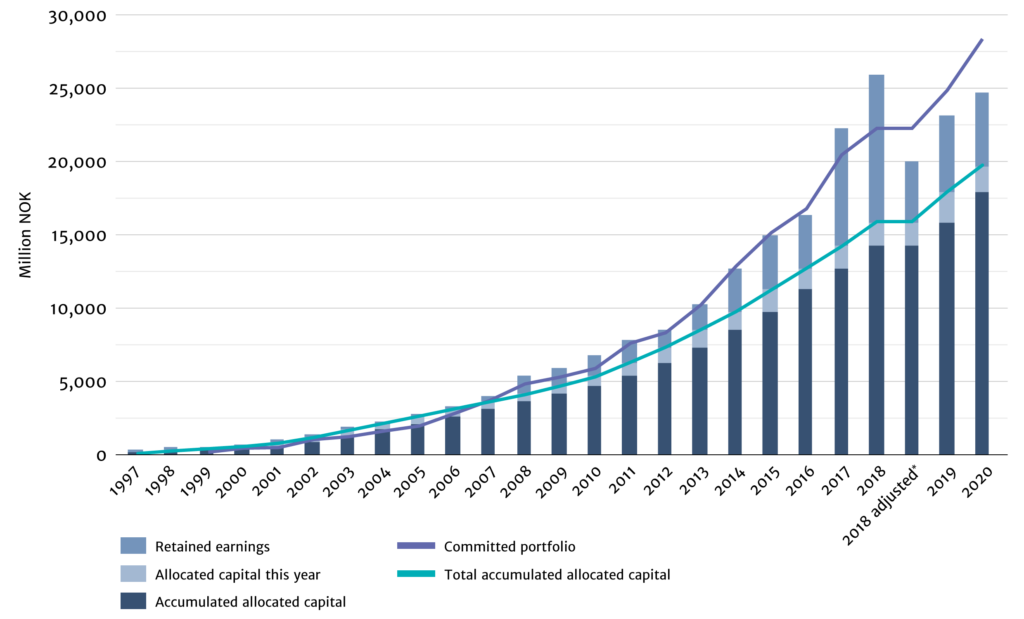

By year end 2020, Norfund had committed investments totaling NOK 28.4 billion in 170 projects. Almost half of the portfolio is invested in clean energy projects.

Norfund’s yearly investment activity has increased significantly since inception, with 2020 reaching an all-time high.

At of end of 2020, committed capital is higher than the cash available. However, the exit from SN Power has released NOK 10.9 billion, which is to be deployed in the years ahead in new, development-promoting investments. Emphasis will be on investment in renewable energy. Settlement and transfer of the SN Power shares took place in January 2021, and the realised gain will therefore be recorded in 2021.

Portfolio since inception

* Norfund changed the presentation of its accounts in 2019. Figures for 2018 have been adjusted accordingly. Preadjusted figures for 2018 are presented in lighter tints.

Priority investment areas

Norfund invests in four areas where the potential for development impact is substantial and that are aligned with the SDGs: Clean Energy, Financial Institutions, Scalable Enterprises and Green Infrastructure*.

Portfolio per investment area (MNOK)

*Green Infrastructure is a new investment area and the first investment was made in 2021.

Key Performance Indicators (KPIs) for Norfund's portfolio

Four Key Performance Indicators are defined for Norfund's portfolio.

Least Developed Countries >33%

The scarcity of capital available in Least Developed Countries (LDC) means the needs for our investments are high. 39% of Norfund's total portfolio is in these markets.

Total portfolio in LDCs

Sub-Saharan Africa >50%

Well in line with Norfund’s strategic target, 51 percent of all commitments in 2020 were in Sub-Saharan Africa. Investments in Sub-Saharan Africa now account for 55 percent of Norfund’s total portfolio.

Greenfield >15% of three years’ moving average

Investments in new power plants, startups and first-generation funds are classified as greenfield investments. Greenfield investments often carry high risk, but may be particularly important to development. The greenfield KPI is different to the other KPIs. This is a floating average of commitments over the past three years and not a portfolio level measure.

Total portfolio in greenfield

Equity and indirect equity >70%

Norfund provides capital in the form of equity, debt and fund investments. Preference is given to equity investments – both direct investments and through funds – because in most developing countries equity is the scarcest type of capital available to enterprises. In 2020,a larger proportion of the investments than normal were loans (44%). This was a result of the challenging and uncertain situation due to COVID-19, which made companies more reluctant to accept equity investments.