Arise is Norfund’s main vehicle for large scale equity investments in banks in Africa. It is a unique specialized investment company with a growing portfolio of leading financial institutions across sub-Saharan Africa.

Background

Arise was established in August 2016 when its four founding owners – Norfund, Rabobank, FMO and NorFinance – agreed to transfer their various equity holdings in financial institutions in sub-Saharan Africa.

The aim of founding Arise is to contribute to the building of economic growth and poverty reduction by developing strong and stable financial service providers. These will support retail enterprises, SMEs, companies in rural areas, and other clients lacking access to financial services. Arise will thereby strengthen their ability to empower themselves.

The mandate

The mandate of Arise is to invest and stimulate growth across all financial services sub-sectors within sub-Saharan Africa. The joint establishment of Arise allows each partner to contribute to development on a scale that is far beyond what each could achieve separately.

Arise is targeting financial institutions that focus on SME and the unbanked. Such institutions get less attention from capital providers. Arise’s investment in such institutions thus has a clear additional effect. These institutions will also receive assistance from Arise’s banking development team with regard to growth strategies and deploying new technologies.

It is our conviction that larger banks have the ability to contribute more strongly to economic development than smaller institutions. However, the availability of sizable equity stakes in such larger institutions are rare and thus making Arise’s portfolio unique in an African context.

Investments

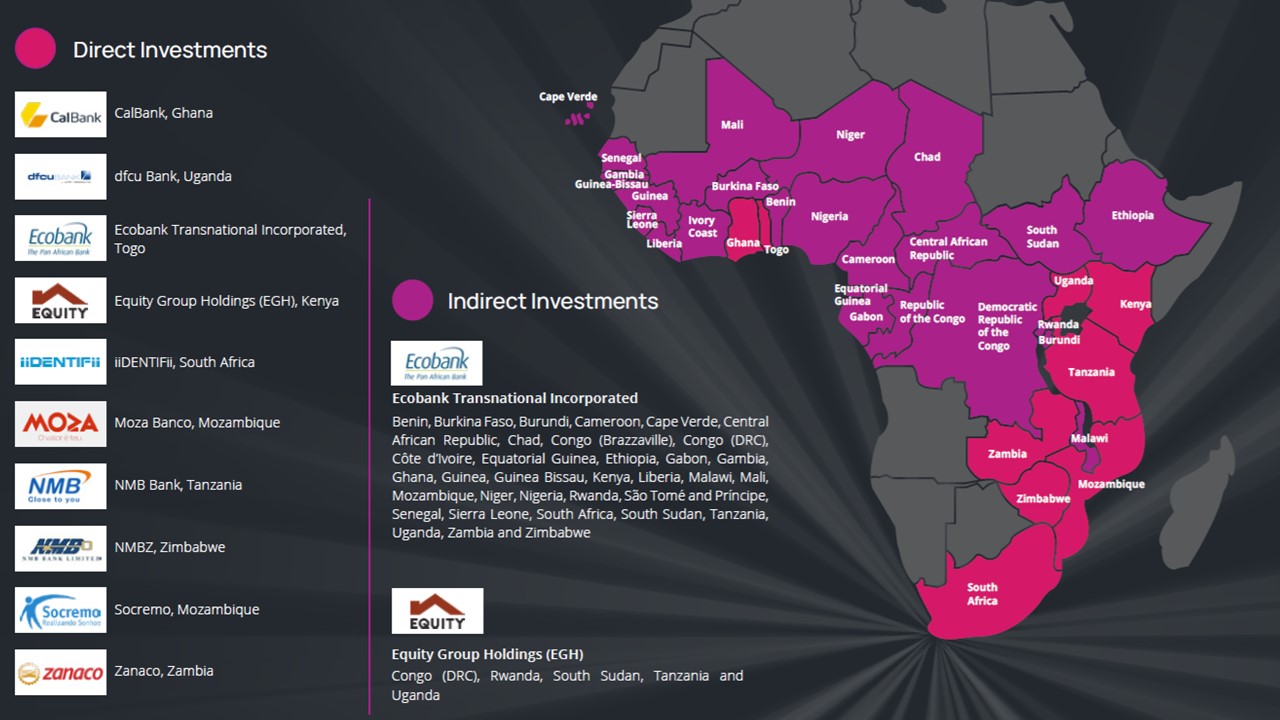

Arise provides capital and expertise to the growing financial sector across Sub-Saharan Africa. Arise is directly or indirectly invested in more than 30 countries across sub-Saharan Africa.

Since its inception Arise has made the following investments:

- acquired a 28% shareholding in CAL Bank of Ghana in 2017

- increased its shareholding in DFCU of Uganda to 59% in 2017 in connection with DFCU’s acquisition of Crane Bank

- acquired a 30% stake in Moza Banco of Mozambique in 2018 through a capital raise a a merger with BTM Bank

- acquired a 14% stake in pan-African Ecobank in August 2019

- Providing a USD 7.5 million senior unsecured shareholder loan to Moza Banco in December 2019

Arise portfolio

Arise today has direct or indirect ownership in 18 top-3 financial institutions in SSA and presence in 38 countries in SSA.

- CalBank 28% stake

- Moza 30% stake

- iiDENTIFii 20% stake

- Ecobank 14% stake

- Zanaco 45% stake

- Equity Bank 12% stake

- Socremo 35% stake

- NMB Tanzania 35% stake

- DFCU Bank 59% stake

- NMB Zimbabwe 18% stake

Active Ownership

Arise gives priority to equity investments and is an active owner. It claims board positions in the investees, organises technical assistance programmes, supports investees financially and helps the banks to improve the services they provide to their clients. Arise focuses particularly on improving the compliance functions of investee companies and ensuring adherence to the highest environmental, social and governance standards.

Our impact

Setting up and following up an evergreen investment company with the size of Arise required investors with large and stable funding. Norfund is actively engaged in Arise through representation on the Supervisory Board and the Asset Management Committee. Norfund, together with FMO and Rabobank, established a technical assistance facility with Arise to further help Arise in influencing its companies. Furthermore, Norfund is clearly catalytic through the inclusion of NorFinance as investor in Arise.

Arise is targeting financial institutions that focus on SME and the unbanked. Such institutions get less attention from capital providers. Arise’s investment in such institutions thus has a clear additional effect. These institutions will also receive assistance from Arise’s banking development team with regard to growth strategies and deploying new technologies.

Expected growth

It is anticipated that Arise will grow to a company with assets in excess of USD 1 billion by 2021.