CASEIF IV

Latin America

Region

153.3

Commitment (MNOK)

Active

Status

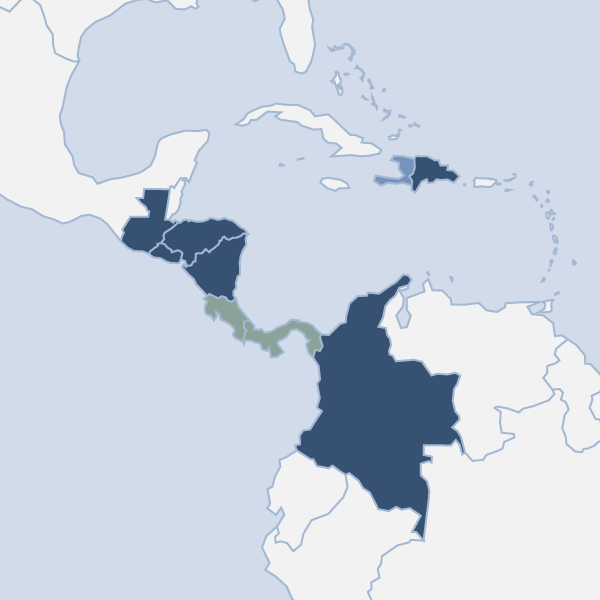

CASEIF IV is the fourth private equity fund raised by LAFISE Investment Management Limited (“LIM” or “The Manager”), a General Partner joint venture between Norfund (20%) and LAFISE (80%). CASEIF IV, like CASEIF III, will focus on medium sized growth-oriented companies in Central America, Colombia and Dominican Republic. Investments will have an average size of USD 6-7m, primarily in mezzanine transactions. The target fund size is USD 70-90m with an initial minimum close of USD 30m

Key information

- Sector:

- SME Funds

- Commitment (MNOK):

- 153.3

- Year:

- 2020

- Region:

- Latin America

- Country:

- Regional

- Domicile:

- Canada

- Instrument:

- Funds

- Status:

- Active

- Mandate:

- Development

Additionality for CASEIF IV

This investment is particularly additional on the following ambitions:

- Investing in capital constrained markets

- Investing in risky markets

- Investing in difficult business environments

- Investing in high risk instruments

- Mobilising private investors

- Taking an active role in investments

- Promoting social and environmental standards

- Supporting enterprise improvements