Increased supply and access to reliable energy enables economic growth, job creation, public services and improved living standards. The climate crisis means we must do so with low-carbon solutions.

Key Achievements in 2022

committed

new capacity financed, 100% renewable

new households gained access to electricity

Strategic ambitions

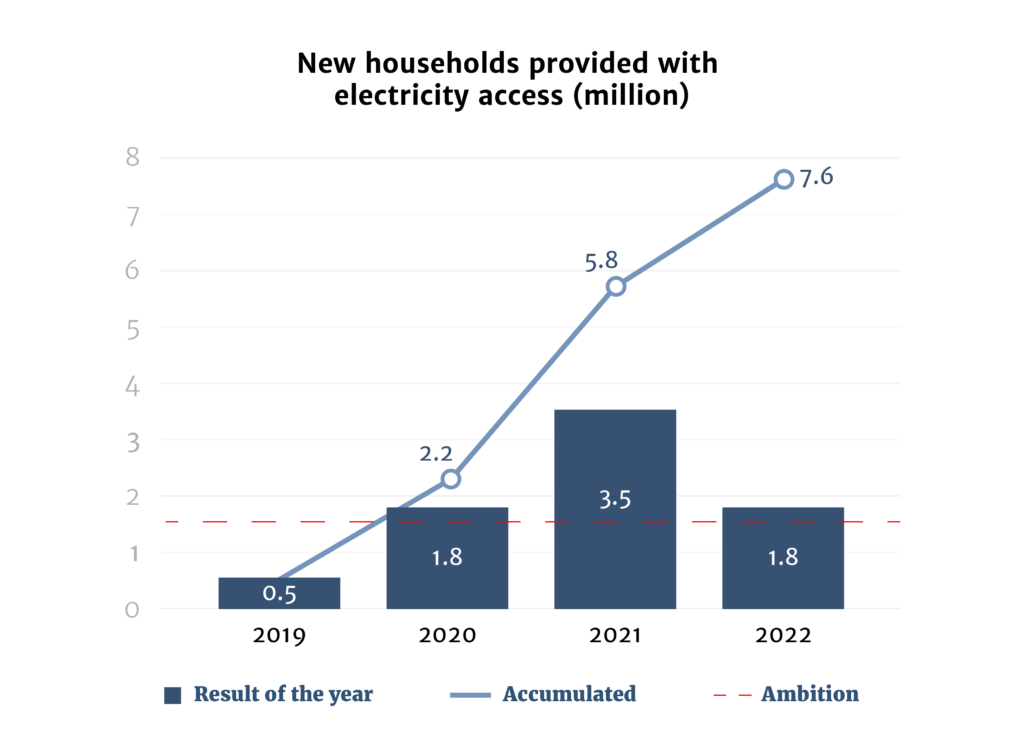

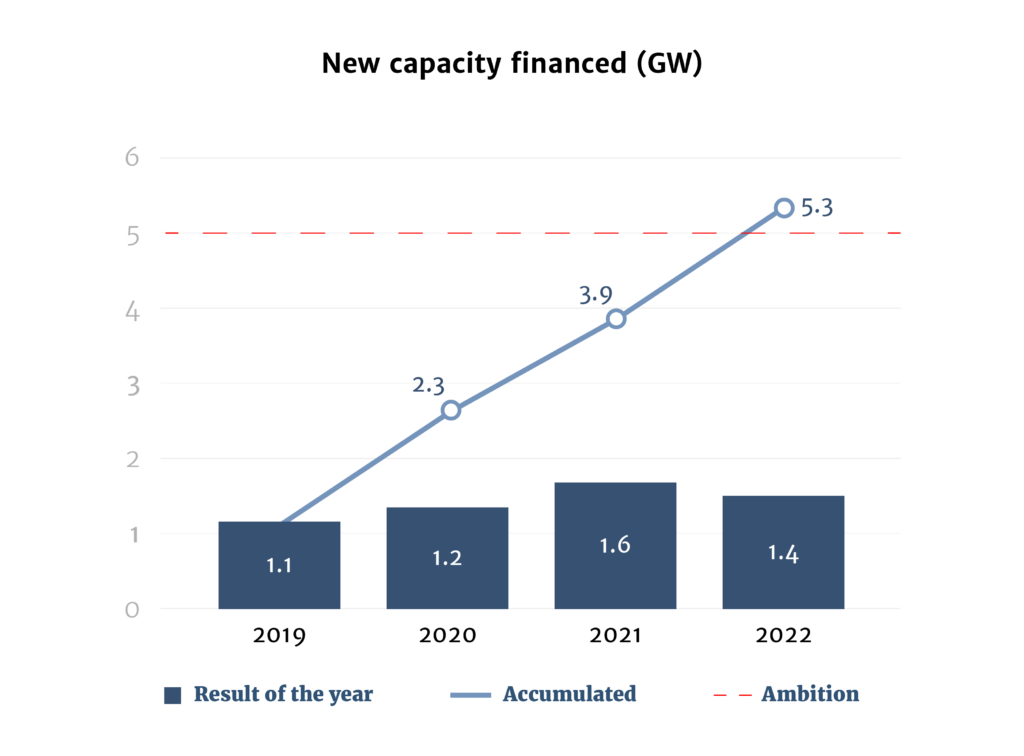

Norfund has defined the following ambitions for the strategy period 2019-2022:

- 5,000 MW new capacity, of which 4,000 MW is renewable

- 1.5 million households provided with access to electricity

Accumulated achievements 2019 – 2021

Investments and Results in 2022

committed in 2022

committed in total RE portfolio

Impact 2022

1,415 MW increased energy supply

In 2022, Norfund financed 1,415 MW of new electricity generation capacity.

The total capacity in our portfolio was 6,593 MW, of which 1,696 MW is under construction. The power plants produced a total of 15.9 TWh of electricity, an amount close to the equivalent of the combined annual electricity consumption of Kenya, Tanzania, and Uganda. This figure is up from 13.8 TWh produced in 2021 due to new assets coming online and others with an increased production.

According to our estimates on indirect job creation, around 467,000 jobs were supported by the electricity produced by the power plants in Norfund’s portfolio in 2022.

100 percent of the new capacity financed was renewable in 2022

In 2022, 100 percent of the new capacity financed was renewable. A total of 4,936 MW of the capacity in our portfolio is renewable.

Together, the renewable power plants in our current portfolio (excl. the Climate Investment Fund) produced 9.3 TWh electricity and have contributed to avoiding an estimated 6.3 million tonnes of CO2e emissions in 2022. Excluding acquired assets, the avoided emissions figure is 4.5 million tonnes CO2e. This has been calculated using the harmonized IFI approach and connected grid emission factors ‘Methodological Approach for the Common Default Grid Emission Factor Dataset’ (2022).

million tonnes greenhouse gas emissions avoided in 2022

More than 1.8 million new household connections

1,814,000 new households were provided with access to electricity through mini-grid solutions or solar home systems in 2022.

Additionally, 4.1 million units of smaller solar-powered solutions, such as lanterns, were sold to households in 2022.

Investments per Region

Investments per region in 2022

Total portfolio per region

Highlights of 2022

Extending the investment partnership with BII

British International Investments (BII) is the UK’s development finance institution, with whom Norfund has enjoyed a close working relationship over many years across diverse sectors. In 2022 BII joined Norfund in our African hydropower joint venture with Scatec and became a shareholder with a 24% interest in this partnership. This investment by BII released USD 88m in capital back to Norfund and lays the basis for future capital commitments from each of the three partners to future hydropower developments on the continent.

Construction activities

During 2022 there was considerable construction activity in the portfolio:

- Globeleq continued the construction of the expansion at the Azito power plant in Cote d’Ivoire with expected commercial operations in early 2023. Globeleq also commenced the construction of the Temane 450 MW power plant and the 19 MW Cuamba solar/battery plant in Mozambique.

- Serengeti Energy advanced the construction of the 21 MW Nkhotakota 1 solar power plant in Malawi, which is expected to reach commercial operations early 2023. They also initiated the construction of the 5 MW Baoma 1 solar power plant in Sierra Leone.

- Norfund has part financed the equity requirements of H1 Capital in the Karusa and Soetwater wind projects which both were connected to the grid in 2022 bringing an additional 300 MW to South Africa.

- Norfund is a member of the ADB led consortium financing the 77 MW Prime Road solar power plant in Cambodia. This plant is now operational.

ERCO Energia

ERCO Energia is a leading player in the Colombian distributed energy market, providing on-site generation to commercial and industrial companies, as well as owning a stake in a renewables-based power retailer to regulated customers. Norfund provided a commitment of USD 30 million equity to the business in 2022 to support the growth of the company’s activities. It represents our first energy investment in Colombia since this country was included in our investment scope.

Nordic Impact Cooperation

Nordic Impact Cooperation is a company jointly owned by Norsk Solar, Finnfund and Norfund. The company develops, owns and operates rooftop solar projects in Vietnam, South Africa and Brazil. Norfund committed USD 7,4 million to the company in 2022 to fund further growth.

CrossBoundary Energy

CrossBoundary Energy is a leading supplier of on-site power to commercial and industrial companies in Africa, including both rooftop solar as well as ground-mounted installations and small scale wind projects. In 2022 Norfund and KLP together committed USD 40million in equity to the company to finance growth.

Empower New Energy

Norfund was one of the founding investors in Empower New Energy – a Norwegian based financier of rooftop solar in Africa. In 2022 the company closed its second round of financing with Climate Fund Managers as the anchor investor. Norfund participated with a USD 15 million equity investment in a total USD 74 million equity raise.

Brighter Life Kenya 2

In 2020 Norfund joined the Development Finance Corporation in one of the first off-balance sheet receivables financing structure for the off-grid industry in “Brighter Life Kenya 1”. This entity purchases receivables from d.light’s sales of solar home and other systems in Kenya, thereby releasing capital for further growth. In 2022, we followed up with a new receivables financing structure, Brighter Life Kenya 2, where Norfund provided local currency financing in Kenyan shillings equivalent to NOK 173 million.

WeLight

In 2019 Norfund joined with Sagemcom of France and the Axion Group of Madagascar to establish the company WeLight with the goal of building and operating mini-grids in Madagascar. This initial capital contribution allowed the company to pilot the business model and gain operational experience from supplying power to 35 villages. In 2022 the company launched its expansion beyond the pilot phase and successfully raised new capital from lenders, and existing shareholders, including Norfund, committed to providing additional equity in both 2022 and 2023 to support growth with the ambition to bring power to an additional 118 villages in Madagascar and expand operations into Mali.

Renewable Energy portfolio

| Investment | Country | Investment year | Sector | Instrument | Ownership share | Domicile | Committed (MNOK) |

|---|---|---|---|---|---|---|---|

| Globeleq | Regional | 2014 | Energy | Loans Equity | 30% | United Kingdom | 2047.4 |

| Fourth Partner Energy | India | 2021 | Solar power | Equity | N/A | India | 904.9 |

| Agua Imara | Global | 2021 | Hydropower | Loans Equity | 100% | Norway | 822.9 |

| Klinchenberg | Regional | 2021 | Hydropower | Equity | 50% | Netherlands | 784.6 |

| H1 Pele SPV | South Africa | 2021 | Wind power | Loans | N/A | South Africa | 441.6 |

| CN Green Roof Asia | Vietnam | 2021 | Solar power | Equity | 50% | Singapore | 405 |

| ERCO Energia | Colombia | 2022 | Solar power | Equity | 15% | Colombia | 295.7 |

| Serengeti Energy | Regional | 2017 | Hydropower | Equity | 14% | Mauritius | 273.7 |

| Berkeley Energy Commercial & Industrial Solutions | Regional | 2020 | Other/hybrid renewables | Equity | 25% | Singapore | 260.8 |

| ICCF | Global | 2010 | Energy | Loans | N/A | Luxembourg | 208.8 |

| Cross Boundary Energy | Regional | 2022 | Solar power | Equity | 45% | Mauritius | 205.3 |

| Scatec Agua Fria | Honduras | 2014 | Solar power | Loans Equity | 45% | Honduras | 199.1 |

| FEI - Facility for Energy Inclusion | Regional | 2019 | Energy | Funds | 18% | Mauritius | 195.8 |

| Metier Sustainable Capital Fund II | Regional | 2019 | Renewable energy fund | Funds | 17% | Mauritius | 189.9 |

| Brighter Life Kenya 2 | Kenya | 2022 | Solar power | Loans | N/A | Jersey | 180.9 |

| Empower | Regional | 2022 | Energy | Equity | 18% | Norway | 149.9 |

| Evolution Fund II (Through KNI) | Global | 2019 | Energy | Funds | 14% | Mauritius | 141.2 |

| AktivCo | Regional | 2021 | Solar power | Loans | N/A | France | 134.3 |

| Greenlight Planet | Kenya | 2019 | Solar power | Loans | N/A | Kenya | 130.4 |

| M-Kopa | Regional | 2017 | Solar power | Loans | N/A | Kenya | 128.7 |

| responsAbility ACPF | Global | 2019 | Renewable energy fund | Funds | 8% | Luxembourg | 112.4 |

| Yoma Micro Power | Myanmar | 2017 | Solar power | Loans Equity | 15% | Singapore | 100.7 |

| Baobab+ | Regional | 2021 | Solar power | Equity | 28% | France | 100.7 |

| Kiangan | Philippines | 2021 | Hydropower | Loans | N/A | Singapore | 95.4 |

| Scatec Los Prados | Honduras | 2015 | Solar power | Equity | 15% | Honduras | 93.1 |

| ESCOTEL | Regional | 2020 | Solar power | Loans Equity | 31% | Mauritius | 92.8 |

| Nordic Impact Cooperation (NIC) | Global | 2022 | Solar power | Equity | 35% | Norway | 71.7 |

| d.light | Global | 2016 | Solar power | Loans Equity | 0% | United States of America | 69.8 |

| SUSI Asia Energy Transition Fund (Through KNI) | Regional | 2021 | Energy | Funds | 19% | Luxembourg | 67.5 |

| Schneider Electric Energy Access Asia | Regional | 2019 | Energy | Funds | 30% | France | 65.6 |

| Scatec Upington | South Africa | 2015 | Solar power | Loans Equity | 30% | Netherlands | 55.9 |

| WeLight | Regional | 2019 | Energy | Loans Equity | 30% | Mauritius | 55.7 |

| Scatec Mocuba | Mozambique | 2016 | Solar power | Loans Equity | 11% | Mozambique | 52.8 |

| Prime Road Solar | Cambodia | 2021 | Solar power | Loans | N/A | Cambodia | 40.2 |

| Scatec ASYV | Rwanda | 2014 | Solar power | Loans Equity | 16% | Rwanda | 37.7 |

| Nam Sim | Laos | 2011 | Hydropower | Loans | N/A | Laos | 33.6 |

| Scatec Benban | Egypt | 2015 | Solar power | Equity | 12% | Netherlands | 30.9 |

| Brighter Life Kenya 1 | Kenya | 2020 | Solar power | Loans | N/A | Jersey | 27.5 |

| Neo1 Solar Plant | Lesotho | 2018 | Solar power | Equity | 21% | Lesotho | 21.8 |

| Sunshine | Regional | 2017 | Solar power | Loans Equity | 0% | Costa Rica | 18.5 |

| Renewable Energy Holdings | South Africa | 2014 | Hydropower | Loans | N/A | South Africa | 13.4 |

| Rwimi | Uganda | 2015 | Hydropower | Loans | N/A | Uganda | 12.1 |

| Lobu Dolom HPP | Indonesia | 2021 | Hydropower | Loans | N/A | Norway | 9.9 |

| Eco-Nor | Regional | 2019 | Hydropower | Equity | 15% | Mauritius | 8.1 |