Access Bank Nigeria

Region

Investment (MNOK)

Status

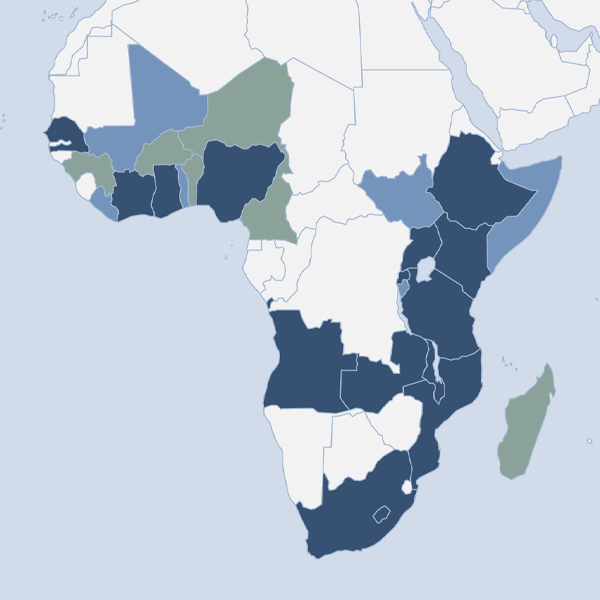

Access Bank is one of the top 4 banks in Nigeria. It is a full service commercial bank operating through a network of 385 branches and service outlets. These are located in major centers across Sub Saharan Africa, as well as in the United Kingdom, and with representative offices in China, Lebanon and India.

Key information

- Sector:

- Financial Inclusion

- Investment (MNOK):

- ‐

- Year:

- 2017

- Region:

- Africa

- Country:

- Nigeria

- Domicile:

- Nigeria

- Instrument:

- Loans

- Status:

- Exit

- Mandate:

- Development

Norfund’s loan is part of a syndicated loan agreement totalling USD 100 million. The credit line was arranged by the Dutch development bank, FMO, together with Norfund and the private sector development banks in France, Finnland and Sweden (Proparco, Finnfund and Swedfund). Other participants are undisclosed institutional investors through FMO’s syndications platform. FMO acted as the Mandated Lead Arranger and will be the Facility Agent.

Enabling export-oriented agribusinesses to grow

The loan is earmarked for USD loans to export-oriented agricultural clients in Nigeria. This includes private businesses within the whole agriculture value chain from agricultural production, processing, distribution and consumption. The loan will thereby help to further boost the country’s agricultural sector – a sector that remains the base of Nigeria’s economy, providing the main source of livelihood and employing over half of the entire workforce. The loan is also important to promote a diversified economy in Nigeria – a country that is heavily reliant on its oil industry.

Increased focus on agribusiness clients

Access Bank strives to deliver sustainable economic growth that is profitable, environmentally responsible and socially relevant. It has demonstrated high profitability despite the challenging economic conditions in Nigeria.

As part of their new strategy, Access Bank aims to increase the number of agri clients in their loan portfolio. The bank has a specialized agri team that focuses on clients within the agribusiness value chain; from the corporates to the commercial mid-players or SMEs that supply the larger clients.

The bank offers loans to a wide variety of agri clients; flour mills and their out-growers, rice processors and milk producers. In addition, Access Bank is looking at clients within cocoa processing, palm oil processing, manufacturing of seed etc.

Access Bank has over 8 million customers and about USD 10 bn in assets. The bank has 4,200 staff, whereas 46% is female.