FINARCA

Region

Investment (MNOK)

Status

Scanned version covenants ok as per 31.3.2006 (Club Loan October 6, 2005 disbursement) in file.

Capital adequacy > 15% 31.3.06 = 17,17%

Debt to equity ratio < 6:1 31.3.06 = 4,82 Open exposure ratio < 0,1:1 31.3.06 = -0,06 Cost to Income Ratio < 0,8:1 31.3.06 = 0,53 Aggregate net foreign exchange exposure < 100% 31.3.06 = 54,17% Single client exposure < 15% 31.3.06 = 14,46% Single group exposure < 30% 31.3.06 = 22,47% Related parties exposure 60 days < 10% 31.3.06 = 4,96% Homepage Descripton: Financiera Arrendadora Centroamericana (“Finarca”), Nicaragua Finarca is a regulated leasing company registered in Nicaragua. Finarca was founded in 1997 by a local Nicaraguan, and Norfund and IFC injected equity capital in 1999. DEG, IFC, FMO, Citibank and other institutions finance Finarca. Finarca provides lease financing and short term loans to SMEs. Leasing has proved a highly effective tool in helping small companies to raise capital and ultimately create more jobs. In many instances these leases are the only form of capital available to Finarca’s clients. www.finarca.com

Key information

- Sector:

- Financial Inclusion

- Investment (MNOK):

- 2.6

- Year:

- 1999

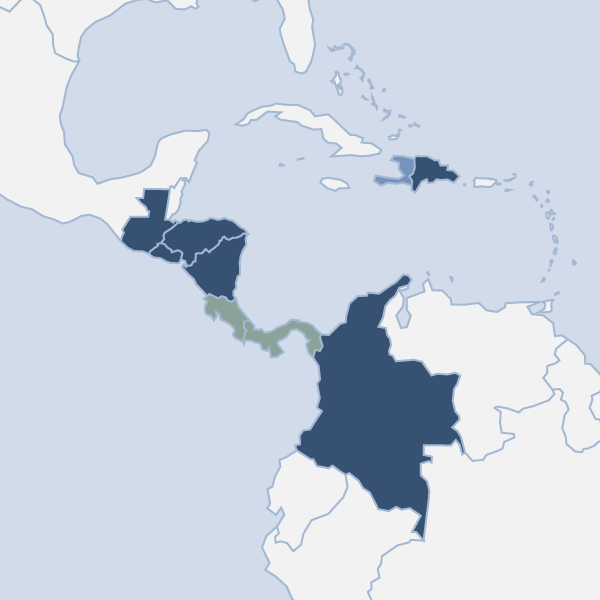

- Region:

- Latin America

- Country:

- Nicaragua

- Domicile:

- None

- Instrument:

- Equity

- Status:

- Exit

- Mandate:

- Development