The share of the world’s population living in poverty has fallen substantially in the past 30 years. Covid-19 reversed the trend, increasing the number of people living in extreme poverty by 70 million. Today, an estimated 685 million people (around 8% of the world) still live in extreme poverty. The global macroeconomic effects of the war in Ukraine are further worsening the situation in developing markets with the combination of these two crises hitting hard.

“Geography may dictate the location of war, but its impact transcends borders and has impacted our operating environment in West Africa.”

Naana Winful Fynn, Regional Director West Africa

Key figures clearly show the need for creating jobs, improving access to energy and finance as well as strengthening infrastructure:

- 344 million new jobs need to be created by 2030, in addition to the 205 million jobs needed to address current unemployment. To worsen this ILO estimates that working hours equivalent of 255 million full-time jobs were lost during Covid.

- 770 million people live without access to electricity, mostly in Africa and Asia. Covid-19 put an end to several years of continued progress and worsened the already-lower energy purchasing power of households in developing countries.

- 1.4 billion people remain unbanked although Covid-19 accelerated the adoption of digital financial services.

- 771 million people cannot access basic drinking water services and globally only 9% of plastic waste is recycled. In particular the pandemic saw the use of single use plastics skyrocket because of sanitary concerns.

Before Covid the funding gap to reach the UN Sustainable Development Goals for developing countries was USD 2.5 trillion, however the global economic contraction caused by the pandemic is estimated to have increased the gap by at least 50%, putting the annual funding gap at USD 3.7 trillion.

A significant increase in private capital inflows is required to bridge the gap. Norfund is the Norwegian government’s main instrument for strengthening the private sector in developing countries and therefore an important tool to help close this gap.

Norfund’s mission is to create jobs and improve lives by investing in businesses that drive sustainable development, thereby contributing to SDG 1: No Poverty. Norfund’s investments are concentrated in four investment areas that contribute directly to specific targets of the SDGs: Renewable Energy, Financial Inclusion, Scalable Enterprises and Green Infrastructure. Additionality and capital mobilisation are key priorities and help to reduce inequalities (SDG 10) between countries and to mobilise funding to developing countries (SDG 17). Norfund is a responsible investor and assesses crosscutting issues such as gender equality (SDG 5) and climate and environment (SDG 13) in our investment process.

Our strategy

In 2022, Norfund’s current strategy period came to an end, having guided us through the challenges of the Covid pandemic and the first year of the war in Ukraine. Despite a downturn in the global economy, Norfund proved to be resilient adapting the strategy to changes seen both globally and in developing markets. The Norfund team maintained record commitment levels each year in while supporting existing portfolio companies through challenging times.

Norfund’s strategy during the last four years (2019-2022)

To fulfill our mandate over the last four years, we focused on countries, sectors and instruments where capital is scarce and our development impact is likely to be strong.

This is also the foundation for our work over the next four years.

Capital is scarce where other investors are reluctant to invest because of high risk. These two criteria – additionality and impact – constitute the backbone of our strategy. Being additional also means adding non-financial value in the form of expertise and active ownership to the investments we make. Through our value-additionality, we can improve both profitability and development impact of the companies. Through the strategy period we have continuously tracked additionality and all investments have been assessed against Norfund’s additionality framework.

Investment Areas

Norfund invests in four areas where the potential for development impact is substantial and that are aligned with the SDGs: Renewable Energy, Financial Inclusion, Scalable Enterprises and Green Infrastructure. Access to electricity and finance are crucial for growing businesses. Scalable enterprises are companies with significant potential for growth and job creation. Green Infrastructure was a new investment area in 2019 with the aim of improving essential infrastructure in cities and urban areas.

Investments in these sectors contribute to job creation and improved lives in developing countries. At the start of the strategy period clear impact ambitions were set for each investment department and progress towards these has been tracked every year.

As part of the Norfund strategy for 2019-2022 ambitions were set for each investment area to reflect accumulated organic growth (that is, development in the companies after Norfund invested) on sector-relevant parameters.

- Renewable energy delivered over its ambitions with access to energy at 7.7 million new households (2022 goal: 1.5 million) and new capacity financed at 5.3 GW (2022 goal: 5 GW).

- Financial Inclusion also delivered over its ambitions with 34.7 million new banking clients (2022 goal: 15 million clients) and an increased loan portfolio of 195.9 billion NOK (2022 goal: 130 billion NOK).

- For Scalable Enterprises, the situation was more challenging, particularly due to COVID-19. Ambitions were not met, with increased revenues for portfolio companies at 1.1 billion NOK (2022 goal: 2 billion NOK) and 32,300 new jobs created (2022 goal: 50,000).

All numbers for development effects are unattributed, meaning they show the total effect of Norfund’s portfolio companies and do not necessarily indicate Norfund’s ownership stake.

Priority countries

Norfund targets 29 core countries that were selected based on three criteria:

- Competence – Norfund has solid market knowledge of and expertise in these countries.

- Additionality – they have considerable investment needs but few alternative investors.

- Attractiveness – each country has sufficient investment opportunities within Norfund’s investment areas.

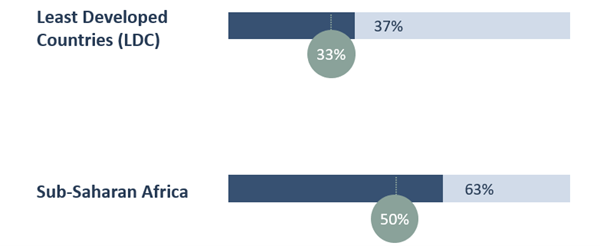

Norfund prioritizes investments in Least Developed Countries and Sub-Saharan Africa with our portfolio delivering the related KPIs at the end of the strategy period. It is increasingly important to be countercyclical in a world where investors are becoming more risk averse because of the uncertainty of the macroeconomic outlook. As UNCTAD wrote in their report: “Although the COVID-19 pandemic has affected all countries, the impact on LDCs has been particularly severe because of their reduced resilience and diminished capacity to react to the COVID-19 shock and its aftermath”.

Priority instruments

Norfund provides capital in the form of equity, debt and fund investments. Preference is given to equity investments because in most developing countries, this is the scarcest type of capital, but we also invest through loans and funds. Our provision of debt to financial institutions increases the ability of companies to provide loans to clients. Debt investment also helps diversify Norfund’s portfolio, both in terms of risk and capital reflows.

Investing in funds via trusted and skilled partners is a way to channel funds to companies that may be difficult to invest in directly, for example due to size or market and to build competent local fund managers. During the strategy period our equity share remained stable with more than 70% of our committed portfolio invested through equity.

Circulating capital for increased additionality

Circulating capital strengthens our ability to fulfill our mandate because it releases capital for new investments. Norfund uses an active, structured, and planned approach when exiting companies (for example, through sales, mergers, and initial public offerings (IPOs)). One of the highlights of the strategy period was the exit of SN Power to Scatec, the most successful exit in Norfund’s history circulating more than 1 billion dollars for new investments in developing countries.