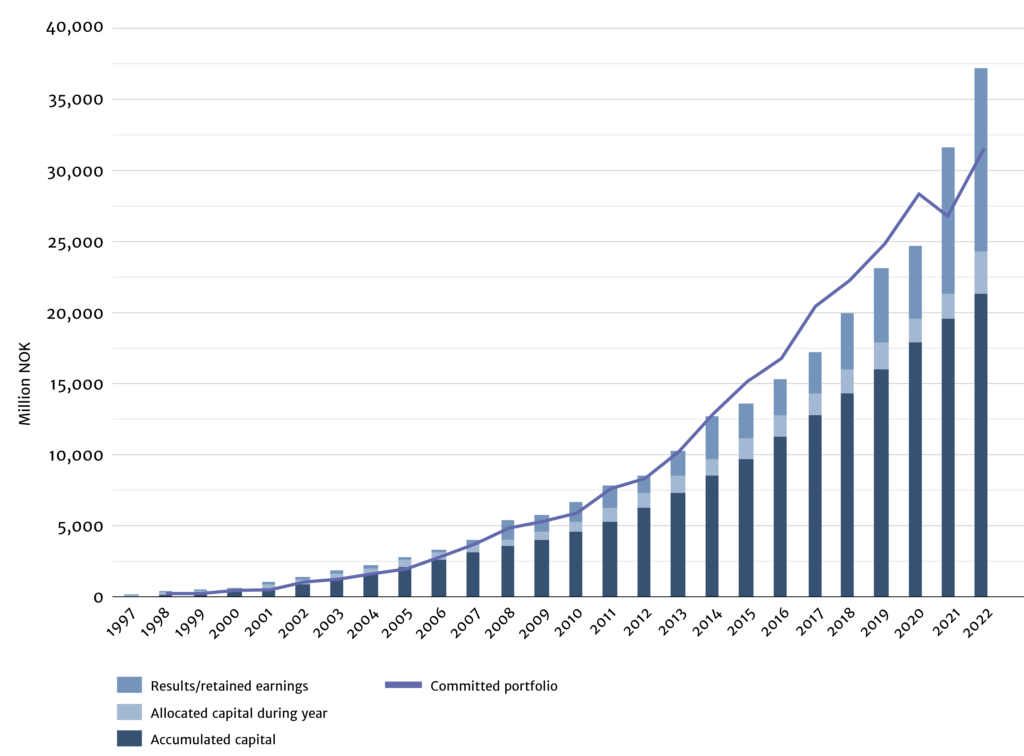

By year end 2022, Norfund had committed investments totaling 31.65 billion NOK in 226 projects. The Development Mandate accounted for 29.5 billion NOK in 219 projects, and the new Climate Mandate accounted for 2.14 billion NOK in seven projects.

Portfolio since inception

Priority investment areas

Norfund invests in four areas under the Development Mandate. These are areas where the potential for development impact is substantial and that are aligned with the SDGs: Renewable Energy, Financial Inclusion, Scalable Enterprises and Green Infrastructure. In addition we now invest through the new Climate Mandate with the Climate Investment Fund, in order to accelerate the global energy transition by investing in renewable energy in developing countries with large emissions from coal and other fossil power production.

Portfolio per investment area (MNOK)

Key Performance Indicators (KPIs) for Norfund's Development Mandate portfolio

Four Key Performance Indicators are defined for Norfund's Development Mandate portfolio.

Least Developed Countries >33%

The scarcity of capital available in Least Developed Countries (LDC) means the needs for our investments are high. 37% of Norfund's portfolio is in these markets.

Total portfolio in LDCs

Sub-Saharan Africa >50%

In line with Norfund’s strategic target, 61% of all new commitments in 2022 were in Sub-Saharan Africa, and 63% of the portfolio is now allocated in the region.

Investments in Sub-Saharan Africa

Greenfield >15% of three years’ moving average

Investments in new power plants, startups and first-generation funds are classified as greenfield investments. Greenfield investments often carry high risk but may be particularly important to development. The greenfield KPI is different to the other KPIs. This is a floating average of commitments over the past three years and not a portfolio level measure. This KPI ended in 2022.

Total portfolio in greenfield

Equity and indirect equity >70%

Norfund provides capital in the form of equity, debt and fund investments. Preference is given to equity investments – both direct investments and through funds – because in most developing countries equity is the scarcest type of capital available to enterprises.

Note: This diagram only includes the Development Mandate