Norfund’s mandate is to establish viable, profitable businesses in developing countries that would not otherwise be initiated because of the high risk involved.

The development of sustainable enterprises is essential in promoting economic growth and reducing poverty.

To fulfil our mandate effectively, we focus on countries and investment areas in which capital is scarce and our development impact is likely to be strong. Capital is scarce where other investors are reluctant to invest because of high levels of real or perceived risk. The extent to which an investment contributes to an outcome that would not have happened otherwise is often referred to as ‘additionality’. These two criteria – additionality and impact – constitute the backbone of our strategy.

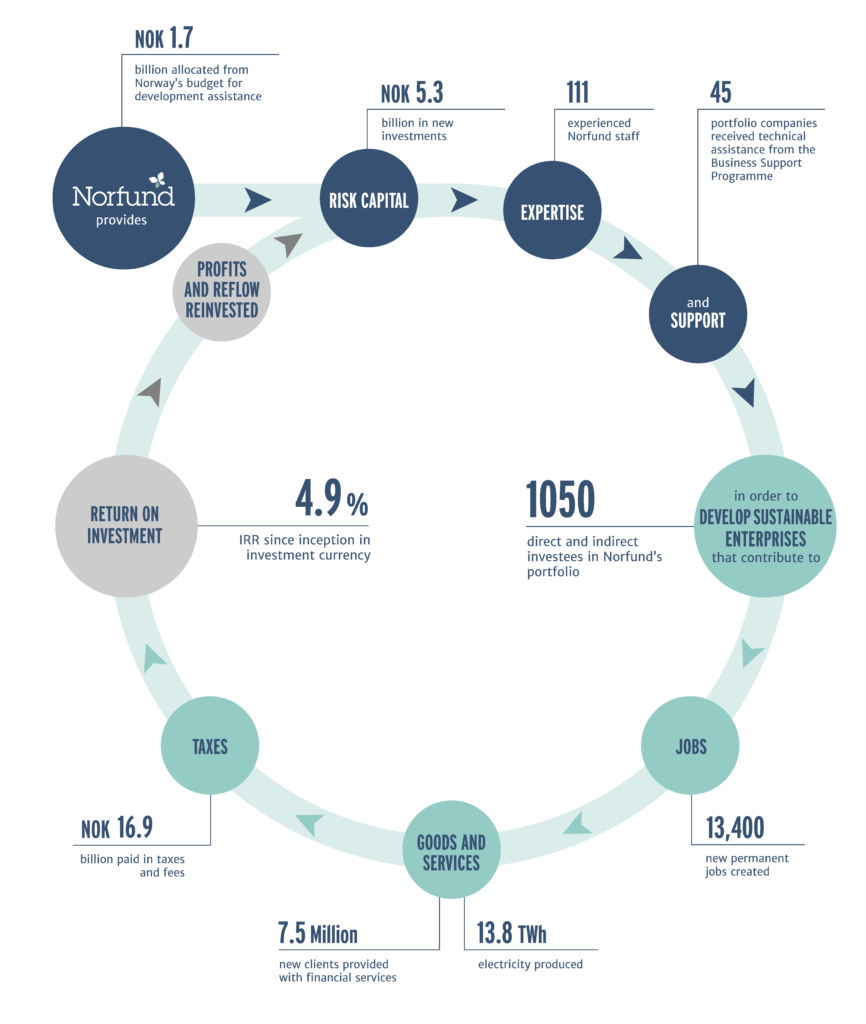

The illustration below shows how Norfund works and how investments in 2021 contributed to creating jobs, increasing energy access and supply and strengthening financial inclusion. When Norfund is no longer considered additional, the investments are exited. The proceeds are then reinvested in new enterprises with greater need for risk capital.

Norfund strategy 2019-2022

Norfund’s strategy is rooted in the mandate, informed by the UN Sustainable Development Goals and reflects the priorities of the Norwegian government’s development assistance policy.

Norfund invests in four areas where the potential for development impact is substantial and that are aligned with the SDGs.

Eight ambitions are defined for these investment areas to be achieved by the end of 2022:

Clean Energy

- 5,000 MW new capacity financed, of which 4000 MW is renewable

- 1.5 million households provided with access to electricity

Financial Institutions

- 15 million new clients are offered financial services

- 130 billion NOK more extended in loans to clients

Scalable Enterprises

- 50,000 jobs created through direct investments and funds, whereof 3,000 jobs created in direct investments

- 2 billion NOK increased total revenues due to realised growth

Green Infrastructure

- NOK 450 million to be committed in 3-7 investments by the end of 2022

Key Performance Indicators

To track progress Norfund also measure progress towards five key performance indicators (KPIs):

- Sub-Saharan Africa > 50%

- Least Developed Countries > 33%

- Equity Investments > 70%

- Greenfield Investments > 15% of three-years moving average of annual commitments

- Renewable energy > 50% share of accumulated allocated capital from government

Portfolio status in 2021 according to Key Performance Indicators

A responsible and active investor

Norfund is an active owner of our portfolio companies, contributing expertise and sound corporate governance – helping our investees to improve their environmental and social performance.

If environmental and social risks are not addressed appropriately, harm can be caused both to people and to the environment. The management of environmental and social risks is therefore an integral part of Norfund’s investment process. Norfund uses the Environmental and Social Sustainability Performance Standards of the World Bank’s International Finance Corporation (IFC). This framework covers eight standards that form the basis for our assessments and follow-up interventions.

Norfund requires high standards of business integrity from employees and business partners and communicates its no-tolerance approach to all stakeholders.

Principles for Responsible Investments (PRI)

Since 2017, Norfund has been a signatory to the Principles for Responsible Investment (PRI) initiative. The PRI outlines six principles for responsible investment that Norfund has committed to and report on annually. The six principles reflect the increasing relevance of environmental, social and corporate governance issues to investment practices.

Operating Principles for Impact Management

The “Operating Principles for Impact Management” is a new investment tool that has established a market consensus for the management of investments for impact. The principles were developed by the International Finance Corporation (IFC), in consultation with a core group of stakeholders and draw on emerging best practices. They provide a reference point against which the impact management systems of funds and institutions may be assessed.

Norfund was among the first founding signatories. In April 2020, Norfund signed its first Disclosure Statement which affirms that Norfund investments and operations are managed in alignment with these Principles.

A minority investor

Norfund invests jointly with other partners, and always as a minority

investor. By being a significant minority investor, Norfund has influence, while supporting local ownership and encouraging other investors to invest in developing countries.

Strategic partners and co-investors

Norfund’s ownership will normally not exceed 35 percent of a company. This means we always depend on competent and trusted partners. Norfund has clear guidelines for how to analyse and evaluate potential partners. The partner’s areas of expertise and knowledge, previous and existing positions and relationships, other roles in the society and reputation are among the factors that are carefully considered.

Being a minority investor is a principle that is defined in Norfund’s mandate. This can enable other international investors to invest in developing countries and supports local ownership.

Co-investing this way enables Norfund to leverage additional capital and to provide the industrial and local knowledge needed for each investment.

Overview of Norfund partners at norfund.no

Responsible Tax Policy

Norfund’s Responsible Tax Policy, adopted by the Board of Directors in 2019, sets out the principles that guide our approach to tax-related issues and what we expect from our portfolio companies and co-investors. The guidelines are based on internationally agreed principles and were drawn up with input from civil society. It consists of seven fundamental principles. They include requirements regarding transparency, that Norfund’s investees shall pay taxes to the countries in which they operate and where the income occurs, and that third countries must only be used when necessary to meet the fund’s development priority of investing in high-risk markets and to protect the fund’s capital.

To ensure consistency with evolving international standards and best practice of multilateral and bilateral development finance institutions, Norfund reviewed its responsible tax policy in 2021. As part of this review, an external study on Norfund’s use of third countries was carried out by PwC.

The report from PwC was made public and shared with representatives from the Norwegian civil society, who were also invited to participate in the review of the policy. The review concluded there was no need to revise the current policy, but certain operational measures were updated to include more focus on tax structures to complement the assessment of domiciles. Norfund increased its investment volume in 2021, including several large fund investments, which led to extensive use of third countries also in 2021.

Business Support

The Norfund Business Support Programme is a tool to enhance the sustainability and capacity development of our investees (SDG 12-6). The Programme addresses several thematic focus areas in line with the strategy developed in 2021

ESG and OHS, Climate, Corporate Governance and Business Integrity, Gender Equality, and focuses on operational improvements and training for board, management and staff.

In addition to supporting our investees, Norfund in certain cases supports projects that consolidate local development effects in host communities by supporting a company’s local community outreach efforts. And sector-related initiatives which are projects that support an entire sector, for example E&S training for the banking sector in a particular country.

The Project Development and Risk Mitigation Facility (PDRMF)

The Project Development and Risk Mitigation Facility is funded by the Norwegian Ministry of Foreign Affairs.

The facility has two purposes:

- Enabling early phase project development within Norfund’s investment areas

- Risk mitigation for commercial investors that wish to invest in Norfund funded projects, throughout the project cycle

The Project Development and Risk Mitigation Facility is used for projects that have a risk level which is higher than other investments in Norfund’s core portfolio. These projects are managed as a separate facility and are not included in Norfund’s overall portfolio valuation.

No new projects were approved in 2021, however there is a strong pipeline that addresses the need for this kind of financing in renewable energy and waste and water management.

For a list of PDRMF projects see the bottom of our Investments page here.