The “Operating Principles for Impact Management” is a new investment tool that has established a market consensus for the management of investments for impact. “Operating Principles for Impact Management” is a new investment tool that has established a market consensus for the management of investments for impact.

A growing number of investors incorporate impact in- vestments into their portfolios, striving to achieve both financial returns and measurable impacts. This is a positive trend. However, lack of consensus on how to manage investments for impact and which systems are needed to support them has created complexity and confusion. The distinction between impact investing and other forms of responsible investing is also not always clear.

A common disciplinary approach

To address this challenge, the International Finance Corporation (IFC), in consultation with a core group of stakeholders, developed the “Operating Principles for Impact Management”. These have established a common disciplinary approach and a market consensus for how to manage investments for impact. The Principles were adopted in April 2019 by 60 signatories, including Norfund, and have now been endorsed by nearly 90 signatories, including Development Finance Institutions (DFIs), Multilateral Development Banks (MDBs), and private investment funds. The Principles reflect best practices across a range of public and private institutions, while allowing for variations in institutional setups and specific routines. The principles have established a set of commonly agreed functions that are needed for effective impact management. They also provide a guide for actors who wish to engage in impact investing, and for investors who wish to screen funds or managers and identify potential providers.

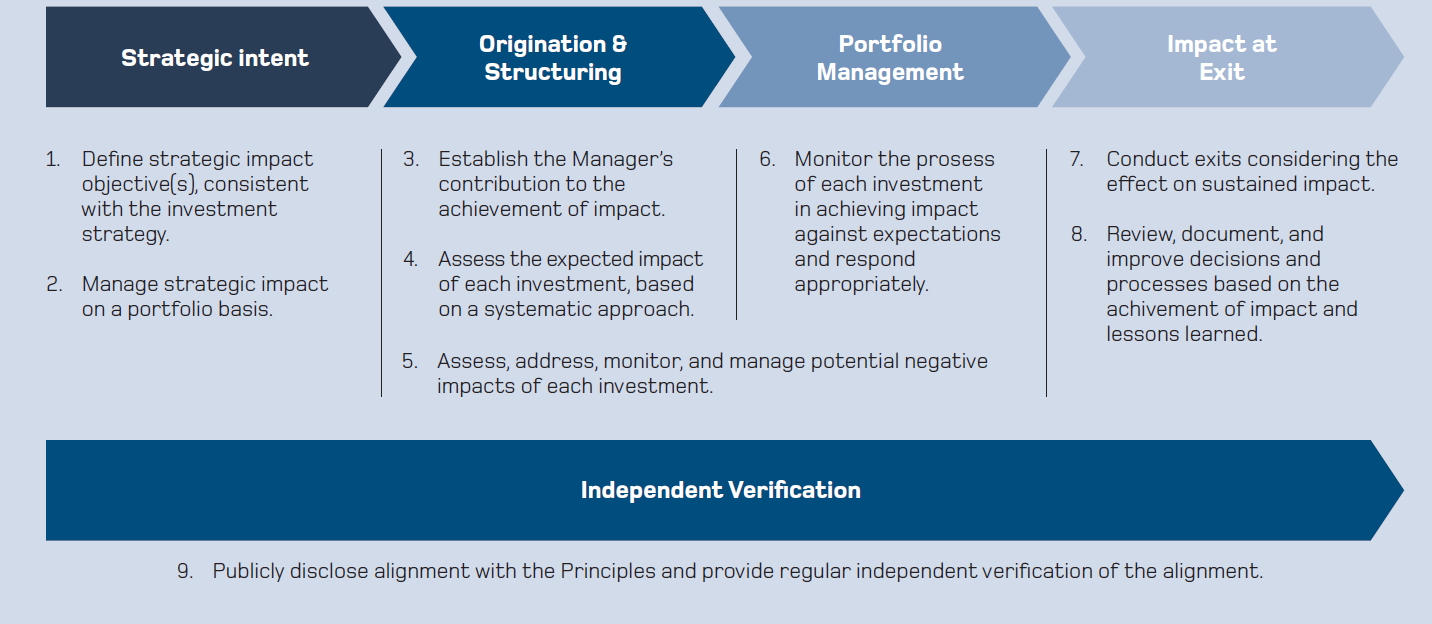

Integrating impact considerations into all phases

The guide integrates impact considerations into all phases of an investment lifecycle: strategy, origination and structuring, portfolio management, exits, and public disclosure of alignment.

While our current practices are aligned with the Operating Principles, we believe that we can always improve. Our internal processes are continuously developed and refined to ensure high standards of impact management and development impact from our investments. Changes will be reflected in future disclosure statements, as we continue to support this initiative for openness and transparency around impact investment.