Msele Nedventures

Region

Investment (MNOK)

Status

"030610 Statusrapport diskutert i IK: * Understreket at vi som hovedprinsipp bør legge press på MFM for tilbakebetaling av exitmidler til aksjonærene, i stedet for reinvestering i porteføljen. Faktisk strategi for oppfølgingen overlates til PL og porteføljeansvarlig.

030610 Telefonsamtale m/ Marc Balkin: * VCM conflict: amicably resolved as per proposal (approved by MFMs legal council) subject to final confirmation from VCM (expected shortly as proposal reflects what was actually agreed in meeting of 29.05.03). * IPS exit: agreement is conditional on J&J transaction materialising, which makes timing uncertain. May still take some time. Dave King is very elusive. * Airshield: MFM wants to keep further cash injection on hold until C.Campbell has built up a complete understanding of the business and its management. Dialogue with Sealed Air is still on, but progress is slow and MFM is trying to build other partner alternatives as well. * Instant image: moving ahead and in business, effectively and temporarily financed by an informal interim loan from O2 Capital to Msele. MFM is comfortable with the arrangement pending cash inflow from first portfolio exit. * Cash flow: Made more difficult as exit proceeds from Tekglass have been suspended in the aftermath of Bob Higginsons suicide. Claim still valid though, but MFM finds it appropriate to leave family in peace a little longer before pushing for resumed payments. In the meantime, MFM accepts that their fees be effectively subordinated other cash obligations. * Next valuation report: not yet planned, but will discuss internally and prepare shortly."

Key information

- Sector:

- SME Funds

- Investment (MNOK):

- 12.2

- Year:

- 1999

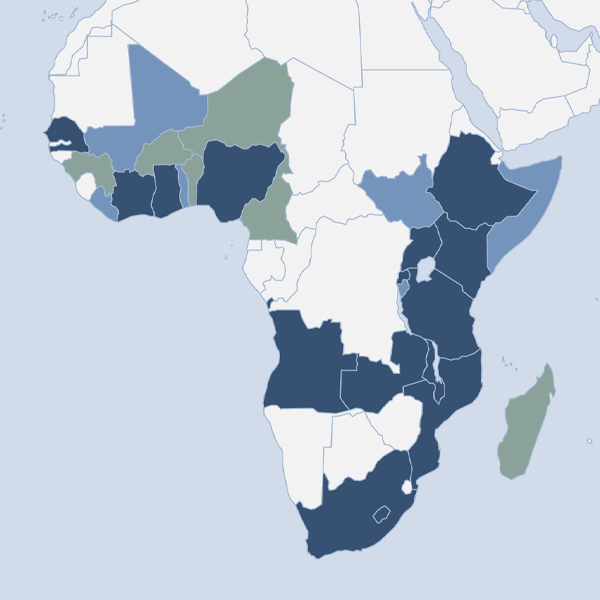

- Region:

- Africa

- Country:

- South Africa

- Domicile:

- None

- Instrument:

- Funds

- Status:

- Exit

- Mandate:

- Development