1997

Norfund is established

Chairman: Arve Johnsen, Managing director: Per Emil Lindøe.

(Photo: Norsk olje og gass, via Wikimedia Commons)

1999

Norfund enters into co-operations with the World Bank’s International Finance Corporation (IFC) and the Association of European Development Finance Institutions (EDFI)

2000

A grant facility for Norfund is established by the Norwegian Ministry of Foreign Affairs

2001

A regional office for Latin America is opened in San Jose

Aureos Capital Limited (ACL) was established

It was established as a joint venture between CDC and Norfund in 2001, and became a leading fund manager for SME investments in emerging markets.

2002

Norfund’s investments are untied from Norwegian industry

SN Power was established

SN Power Invest was established – a joint venture between Norfund and Statkraft. The company grew to be a leading commercial investor and hydropower project developer in emerging markets. In 2020 Scatec acquired SN Power (see highlight).

2003

A regional office for Southern Africa is opened in Johannesburg

2004

A system for measuring development effects is introduced

Agribusiness Development Corporation (LAAD)

Norfund invests in Latin American Agribusiness Development Corporation (LAAD), a specialized lender that finances small and medium-sized agribusiness companies in Latin America. In 2017, Norfund supported LAAD further by providing an additional loan.

2006

Kjell Roland was appointed as Managing Director for Norfund

European Financing Partners (EFP)

Norfund invested in EFP, a private limited liability company owned by 12 European Development Finance Institutions (DFIs) and the European Investment Bank.

2007

Kristin Clemet is appointed chair of the board of Norfund, and a new focused strategy is adopted

A regional office for East Africa is opened in Nairobi

Hattha Kaksekar (HKL)

Norfund’s equity investments, loans and active shareholding in HKL contributed to its extensive development, from a small NGO to one of Cambodia’s leading mid-size microfinance institutions. In 2016 the institution was ready for investment from an experienced shareholder in the banking sector, and Norfund sold our shares.

2008

The Norwegian Microfinance Initiative (NMI) is established

NMI gives poor people in developing countries access to financial services by uniting private and public capital. Established in 2008 by Norfund and a group of Norwegian private investors, the Initiative aims to be the leading Nordic microfinance platform. In 2016 the Danish Investment Fund for Developing Countries (IFU) joined, and the name was changed to Nordic Microfinance Initiative.

2009

Africado

Africado – an agricultural investment that has succeeded in commercialising a traditionally low-value crop. New techniques and agricultural training are creating jobs and new sources of revenue for small-scale avocado farmers in Tanzania. This also enabled them to expand production and reach export markets.

Bugoye Hydropower Plant

The 13 MW plant in Uganda was a joint development project between Trønder Energi and Norfund.

2010

Agri-Vie Fund

Agri-Vie Fund I, a fund focused on the food and agribusiness sector in Sub-Saharan Africa. In 2017 Norfund worked closely with the management to also establish Agri-Vie II.

2011

A regional office for Asia is opened in Bangkok

2012

A regional office is opened in Maputo, Mozambique

Scatec Solar Kalkbult

The Kalkbult plant in South Africa’s Northern Cape region is one of Africa’s largest solar plants. The 75MWp plant, developed by Scatec Solar, became operational in late 2013.

Kinyeti Venture Capital

– a pioneering investment company in the recently independent Republic of South Sudan, investing in SMEs, was established as a joint venture between Norfund and Swedfund.

2013

KLP Norfund Investment AS (KNI) is established

KNI is a co-investment vehicle financed jointly by KLP and Norfund. KNI invests equity in selected finance and renewable energy projects within Norfund’s investment strategy.

Lake Turkana Wind Power Project (LTWP)

LTWP is the largest wind power plant of its kind on the African continent, providing almost 17% of Kenya’s installed capacity with 365 wind turbines installed in a dry and arid area in Northern Kenya. The LTWP is the largest single private investment in Kenya’s history. The windfarm was connected to the national grid in 2018. In July 2021, Norfund sold all its shares to the Anergi Group.

2014

Globeleq

In 2014, Norfund and CDC took full ownership of Globeleq, one of Africa’s leading electricity generation developers and operators. With 13 power plants total Globeleq currently generates more than 1,400 MW and has another 2,000 MW in development.

2015

Equity Bank

One of East Africa’s leading banking groups, Equity Bank has over 9 million customer accounts in Kenya, South Sudan, Uganda, and Rwanda. Few banks have succeeded as well as Equity Bank in developing efficient services for mass markets in developing countries. Its services include insurance agency, investment banking, securities brokerage and information and telecommunications technology outsourcing services.

2016

Arise

Norfund, FMO, NorFinance, and Rabobank joined forces in establishing Arise. The aim is to strengthen the financial sector in Sub-Saharan Africa and increase SMEs’ and poor unbanked peoples’ access to capital. Arise partners with sustainable, locally-owned Financial Services Providers and has become a leading African investment company.

The Johannesburg office is closed, and staff are transferred to Arise

A regional office for West Africa is decided to be opened in Accra, Ghana

2017

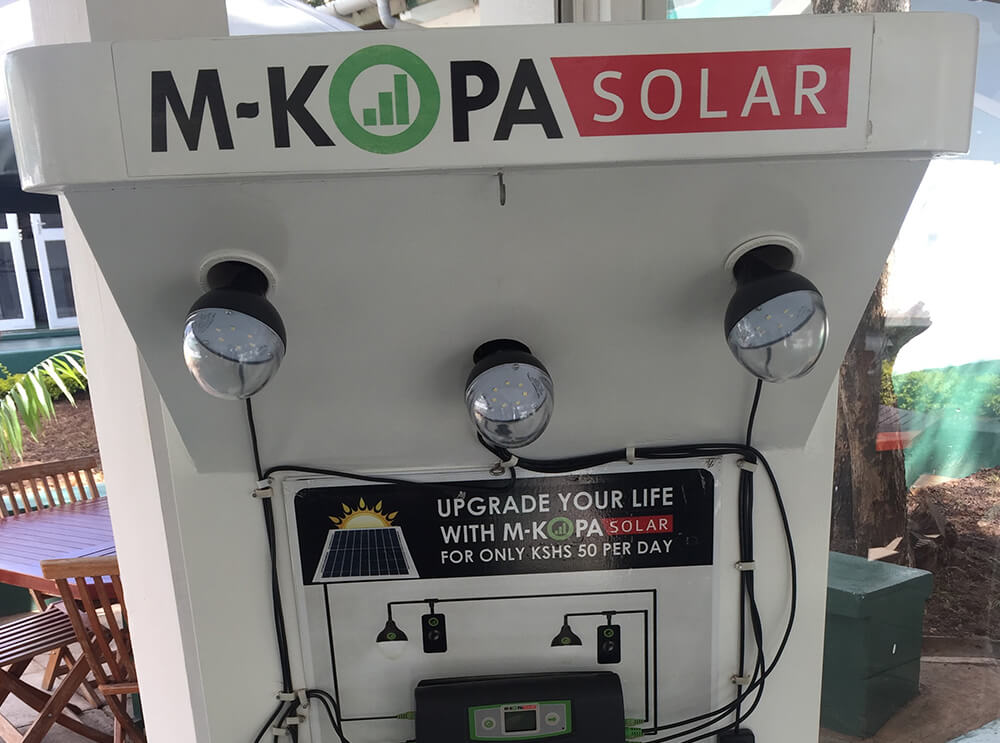

M-KOPA

Norfund was part of a lender consortium that provided M-Kopa with USD 80 million in local currency debt to expand its business of supplying pay-go solar home systems in Kenya and Uganda. This was the largest single financing to date in the off-grid segment.

Neofresh

– a South African company that specializes in the production, packing and marketing of papaya and other sub-tropical fruits. Norfund’s investment contributes to skills development and a more efficient production line and value chain with higher yields.

2018

The Nordic Horn of Africa Opportunities Fund

Norfund, together with Shuraako and the Danish development finance institution, IFU, established a USD 10 million fund to support small and medium sized companies in Somalia. The Fund is among the first commercial investment funds in Somalia and the business environment in Somalia is extremely challenging.

Marginpar

An integrated group of flower producers in Kenya and Ethiopia. Norfund’s investment in Marginpar enabled the acquisition and development of several underperforming farms which have secured decent jobs. Additionally, during the COVID-19 pandemic in 2020 Norfund stepped in with an emergency loan to keep people employed and the company going.

Tellef Thorleifsson becomes new CEO of Norfund

2019

Arise makes a direct equity investment in Ecobank

A pan-African bank operating in 33 countries, including in the Sahel region where very few other financial institutions are present. Ecobank has a strong brand recognition through a substantial network of over 24 million customers served by some 14,000 employees and 690 branches across the continent.

First Fintech investment

Norfund invested in Quona Capital, a venture firm and an experienced investor in the Fintech sector focusing on financial inclusion in emerging markets.

2020

SN Power sold to Scatec

After building SN Power into a leading hydropower company in developing countries, Norfund sells all the shares to Norwegian energy developer Scatec for 1,17 billion dollars.

Lilongwe Dairy

Norfund invests in a company that has grown to be Malawi’s leading dairy producer. A year after the investment, the number of smallholder farmers delivering milk to the dairy has increased by from 8000 to 9000.

Joint Impact Model (JIM)

Norfund applies a new model to estimate the number of jobs our investments support indirectly. The results are calculated using economic modelling and do not represent actual figures, but still give a new insight into the overall impact of our investments.

2021

Norfund asked to manage new climate investment fund

The Norwegian government plans to allocate NOK 10 billion over five years to a new fund that will invest in renewable energy in developing countries with the aim of contributing to reduced greenhouse gas emissions. One billion NOK from Norfund’s capital and one billion NOK from the state budget will be set aside annually for the fund. Read more here.

Phatisa Food Fund 2

Together with BII, Finnfund, FinDev Canada, and BIO, Norfund jointly committed 83 million USD to the fund which will invest across the African food value chain, considering investments in mechanisation, inputs, poultry and meat production, food processing and manufacturing, logistics, aggregation and distribution across Sub-Saharan Africa. Norfund’s commitment totalled 20 million USD.