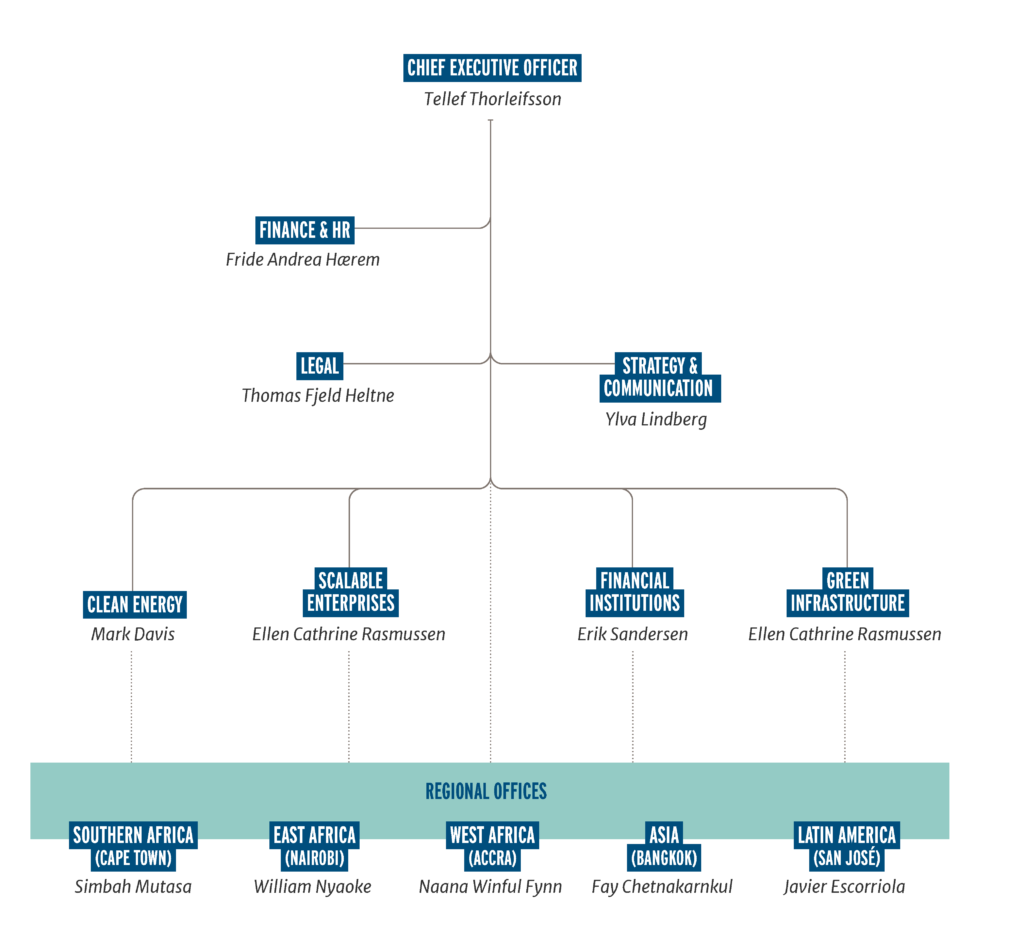

Norfund has Norway’s largest specialist team investing in developing countries based in our office in Oslo, but also ensures local presence and expertise through five regional offices in Africa, Latin-America and Asia.

Investment expertise

In 2021, 70 out of 111 employees were working directly on investments, following the projects through all the phases of the investment process. This includes eight dedicated personal dealing with Environmental and Social issues (E&S).

Norfund has four sector-based investment areas: Clean Energy, Financial Institutions, Scalable Enterprises and Green Infrastructure.

Country presence

Thirty-four Norfund staff members are employed across five regional offices (Nairobi, Cape Town, Accra, San José and Bangkok) to ensure local proximity and knowledge. The regional offices generate investments, monitor existing commitments and provide all the sector-based departments with support.

Impact expertise, financial analysis, organisational development and legal support

The Strategy and Communication department leads strategy development and implementation, analyses development effects and additionality. They also manage stakeholder relations and communication, as well as dialogue with Norfund’s owner, the Norwegian Ministry of Foreign Affairs.

The Finance, IT, Risk and HR departments are responsible for Norfund’s accounts, financial analysis and portfolio reporting, as well as for recruitment, skills and staff development. This department is also responsible for Enterprise Risk Management, IT, the Business Support scheme and the Project Development and Risk Mitigation Facility.

The Legal department is responsible for legal and compliance issues.

Norfund Academy

As a result of the Norfund competence project, “Competence development”, “Teams” and “Knowledge sharing” was identified as key building blocks to improving the way we work. Subsequently, the Norfund Academy was established in order to strengthen and structure organisational learning initiatives.

Norfund Academy was well-received in the organisation, and during 2020-2021 new courses and content were added. By the end of 2021 topics such as IFC performance standards, Business Integrity and Core investment competencies were chosen to be the focus areas for competence development going forward. Alongside the revision of the investment manual, various internal contributors will work to produce content related to investment core competencies. The current course catalogue contains courses like New Joiner, Cyber Security, E&S training, Project Management, sessions for IT-systems in Norfund as well as courses arranged by European Development Finance Institutions (EDFI).

Investment committee

Norfund’s Investment Committee (IC) is important, both for quality assurance and for strengthening decision-making. While the CEO/Management Team decide on investments up to USD 4 million, the IC is mandated to decide on investments between USD 4-15 million. The IC also reviews investment proposals exceeding USD 15 million; these proposals are given final approval by the Board of Directors.

The IC is chaired by the CEO, Tellef Thorleifsson and has seven additional members:

- Two external members: Per Aage Jacobsen and Kathryn Baker,

- Four management team members; Mark Davis, Erik Sandersen, Ellen Cathrine Rasmussen and Thomas Fjeld Heltne

- One ESG advisor; Karin Bianca Gullman.

Management

Tellef Thorleifsson

Chief Executive OfficerFride Andrea Hærem

Chief Financial Risk Officer & HRThomas Fjeld Heltne

Executive Vice President, General CounselMark Davis

Executive Vice PresidentYlva Lindberg

Executive Vice President, Strategy & CommunicationErik Sandersen

Executive Vice President, Financial InstitutionsEllen Cathrine Rasmussen

Executive Vice President, Scalable Enterprises

Tellef Thorleifsson

Chief Executive Officer

Tellef Thorleifsson has been CEO of Norfund since Autumn 2018. Prior to Norfund, he was a co-founder and managing partner of Northzone. Thorleifsson was instrumental in building Northzone to become a leading international venture fund. Since inception in 1996 it has raised more than EUR 1.5 billion through nine funds and invested in more than 130 companies. Thorleifsson is also a co-founder of the Voxtra Foundation which has been making targeted investments and grants within agribusiness in East Africa. Thorleifsson has held several directorships.

Fride Andrea Hærem – from December 2021

Chief Financial Risk Officer & Head of HR

Fride Andrea Hærem took the position as CFRO and Head of HR in Norfund in 2021. Before joining Norfund, she was EVP for HR, Marketing and Communication, IT and Strategy at Norconsult. She has more than 10 years of experience in HR directorship roles and has held several finance manager positions, including at Posten and Cermaq. She holds a Master of Management with a specialisation in international business leadership from BI Norwegian Business School.

Cathrine Kaasen Conradi – until December 2021

Chief Financial Risk Officer & Head of HR

Prior to joining Norfund, Cathrine was a partner in Cinclus Equity Partner. She has more than 10 years’ experience in private equity and has held several board positions in companies within the oil service sector, IT and retail. She also has a background from Accenture’s Strategy Department working with clients within telecom, energy and the financial sector.

Thomas Fjeld Heltne

Executive Vice President, General Counsel

Thomas Fjeld Heltne took the position as General Counsel in Norfund in 2019. Before joining Norfund, he was Director M&A at Norsk Hydro. Heltne has throughout his career worked with transactions, financing and international projects, both from the legal and commercial side. He holds a degree in law from Norway as well as a Master of Laws from LSE and Corporate Finance from the Norwegian School of Management. Heltne has been member of and observer to boards of Norwegian industrial companies and served on the Trade Policy Panel for the Confederation of Norwegian Enterprise (NHO).

Ylva Lindberg

Executive Vice President, Strategy & Communication

Prior to joining Norfund, Ylva was founding partner of SIGLA, a boutique consultancy on sustainability and business, for 13 years. She has worked with sustainable and impact investments for almost 20 years and has experience with asset management and consumer goods. Ylva is a senior associate of the University of Cambridge Institute for Sustainability Leadership, board member of Lærdal Medical and member of the Responsible Investment Advisory Council of BMO Global Asset Management.

Erik Sandersen

Executive Vice President, Financial Institutions

Erik joined Norfund in 2014 and has represented Norfund on several boards of banks and microfinance institutions. He is currently a board member of the South Africa-based bank investment firm Arise and of the Nordic Microfinance Initiative. Prior to joining Norfund, Erik worked for 10 years as a co-founder and partner in a venture capital firm in the Nordic region. He has also worked as an executive in the IT sector and for the Boston Consulting Group in London and Oslo. He holds a master’s degree in engineering from the Norwegian University of Science and Technology (NTNU) and an MBA from Stanford University.

Mark Davis

Executive Vice President, Clean Energy

Mark has worked extensively with renewable energy investments, regulation and policy in developing countries, with a focus on Africa. Prior to joining Norfund he was a partner at ECON Analysis, and previously was Postgraduate Director at the Energy & Development Research Centre, University of Cape Town. He holds a PhD in energy economics from the University of Sussex, and earlier degrees in mathematics and applied science from the University of Cape Town.

Ellen Cathrine Rasmussen

Executive Vice President, Green Infrastructure and Scalable Enterprises

Ellen Cathrine Rasmussen joined Norfund as EVP for Scalable Enterprises in March 2020. In 2021 she also took on the role of EVP for Green Infrastructure. Prior to Norfund, Ellen held several senior positions at Yara, the world’s leading fertilizer company. Her last position in Yara was as VP of Sustainability Programs and Global Projects. Prior to that, she was country manager for the Ivory Coast. Earlier in her career Ellen spent four years as EVP for Agrinos, an international agriculture input provider, responsible for Europe, Middle East, Africa and Asia. Ellen has also had various management positions at Norsk Hydro and served as a board member for SINTEF. She studied economics in Norway and France.

Board of Directors

Norfund’s Board of Directors is appointed by the General Assembly. The General Assembly is constituted by the Norwegian Minister of International Development who governs the state’s ownership in Norfund.

Norfund’s Board of Directors ensures that the Fund operates in accordance with the Norfund Act of 1997 and the fund’s statutes. The Board defines Norfund’s strategy and approves individual investments exceeding specified thresholds. Other investment decisions are delegated to the CEO and Investment Committee.

In 2020, the Board decided to appoint a Risk and Audit committee consisting of three Board members with the aim to strengthen risk management. The members are Tove Stuhr Sjøblom, Martin Skancke and Brit Rugland.

In 2021, the Board held a total of 9 board meetings. The Board did not travel abroad in 2021.