The Climate Investment Fund managed by Norfund became operational in 2022. The fund is Norway’s most important tool in accelerating the global energy transition by investing in renewable energy in developing countries with large emissions from coal and other fossil power production.

To help developing countries build their economy on the backbone of renewable energy, the Climate Investment Fund (CIM) will allocate 10 billion NOK from 2022-2026 to invest in renewable energy and enabling technologies.

Norfund manages the fund on behalf of the Ministry of Foreign Affairs. The investments under the Climate Investment Fund are in Norfund’s own name, but the fund’s investments and portfolio are managed separately from Norfund’s other activities.

Ambitions 2022-2026

- 9 GW new renewable energy capacity financed

- 14 million tons CO2 avoided per year2 – equivalent to 30% of Norway’s annual GHG emissions

- 1bn invested into “next wave” technologies

The strategy for the Climate Investment Fund

The Climate Investment Fund shall contribute to reduce or avoid GHG emissions from coal fired power and other fossil energy production. The fund aims to ensure that economic growth is built on low carbon technologies in emerging markets, especially where GHG emissions are significant today, or are expected to become large in the future. Within our mandate, we need to prioritize. Our strategic choices have therefore been assessed against three criteria: climate impact, additionality and feasibility.

Geography

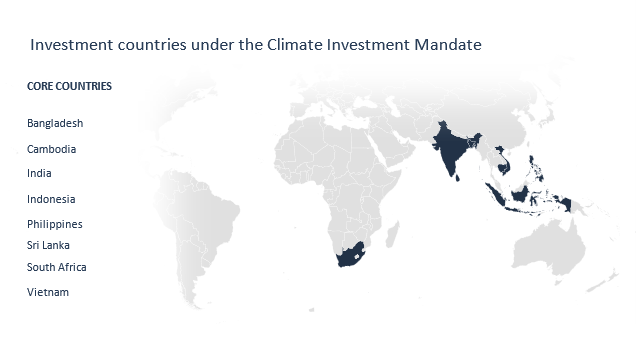

The Climate Investment Fund prioritizes existing Norfund strategy countries to maintain focus and build on existing capabilities. Among existing strategy countries, we prioritize 8 core countries: India, Vietnam, Philippines, Cambodia, Indonesia, Sri Lanka, Bangladesh and South Africa.

Sectors

We invest in both large scale grid connected renewables such as wind farms and smaller projects selling directly to commercial and industrial customers such as rooftop solar. We may also invest in enabling technologies with high climate impact (e.g., storage, transmission), focusing on verticals where Norfund has strong competence, can be additional and where there are investable opportunities in our markets.

Risk profile

The CIM applies the risk appetite statement of Norfund, but with the opportunity to take somewhat higher technology commercialization risk for example within floating solar and offshore wind. In this way, Norfund can help accelerate the implementation of renewable energy technologies in our markets through investments that private sector players hesitate to take on. The investments will be done on commercial terms.

Partners and platforms

The climate mandate, in line with Norfund’s overarching strategy, aims to establish new as well as strengthen existing platforms and partnerships.

This strategy of sharing risk can enable industrial investors to realize more projects or enter into new markets, thereby multiplying the impact of Norfund’s capital, and leading to sustainable business ventures.

Exits

Under the CIM we have an ambition to actively seek exit of mature or de-risked investments to circulate capital and multiply the climate impact we can have per dollar committed to the fund. Norfund has for the past years worked on improving our practices regarding exits, including assessing exit opportunities at time of investment and structure investment with exits in mind. We will build upon this work in the year to come.