February 22, 2024

Norfund has a long-term investment perspective and we support our portfolio companies in their efforts to become sustainable companies.

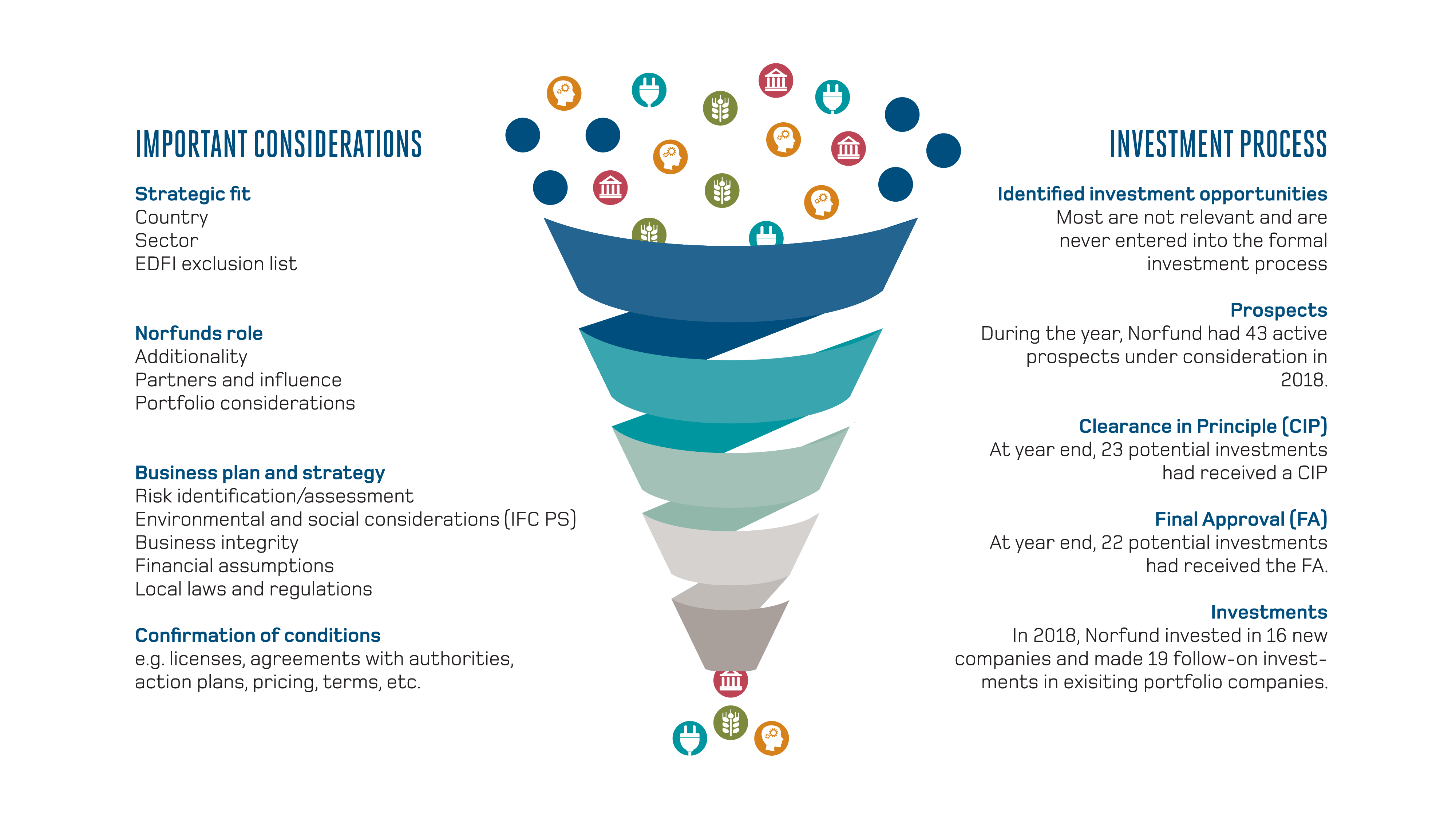

The investment process is divided into 5 phases: From the identification of new projects, then to due diligence to the investment, active ownership and finally the exit.

Identification

Norfund’s project cycle begins with the identification of investment opportunities. Each year we are approached by companies seeking finance for establishing or growing businesses in low- and middle-income countries. We also search the market actively for projects that fit our mandate.

The identification process is divided into three steps:

The initial screening of potential investments is primarily a desk-based exercise in which we review material received from project promoters. The project must fit with Norfund’s sectoral and geographical priorities and our investment share range (usually USD 5-15 M). Projects are then assessed against the EDFI exclusion list. During the first stage of project screening, Norfund considers the additionality and sustainability of the potential investment as well as the potential for catalyzing private capital.

Our partners and co-investors are closely assessed to ensure they support the high standards that Norfund demands. Shareholders, board members and the senior management of the partners must also be clearly identified.

If a project fits our strategic priorities and passes the first screening stage, Norfund’s project team prepares a first investment paper which is presented to Norfund’s Investment Committee. If the Investment Committee approves the Clearance in Principle proposal, the potential project progresses to a due diligence.

Due diligence

To ensure that the investment is sustainable and in line with Norfund’s mandate, a thorough due diligence assessment is done before any investment decision is made. During due diligence , we assess issues such as:

- The quality of the project and its execution strategy

- The financial records and model

- The project market; demand and competition

- Environmental and social risks

- The management team

- E&S mitigation plans, guided by the IFC Performance Standards

- Alignment with the other shareholders

- Legal and corporate structure

The due diligence phase has three core elements:

A thorough review of the partners involved in a project is essential during the due diligence phase. A detailed overview of the ownership structure is always required. A Business Integrity check may be required if any uncertainties or politically exposed persons (PEP) are identified.

The company’s willingness to improve standards and practices according to IFC Performance Standards is an important element of the due diligence process. The IFC Performance Standards include issues such as workers’ rights, anti-discrimination and equal opportunities, health and safety, biodiversity, land acquisitions, and relationships with local communities.

During negotiations with potential partners, Norfund reviews the appropriate investment instruments and the terms of the investment. Before a final investment decision is made, Norfund discusses a range of issues with clients, including Norfund’s share of the investment, the price mechanisms, corporate governance, environmental and social impact and Norfund’s exit strategy.

Norfund always invests together with other partners. Negotiations therefore typically include the need to find common ground between several parties, each of which may have different perspectives and objectives.

A Final Approval investment paper is based on the due diligence assessment and an agreed term sheet outlining the structure of a proposed investment. Larger investments and projects considered to be high risk also require approval by Norfund’s Board of Directors. Investment decisions for all other projects are delegated to the Managing Director of Norfund and to Norfund’s Investment Committee.

Investment

Norfund’s investment agreements specify:

- the amount Norfund commits to invest

- the sequence of its disbursement

- representations and warranties

- the applicable terms and conditions of the financial instrument

The investment phase has four key elements:

The size of the investment, the investment period, and how the funds will be disbursed are specified by an agreement. Disbursements are structured in different ways. Investment tranches, for example, may be linked to specific milestones in a company’s business plan. Norfund may also request that the fulfilment of plans for the implementation of higher standards be a requirement for disbursements.

All project requirements that Norfund regards as important are made legally binding, including compliance with environmental standards and labour standards. We do not expect enterprises to be ‘perfect’ when we invest initially, but we expect companies to show a willingness to improve. Plans for the implementation of higher standards are therefore included as part of our investment agreements when applicable.

In addition to being an active shareholder, Norfund typically requires the right to nominate at least one seat on the Board of Directors of the portfolio company.

Active ownership

As an active, strategic minority investor, Norfund contributes with expertise and experienced board directors to its portfolio companies.

Securing competent boards of directors for our portfolio companies is important. The Board of Directors is appointed by the shareholders to represent their interests in the company. Norfund evaluates the composition of the existing Board and assesses which competencies would be the most value-adding.

Through our networks in Norway and abroad, we identify individuals who can provide these competencies. These include expertise from a particular industrial sector or appropriate experts in business development or corporate governance.

Monitoring and support

Norfund’s project manager and the supporting team follow the activities of the companies from a shareholder perspective. We monitor, for example, whether companies are:

- Operating in accordance with the agreed strategy

- Performing according to the company’s financial plans

- Practicing satisfactory corporate governance and internal control

- Following domestic laws and international standards

- Taking environmental and social concerns into account

- Ensuring a satisfactory working environment

When relevant or needed, Norfund offers a Business Support Program to strengthen the development effects and value creation to the companies.

Exit

As companies grow and become profitable and sustainable, they are increasingly attractive to private investors. At a certain point, Norfund’s involvement may no longer be additional, and the investment can be exited.

Typically, exits occur after 5–10 years for equity investments, after 5–7 years for debt holdings, and after 10–12 years for fund investments.

Returns and profits post exit are reinvested in new businesses where there is a greater need for our risk capital.