Norfund’s mandate is to support the creation and expansion of viable and sustainable businesses to create employment in developing countries. In order to investigate delivery on the mandate, we have performed an analysis of the status of Norfund’s exited companies by end 2019.

The Survey and Analysis

The first exit analysis was performed in 2015. In 2019, a second analysis was undertaken, with standardized definitions and parameters to allow for continuous updates of the dataset and comparability over time.

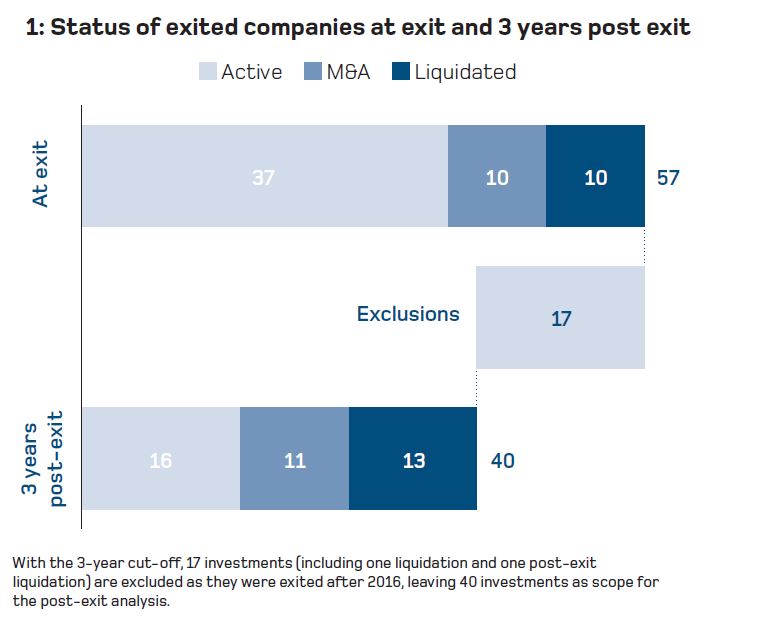

In the exit analysis, companies are followed from time of investment to three years after Norfund’s exit to understand whether they survive, and if they thrive.

- Survival: Survival rate is tracked during Norfund’s holding period and three years after Norfund exited the investment (post-exit).

- Performance: The second aspect considered is company performance in job creation, financial indicators and other development impacts, tracked during holding period and 3 years post-exit.

Key Results

1. Norfund investments have a healthy survival rate, both during and after ownership.

During the holding period, the survival rate for investments is above 80 per cent. Three years after exit, more than 4/5 of companies that were active at time of exit are still active.

13 companies were liquidated by the 3-year post-exit mark, of which nine during our holding period and four after exit.

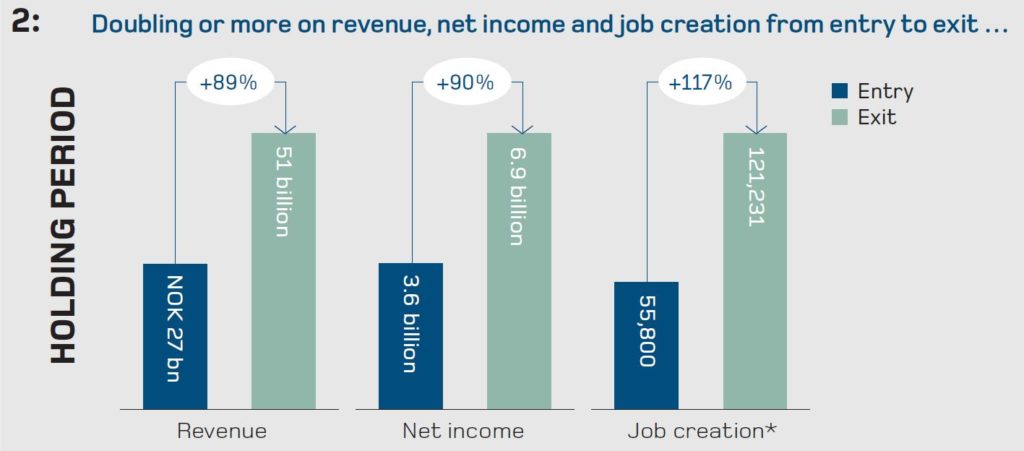

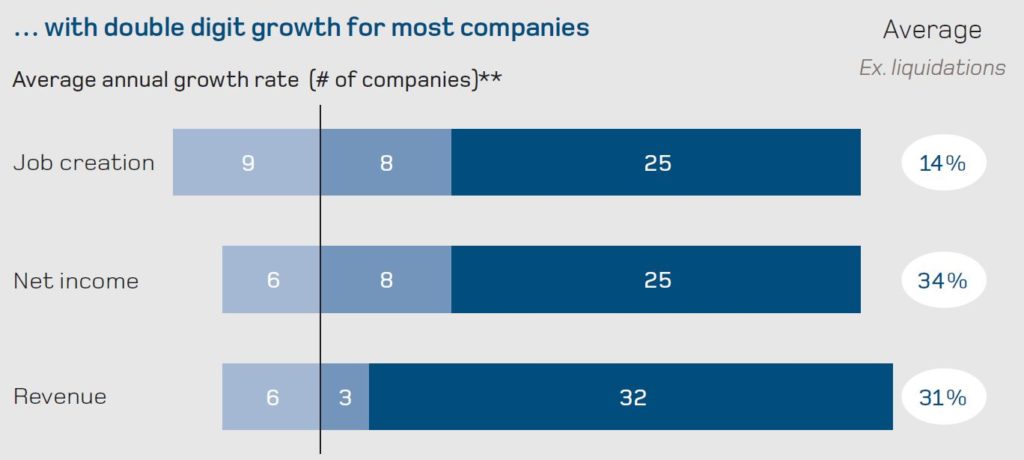

2. Performance in surviving companies is solid, both during and after Norfund’s investment.

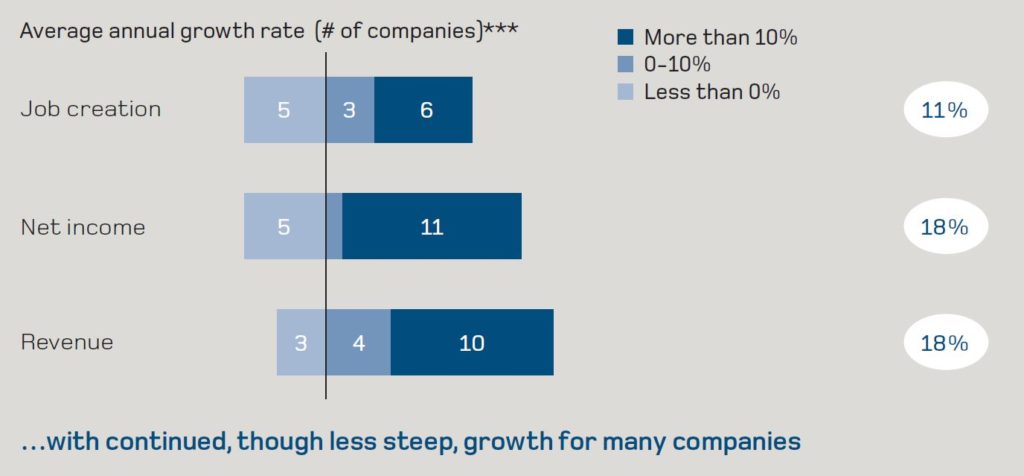

Overall, exited companies saw a doubling or more in revenue, net income and job creation from entry to exit, with double digit growth rates for most companies.

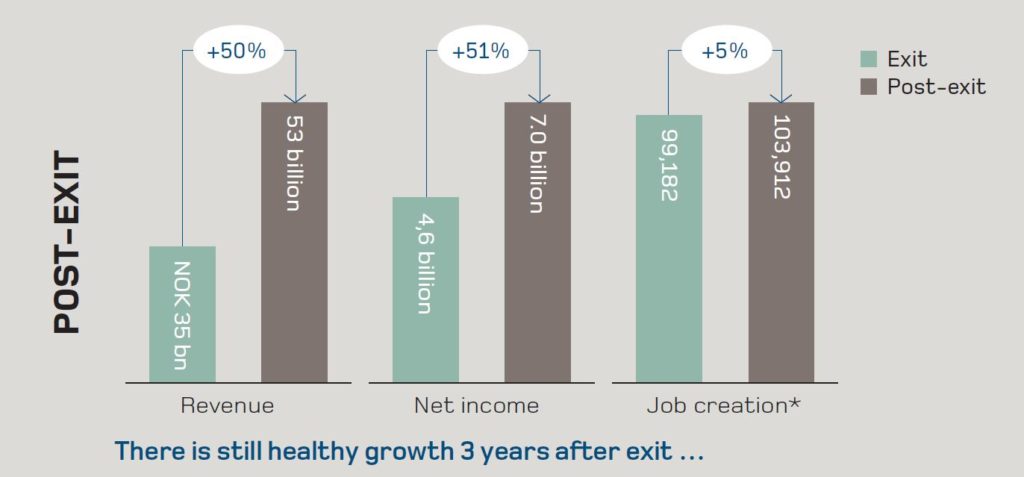

The overall post-exit performance showed healthy growth three years after Norfund’s exit with continued, though less steep, growth for many companies.

As Norfund enters in order to create or expand companies, this pattern is perfectly aligned with expectations and an indication that Norfund is successful in delivering on its mandate.

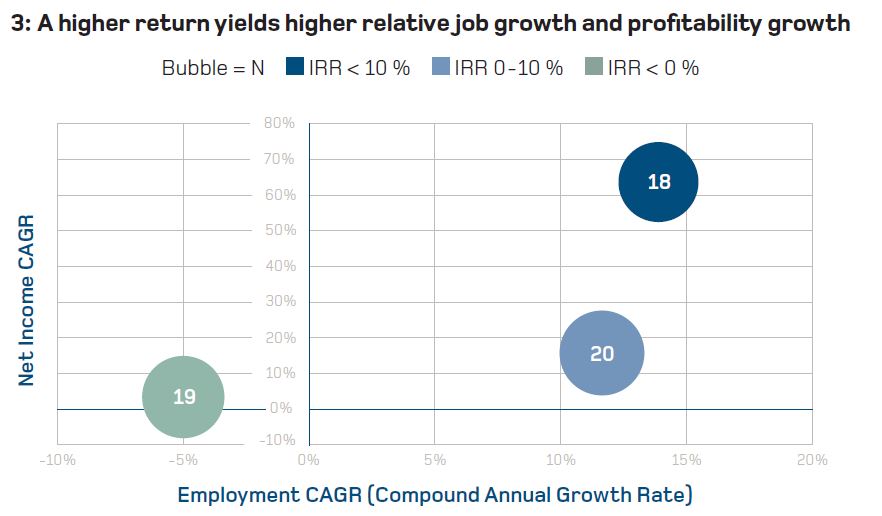

3. A clear relationship between healthy returns and job creation.

For Norfund to truly succeed on job creation and sustainable businesses, it is essential to achieve healthy returns.

Positive IRR for Norfund is associated with higher annual growth in employment for companies during the holding period. The data indicates a positive but diminishing impact on job creation once IRR reaches a certain level.

This suggests that a sensible ambition is to achieve healthy, rather than maximum returns at the portfolio level.

Data limitations

The current analysis is undertaken primarily as a self-assessment and learning tool and has several data limitations. As such, the results are considered indicative, rather than conclusive.

There are plans to expand and improve on the dataset in the future to address these limitations and over time make findings more robust. Limitations include:

• Limited number of observations

• Data quality limitations

• Exclusion of exits to and in platforms