CIFI Sustainable Fund

Region

Commitment (MNOK)

Status

The Sustainable Infrastructure Fund “SIDF” is targeting a size of USD 300m with a 50% leverage, targeting USD 150m in equity commitments. The portfolio is expected to consist of up to 15 investments with target size of (USD 15-50m); specifically, senior secured infrastructure loans in USD under New York law with maturities higher than 7 years. The projects that will be financed will range in total project costs from USD 20-100m (mid-market projects). The target sectors are all sustainable: renewable energy (hydros less than 25MW, solar, wind), water and sanitization, waste management, energy storage, telecommunications, education, logistics, electric transportation, alternative fuels and health. There will be caps on some sectors such as waste management (20%) which is A risk according to EDFI guidelines. The fund has a hard commitment to invest a minimum of 50% into renewable energy projects which will contribute to Norfund´s renewable energy KPI.

Key information

- Sector:

- Financial Inclusion

- Commitment (MNOK):

- 216.5

- Year:

- 2023

- Region:

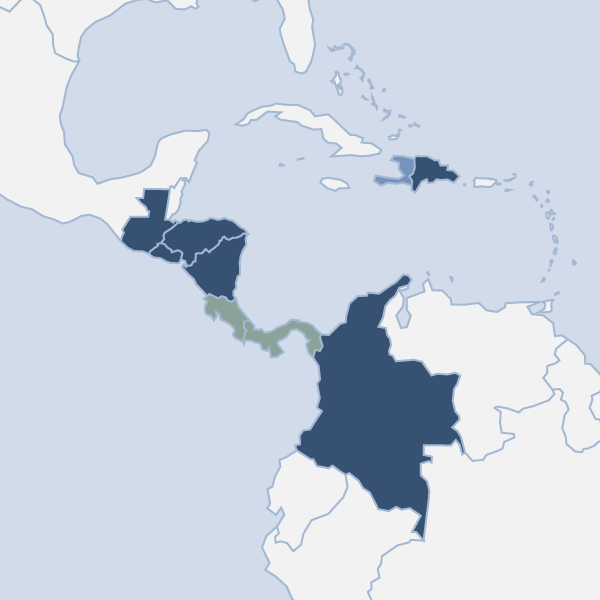

- Latin America

- Country:

- Regional

- Domicile:

- Canada

- Instrument:

- Funds

- Status:

- Active

- Mandate:

- Development