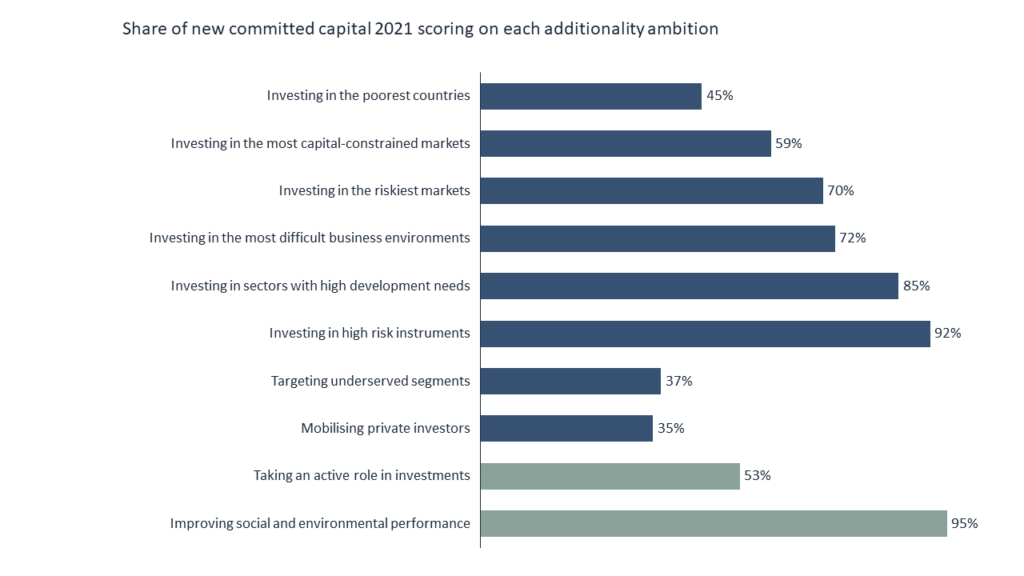

Norfund has a defined additionality framework that helps assess the additionality of our investments and ensure alignment with the OECD definition. This framework consists of ten additionality ambitions (see table below) reflecting both the financial and value additionality of our investments. For each ambition, we have identified relevant indicators to assess the extent to which we meet these ambitions.

Based on our experience with the use of the framework since 2018, the framework was revised in 2020 to better reflect the markets we operate in.

Additionality informs our investment decisions

The framework informs our investment decisions and the way we report on additionality. Each new potential investment is assessed against the ten ambitions, explained in the graph below, and is accompanied by a narrative description of additionality. In 2021, Norfund invested in 29 new companies and funds that were all assessed using the additionality framework. More information on which ambitions the investment is particularly additional on is listed on the individual investment webpage.

Percentage of committed capital to new projects in 2021 scoring materially on each additionality ambition (follow-on investments are not included):