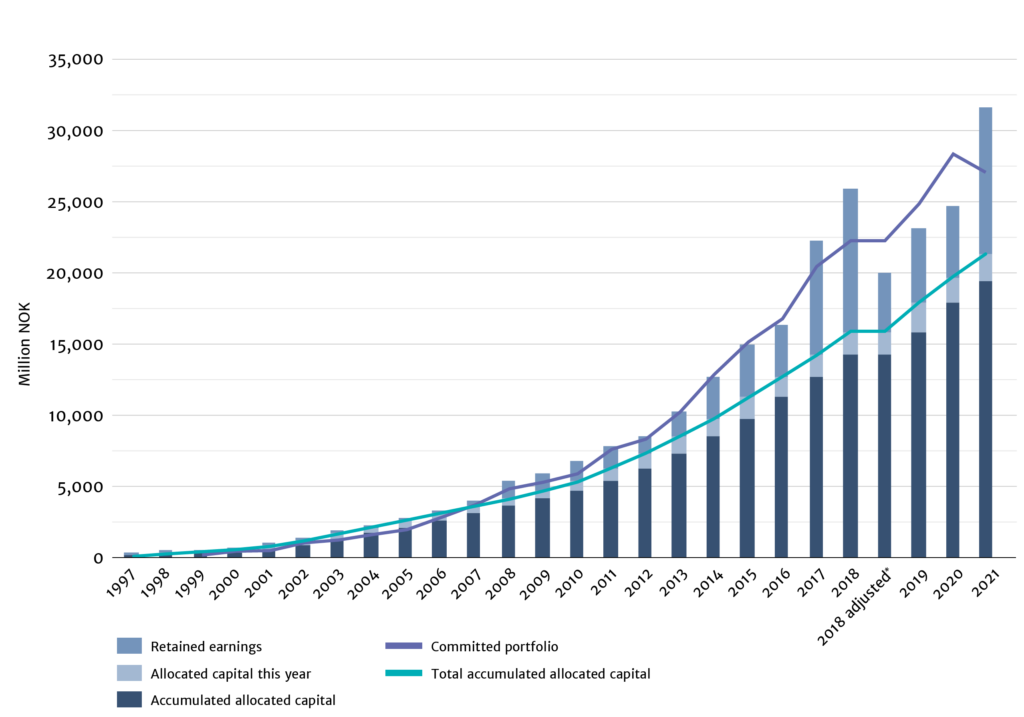

By year end 2021, Norfund had committed investments totalling 26.9 billion NOK in 195 projects. In 2021 Clean Energy made up over a third of investments. It was also the first year a Green Infrastructure investment was made.

Portfolio since inception

Priority investment areas

Norfund invests in four areas where the potential for development impact is substantial and that are aligned with the SDGs: Clean Energy, Financial Institutions, Scalable Enterprises and Green Infrastructure.

Portfolio per investment area (MNOK)

Key Performance Indicators (KPIs) for Norfund's portfolio

Four Key Performance Indicators are defined for Norfund's portfolio.

Least Developed Countries >33%

The scarcity of capital available in Least Developed Countries (LDC) means the needs for our investments are high. 40% of Norfund's total portfolio is in these markets.

Total portfolio in LDCs

Sub-Saharan Africa >50%

In line with Norfund’s strategic target, 50% of all commitments in 2021 were in Sub-Saharan Africa. The sale of SN Power caused a drop in the share of our investments in Asia, and is hence the main reason for the increase in the share in Sub-Saharan Africa, from 54% in 2020 to 65% in 2021.

Investments in Sub-Saharan Africa

Greenfield >15% of three years’ moving average

Investments in new power plants, startups and first-generation funds are classified as greenfield investments. Greenfield investments often carry high risk, but may be particularly important to development. The greenfield KPI is different to the other KPIs. This is a floating average of commitments over the past three years and not a portfolio level measure.

Total portfolio in greenfield

Equity and indirect equity >70%

Norfund provides capital in the form of equity, debt and fund investments. Preference is given to equity investments – both direct investments and through funds – because in most developing countries equity is the scarcest type of capital available to enterprises.