Growing sustainable scalable enterprises drives industrialisation, economic growth and job creation.

Results in 2020

Committed through direct investments and funds

Created by companies in the scalable enterprises portfolio*

Decrease in revenue (-16%)

*9,300 new jobs were created within this investment area (including jobs in indirect investees through funds) although 800 jobs were lost in the direct portfolio companies.

Jobs are vital to reducing poverty. They generate income, and when in the formal sector, the jobs can provide a range of other benefits and help people to improve their knowledge and skills.

In most countries, private enterprises create the vast majority of jobs. This is especially true in developing countries, where more than 90 per cent of jobs are in the private sector1 .

The COVID-19 pandemic has had a serious negative impact on global working hours and income in 2020, with the prospect of a slow, uneven and uncertain recovery in 2021. International Labour Organization (ILO) surveys show that 8.8 per cent of global working hours were lost for the entirety of 2020, equivalent to 255 million full-time jobs.

Avoiding further job losses and creating a substantial number of new jobs in developing countries is more important now than ever before because they are places that were struggling with high unemployment rates even before the pandemic.

The agribusiness sector is labour intensive and has a high demand for local suppliers and associated farmers and is thereby vital to economic growth and job creation. In Sub-Saharan Africa, this sector remains largely underdeveloped in terms of productivity and local value creation.

Manufacturing holds great potential as an enabler of economic growth and transformation in Africa. Few countries have developed their economies without developing a strong manufacturing base.

In Africa, more than 80 per cent of the jobs are within the informal sector*. This means that the workers are not registered, they have no insurance, sick leave schemes, limited training and health & security rights. Therefore, the rationale is not only about creating a large number of jobs, but also as many jobs as possible in the formal sector where workers are treated well.

Norfund’s investments in scalable, sustainable businesses help to create jobs, generate government revenue and provide the goods and services that people need.

Lack of finance is a significant obstacle to business growth. The volume of foreign direct investment in developing regions is low. Additionally, the COVID-19 crisis has resulted in considerable capital outflow from emerging markets.

Growth capital, sector expertise and investors who are willing to take risks are needed to unlock the potential of scalable enterprises in developing countries.

Norfund invests in scalable enterprises (SE) both directly and through funds. Our direct investments are focused on scalable enterprises within agribusiness and manufacturing in Sub-Saharan Africa. These investments are always made in collaboration with strong industrial or financial partners.

As a direct equity investor, Norfund acts as a responsible owner. We assist developing businesses in becoming robust and sustainable while supporting their growth strategies. Norfund also provides advice to identify and mitigate environmental and social risks.

Smaller businesses also require access to capital and support. Fund investments help us to reach more companies and business areas than we are able to on our own. Funds also enable us to invest in enterprises in fragile states with challenging business environments. Fund managers contribute to developing local, sustainable and scalable businesses based on local knowledge, industry insight and efficiency initiatives.

Strategic ambitions

Norfund’s impact objective for this business area is to foster growth in portfolio companies, both in the form of increased employment and increased revenues.

Norfund has defined the following ambitions for the strategy period 2019-2022:

- Create 50,000 jobs through direct investments and funds, whereof 3,000 jobs created in direct investments

- NOK 2 billion revenue increase in direct investments

Accumulated achievements 2019 – 2020

Investments and Results in 2020

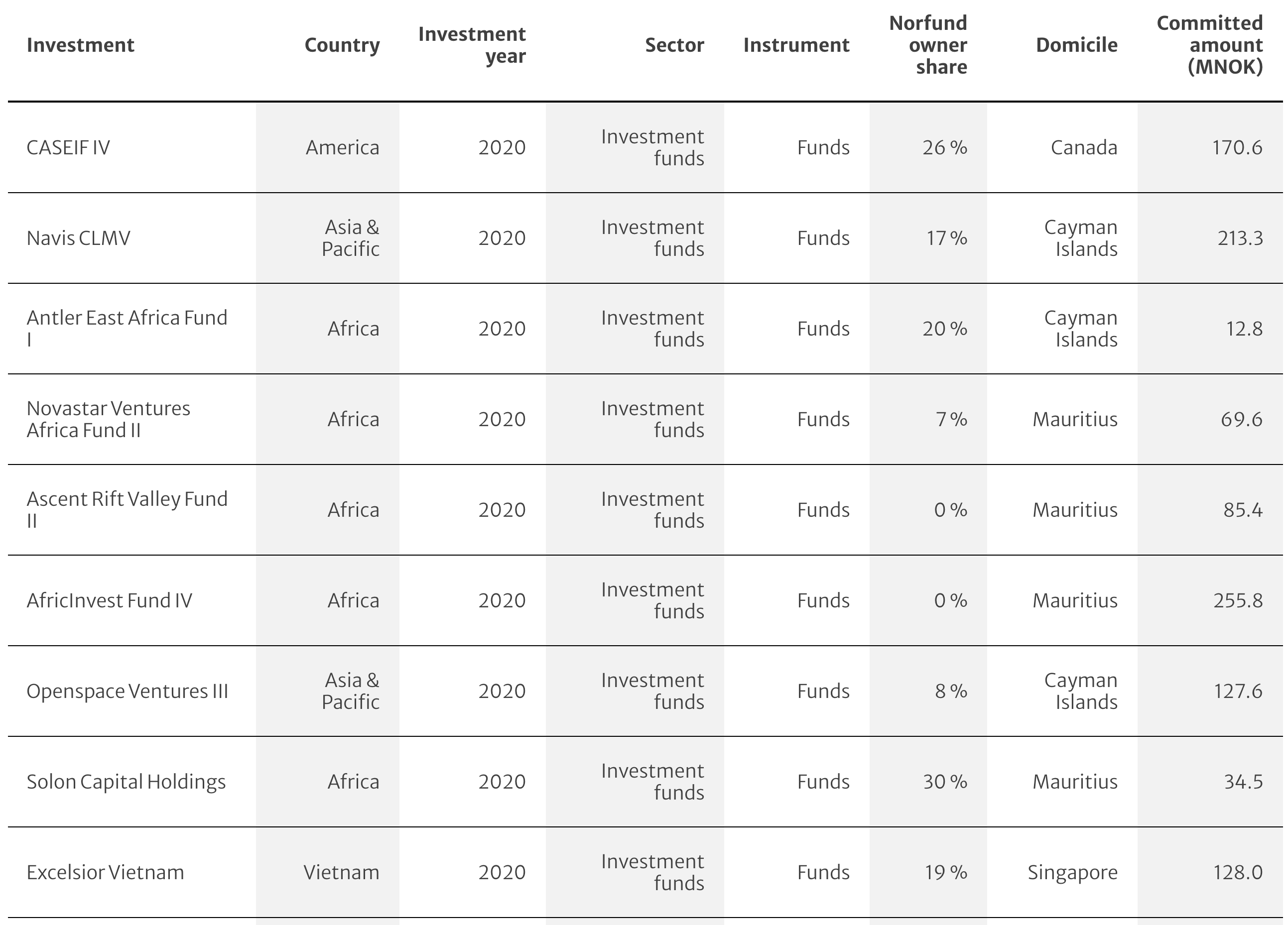

Scalable enterprises account for 23 per cent of Norfund portfolio. By the end of 2020, the portfolio included 25 direct investments and 55 fund investments.

Committed in 2020

Committed in total SE portfolio

Impact 2020

2020 was a challenging year for most of Norfund’s investees. A survey including half of Norfund's portfolio companies (all investment areas) indicates that more than 60 per cent of the companies have experienced revenue decrease as a direct or indirect consequence of COVID-19. Companies in the agribusiness, manufacturing and tourism sectors were especially hard hit.

9,300 new jobs created

As a consequence of COVID-19, the number of jobs within Norfund’s direct investments was reduced by 800. However, several of the investee companies within our funds portfolio were less influenced by the pandemic and succeeded to grow their businesses. When including these investee companies, the number of jobs in this investment area increased by 9,300 in 2020.

By the end of 2020, the total number of direct jobs in the Scalable Enterprise portfolio (excl. funds) was 12,470 and more than 200,000 when including the indirect investee companies through our fund investments.

Jobs created in Norfund's total portfolio in 2020

16 per cent revenue decrease

In 2020, revenues in Scalable Enterprise’s direct investments decreased by 430 MNOK (-16 per cent).

17 out of 26 companies had a negative development, with an average growth rate of -34 per cent. This is to a large degree a consequence of the Covid-19 pandemic.

More about the effects of Covid-19

Investments per region

Sub-Saharan Africa is the priority region of direct investments in agribusiness and manufacturing. Norfund's staff in South Africa, Kenya and Ghana played key roles in identifying and monitoring our direct investments.

With the tight travel restrictions due to the pandemic, the value of local staff and the local resources of fund managers was truly highlighted.

Investments in 2020

Total Scalable Enterprise portfolio

In addition, to empower the fund managers with whom Norfund already had a relationship, as well as some new ones, Norfund invested a total of NOK 1.171 million in five funds in Africa, three funds in Southeast Asia and one in Latin America.

Supporting existing investees in overcoming the COVID-19 crisis

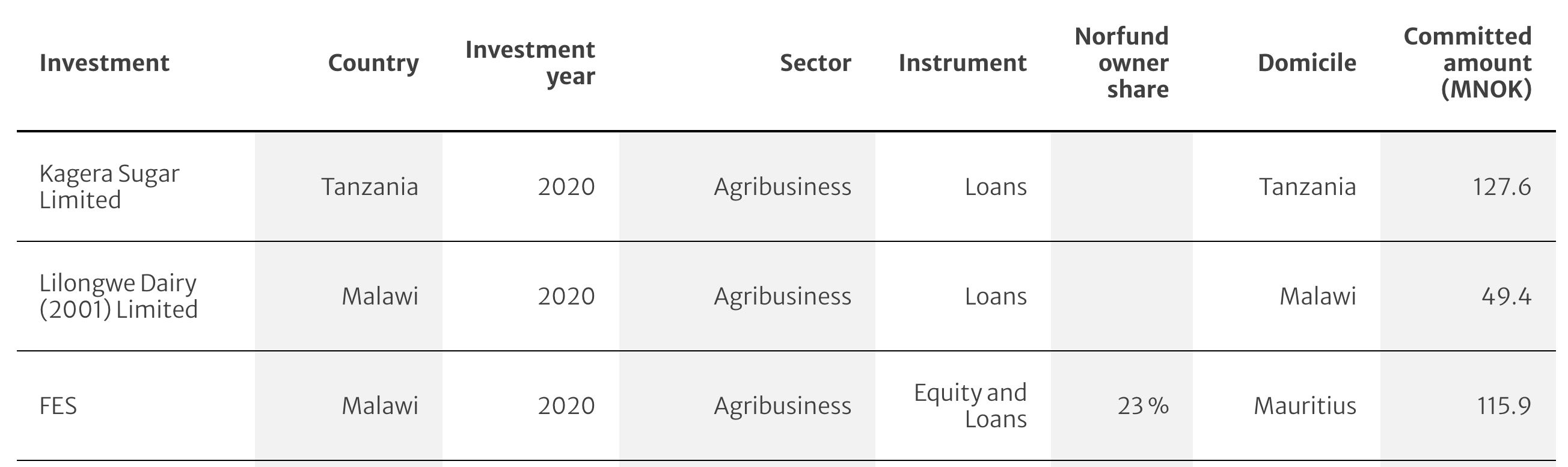

Despite the pandemic, Norfund made direct investments of NOK 293 million in three companies: Farming and Engineering Services Limited (FES), Lilongwe Dairy in Malawi and Kagera Sugar Limited in Tanzania.

We also committed NOK 382 million in COVID-19 relief loans to scalable enterprises in 2020. In Africa, the agribusiness sector and the tourism sector were hit especially hard as their markets almost disappeared overnight when the pandemic hit Europe. However, the investees showed an impressive willingness and ability to adapt to the situation, and the agribusiness companies managed, to a large degree, to regain market position after the initial disruption of the supply chain.

For example, the two tourism companies, Asilia and Basecamp, reduced their prices drastically and made visits affordable to local guests. The flower producer Marginpar handled the situation by temporarily reducing everyone’s salary while continuing to grow flowers to be able to respond to renewed international demand.

Highlights of 2020

New investee companies

New fund investments

Follow-on investments

Investing in scalable agribusinesses in Sub-Saharan Africa.

Farming and Engineering Services Limited (FES) is a Malawian provider of agricultural equipment and services. The company aims to contribute to mechanising African agriculture, ensuring food security and enhancing farmer profitability. Norfund has committed an equity and loan investment of up to NOK 116 million to FES. This investment will support the company’s growth strategy and help it expand into neighbouring countries.

Lilongwe Dairy is the major dairy producer in Malawi and buys milk from 10,000 small-scale farmers in Malawi. With capital and active ownership, Norfund aims to contribute a sustainable expansion of the dairy. In addition to creating jobs within the dairy, this will help provide farmers with a stable income and meet the increasing demand for dairy products – with local production.

Kagera Sugar Limit is a sugar manufacturing company in Tanzania. The company is the third largest sugar producer in the country and is involved in growing sugar cane and processing and distributing sugar. Norfund’s investment forms part of a syndicated loan that will finance an expansion of the company’s production capacity.

Strengthening early-stage technology companies

Openspace Ventures III is one of the new funds Norfund invested in this year. It invests in early-stage technology companies in Southeast Asia, with an emphasis on Indonesia. Digital technologies create opportunities for the establishment and growth of new businesses and business models in Southeast Asia. In addition to creating jobs and economic growth, these companies will provide rural populations with access to previously unreachable services.

Scalable Enterprises direct investments portfolio

Click here for total portfolio - scalable enterprise direct investments

Scalable Enterprises funds portfolio