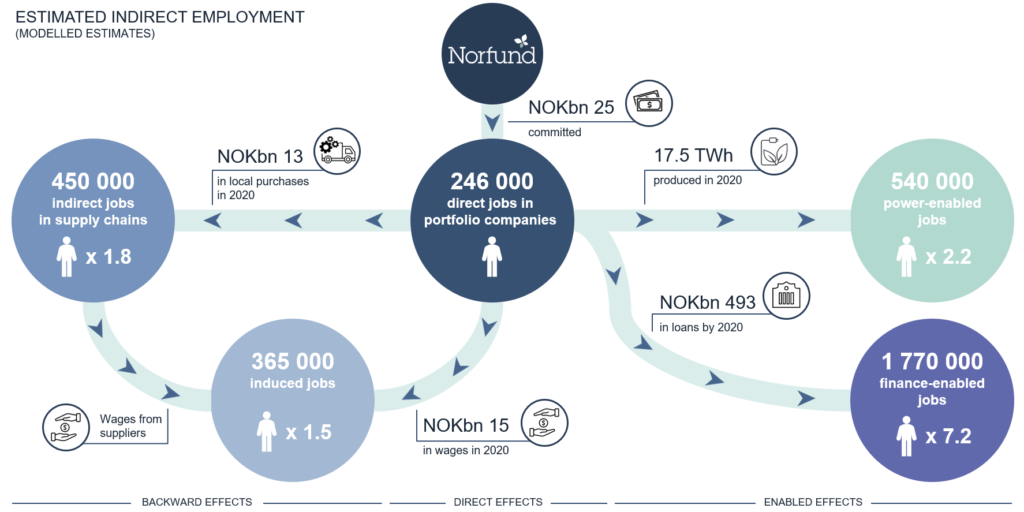

For the first time, Norfund has a applied a new model to estimate the number of jobs our investments support indirectly. The results are calculated using economic modelling and do not represent actual figures, but still give a new insight into the overall impact of our investments.

Norfund’s mission is to create jobs and improve lives. we do this by investing in and developing companies.

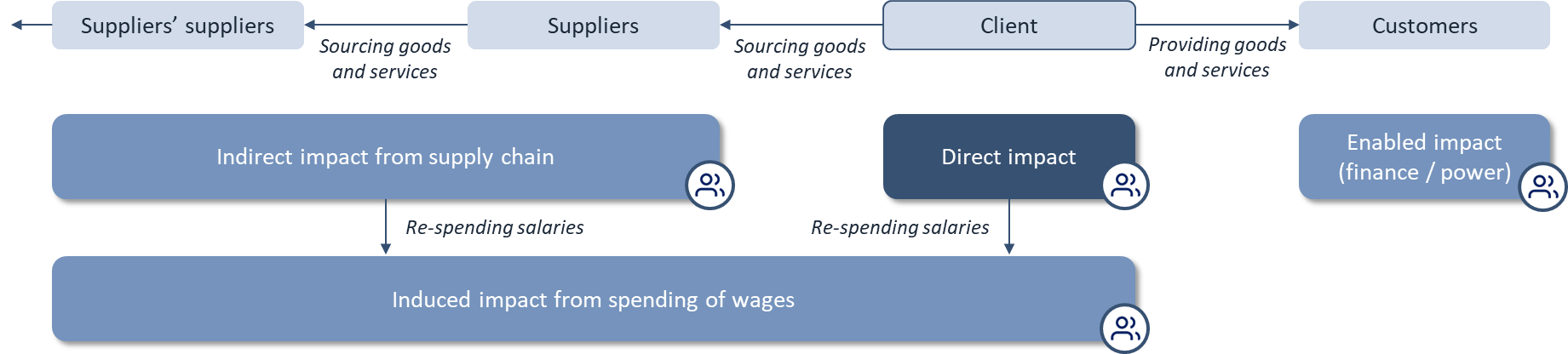

However, the companies in Norfund’s portfolio also contribute indirectly to employment and job creation when they buy goods and services from other enterprises and when the employees or suppliers’ employees spend their salaries.

Portfolio companies also enable employment through energy supply and access to finance – Norfund’s two largest investment areas.

Finally, companies contribute to government revenues and spending ability by paying taxes, stimulating further job creation in public service sectors such as health and education.

Estimated jobs indirectly supported

Although research and case studies have showed that these indirect employment effects are real and substantial, Norfund has not been able to quantify them in a meaningful way until now.

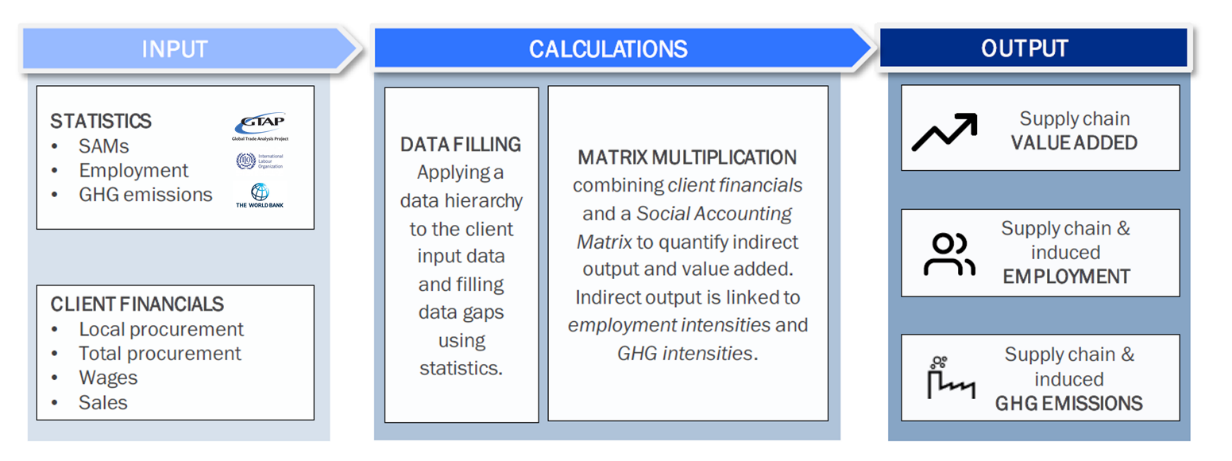

This year, we have, for the first time, applied the Joint Impact Model (JIM) to estimate the scope of the indirect employment effects from our investments. The JIM combines macro statistics with client financials to estimate indirect impacts for which observed data is not available.

The estimates are calculated using economic modelling and do not represent actual figures. Nevertheless, they provide interesting insight into the indirect impacts of our investments.

The analysis is based on the investments that we have sufficient data for the model from, which represent 54 per cent of all the portfolio companies, or 87 per cent of all committed capital in Norfund’s active portfolio by the end of 2020.

Results are reported on an aggregate level, without attribution, i.e. not taking account of Norfund’s investment share.

Direct jobs

By end of 2020, a total of 246,000 jobs are held directly in the subset of Norfund’s portfolio companies for which the model is applied. These are actual figures reported by investees, but do not include third party hires, as opposed to the harmonised indicator on direct jobs that Norfund normally reports on. The confidence level for the actual figures is high, ranging from 4 to 5 (of 5).

39 per cent of the direct jobs are in Least Developed Countries (LDC) and just over half the jobs are in Africa. Around one third of the direct jobs are held by women.

Indirect jobs

Indirect jobs from supply chains: During 2020, the companies in Norfund’s portfolio purchased NOK 13 billion of inputs from local providers in 2020.

This is estimated to have supported around 450,000 jobs in the supply chains, or 1.8 times as many jobs as held directly in Norfund’s portfolio companies.

55 per cent of the jobs from supply chains are in LDC and two-thirds are in Africa. The model estimates that 43 per cent of the jobs are held by women, while one in five jobs are held by youth (aged 15-25).

The confidence level for the modelled estimates range from 2 to 3 (of 4), depending on investee data availability and due to using 2020 fiscal year data (as the ideal is 2017-2019 fiscal years data for the current version of the model).

Induced jobs from spending of wages: During 2020, the companies in Norfund’s portfolio companies reported paying NOK 15 billion in wages to employees. Wages spent by workers in the supply chain companies also support economic activity.

It is estimated that around 365,000 jobs were supported by this local spending, or 1.5 times as many jobs as held directly in Norfund’s portfolio companies.

46 per cent of the induced jobs are in LDC and 58 per cent are in Africa.

It is estimated that 44 per cent of the jobs are held by women and one in five of the jobs are held by youth (aged 15-25).

The confidence level for the modelled estimates range from 1 to 2 (of 3), depending on investee data availability and due to using 2020 fiscal year data.

Enabled jobs by power: During 2020, the companies in Norfund’s portfolio generated a total of 17.5 TWh electricity. This is equated to output in electricity-using sectors, which in turn is translated to estimates of the number of workers needed to produce this output.

In 2020, around 540,000 jobs were supported by the power produced by Norfund’s clients, or 2.2 times as many jobs as held directly in Norfund’s portfolio companies.

Over half the jobs are in LDC and almost nine in ten of the jobs are in Africa.

The confidence level for the modelled estimates is 1 (of 2), due to using 2020 fiscal year data.

Enabled jobs by finance: By the end of 2020, the banks and other financial institutions in Norfund’s portfolio had a total outstanding loan portfolio of NOK 493 billion to businesses of all sizes.

This supported an estimated 1,770,000 workers in borrowing companies, or 7.2 times as many jobs as held directly in Norfund’s portfolio companies. 70 per cent of the jobs are in LDC and while close to half of the jobs are in Africa.

An additional 685,000 jobs are supported through these companies’ supply chains, and 1,010,000 jobs are supported by the spending of wages.

The confidence level for the modelled estimates is 1 (of 2), due to using 2020 fiscal year data.

The model does not estimate jobs in the public sector financed through increases in tax income, although there are good reasons to believe that there are such indirect effects as well.

The Joint Impact Model

The JIM can be applied to estimate indirect impacts such as value added, employment and GHG emissions. The model combines macro statistics with client financials to estimate these indirect impacts. The model is continuously improved and updated when new macro data is available.

Objective

The purpose of the JIM is to enable users to estimate the gross direct and indirect economic, employment and environmental impacts of a portfolio of investments in developing markets in a single year, and to track changes in these impacts over time.

The JIM is a portfolio-level tool that relies on modelling, using statistics reflecting sector and country averages. Impact results from the model can be considered robust at the portfolio level. Results for individual investments or small portfolios will be indicative only; alternative impact measurement tools will generally be preferred.

The Joint Impact Model (JIM) was launched in 2020. The model was developed in collaboration between AfDB, BIO, CDC Group, FinDev Canada, FMO and Proparco with Steward Redqueen.

The model was piloted in 2020 before the official launch. Norfund participated in the pilot phase of the JIM and tested the model on a subset of our portfolio companies, covering 74 per cent of Norfund’s committed portfolio by 2019. Based on the testing, Norfund provided feedback to the JIM project team.

Methodology

Overview of methodology supply chain and induced impact

The main methodology used is Input-Output modelling (IO-modelling). The key ingredient of the IO model is a Social Accounting Matrix (SAM), which is a statistical and static representation of the economic structure of an economy. The SAM describes financial flows of all economic transactions within an economy. It shows, per sector, how much a sector spends – on average – on other sectors within the local economy, on imports, on salaries, taxes and profits. A SAM allows us to calculate how local procurement and spending of wages translate into output and value added for other sectors.

The supply chain and induced money flows is subsequently linked to employment intensities, i.e. number of jobs over the financial value of output produced, to estimate the employment impact. For enabled impacts, the model relies on proxy data to quantify the additional company revenues related to these investments.

Norfund’s approach

Norfund has used the model to estimate indirect employment impacts supported through our portfolio companies where we have active commitments by end of 2020. Norfund uses ex-post estimations, i.e. based on the outstanding portfolio, and does not apply attribution, i.e. not taking account of Norfund’s investment share.

The indirect impacts are calculated at investee level and then aggregated to portfolio level and should be interpreted as directionally correct modelled estimates.

Modelled estimation results cover 87 per cent of Norfund’s commitments by the end of 2020, or 54 per cent of of all the portfolio companies in Norfund’s active portfolio, direct and through platforms and funds. The limited coverage is due to lack of sufficient data for the remaining part of the portfolio companies.

Overview of direct and indirect impacts

Norfund has so far not used the JIM to estimate indirect GHG emissions impacts or indirect value-added impacts.

More about the JIM at jointimpactmodel.com