By investing in banks, microfinance and other financial institutions, Norfund contributes to increased financial inclusion and in particular to more jobs in small and medium sized companies.

Key achievements in 2022

committed

new clients served

increase in lending to clients

Strategic ambitions

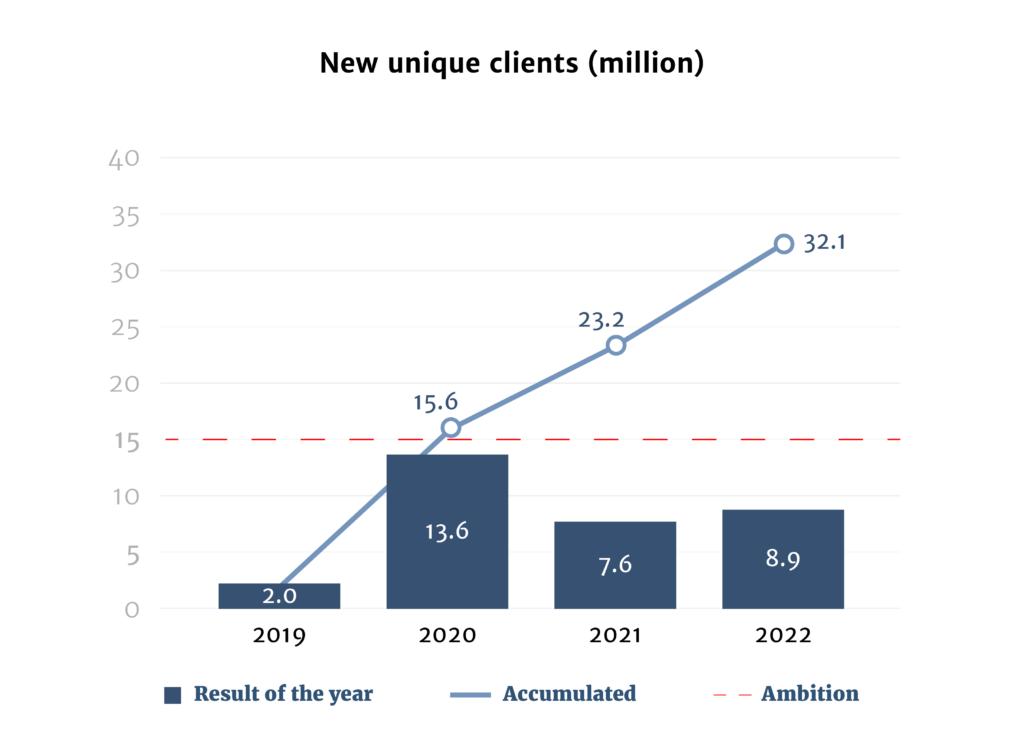

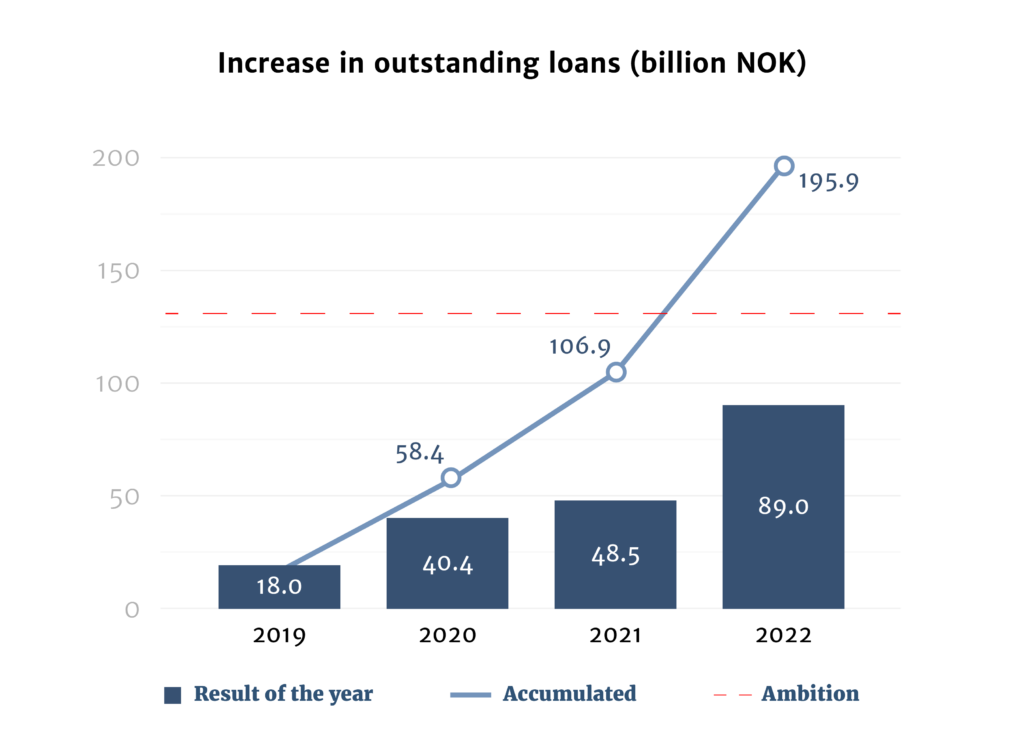

Norfund has defined two ambitions for its direct investments in financial institutions for the strategy period 2019 – 2022:

- Offer financial services to 15 million new clients

- Extend 130 billion NOK more in loans to clients

Both of these targets were reached with good margin.

Accumulated achievements 2019 – 2022

Investments and Results in 2022

Norfund is invested directly in 74 financial institutions (FI), ranging from regional banking groups and funds that invest in banks to local microfinance institutions.

committed in 2022

committed in total FI portfolio

Impact during the strategy period 2019-2022

32.1 million new clients provided with financial services during the strategy period

195.9 billion NOK increased loans to clients during the strategy period

Investments per region

In 2022, a total of 15 commitments were signed with financial institutions in Sub-Saharan Africa, Asia and Latin America.

Investments per region in 2022

Total portfolio per region

Challenging macro environment

Increased interest rates and sovereign risk are the main trends that affected the FI markets in our countries and posed challenges during 2022. For the banks we are invested in and for Norfund’s return, increased interest rates have positive effects short-term. However, in the medium-term, we are more concerned about the asset quality and the loan growth of the banks we are invested in. The increased interest rates combined with high levels of government debt in our investment countries, lead to increased default risk. For example, Sri Lanka defaulted on its foreign debt in April 2022, where we are invested in NDB Bank, which suffered as a consequence of the default. The government in Ghana also defaulted on its debt in December 2022, which may result in knock-on effects on businesses and banks’ balance sheets going forward.

Myanmar

A challenge during 2022 was the economic situation in Myanmar, precipitated by the military coup early in 2021. Economic development started to slow in 2021, and due to the continued economic slowdown, there have not been any new investments in the area in 2022. Norfund maintains three investments in the country with Yoma Bank and the microfinance institutions Myanmar Finance and Advans Myanmar, trying to operate in a very complicated commercial and regulatory environment.

Highlights of 2021

new investee companies

follow-on investments

The FI loan portfolio developed positively in 2022, with 11 new loans of a total of USD 151.5 million, in addition to the previous portfolio. Despite covid-effects and a challenging macro environment, the FI loan portfolio only has four non-performing loans out of a total of 55 loan engagements.

Large investment in Banco BDI

In 2022, the largest single investment was in Banco BDI in the Dominican Republic. Norfund completed a USD 17.8 million equity investment, which is equivalent to a 20% stake as of December 2022. BDI is a family-owned local bank that offers finance solutions to SMEs. It was founded in 1974 and is currently the 10th largest bank out of 17 in the country, and one of a few banks with SMEs as its main focus. As of December 2022, BDI has a strong brand recognition through a network of 22,718 customers served by 355 employees and 11 branches across the country. This was Norfund’s first investment in the Dominican Republic.

First investment in Democratic Republic of the Congo (DRC)

Norfund completed a USD 6.75 million investment in CRDB, which will be used to establish CRDB Bank DRC S.A in Lubumbashi, the Democratic Republic of Congo. It will be a banking subsidiary of CRDB Bank Plc., the second largest bank in Tanzania, which sees a business opportunity on increased trade between Tanzania and DRC. CRDB will be the majority shareholder (55%) and Norfund (22.5%) and IFU (22.5) as the minority strategic investors. DRC is the country with the lowest banking penetration in Africa, making this a highly additional investment. The investment from Norfund will be used for capital expenditures, licenses, and initial operating costs. The bank is at end of year 2022 waiting to receive the necessary banking licenses in order to start operations.

FinTech

Access to high quality, affordable financial services is essential for social and economic development, gender equality, resilience, and livelihoods. Unfortunately, globally around 1.4 billion people are unbanked. It is also a gender issue: women are disproportionately affected: 74% of men and 68% of women in developing countries have account ownership.

While many individuals may not have access to financial services, many more have mobile phone access, making this a useful tool to bridge this gap. FinTech can increase the breadth of available financial services. Our mandate is to increase financial inclusion, making FinTech a natural area of interest for Norfund.

In 2022, two commitments were made in this area:

- Norfund committed EUR 10 million to Wave Money, a digital payments company in West Africa. The investment is part of a syndicated loan led by IFC, of a total of up to EUR 90 million. Norfund’s senior secured loan will support the company’s growth and promote access to affordable financial services for low-income households in Norfund core countries.

- Norfund committed USD 8 million to Integra Partners Fund II, which was launched in 2021. The main investment thesis to drive access and affordability for financial services and insurance in South-East Asia. Norfund’s investment will provide capital to early growth stage fintech companies and hence improve access to financial services for underserved population in Norfund core countries in Asia.

Financial Inclusion portfolio

| Investment | Country | Investment year | Sector | Instrument | Ownership share | Domicile | Committed (MNOK) |

|---|---|---|---|---|---|---|---|

| Arise B.V. | Regional | 2016 | Banking | Equity | 33% | Netherlands | 2835.8 |

| NorFinance AS | Regional | 2013 | Banking | Equity | 50% | Norway | 502.5 |

| Yoma Bank Limited | Myanmar | 2019 | Banking | Equity | 11% | Myanmar | 294.9 |

| AfricInvest Financial Inclusion Vehicle (FIVE) | Regional | 2018 | Banking | Equity | 21% | Mauritius | 273.6 |

| Mutual Trust Bank Limited | Bangladesh | 2019 | Banking | Loans Equity | 10% | Bangladesh | 264.2 |

| Banco Promerica Costa Rica | Costa Rica | 2018 | Banking | Loans | N/A | Costa Rica | 229.2 |

| Banco Promerica Guatemala | Guatemala | 2016 | Banking | Loans | N/A | Guatemala | 226.7 |

| LAAD | Regional | 2004 | Other financial services | Loans | N/A | Netherlands Antilles | 226.7 |

| NMI Fund IV | Global | 2018 | Microfinance | Funds | 25% | Norway | 216 |

| Access Bank (Ghana) Plc | Ghana | 2022 | Banking | Loans | N/A | Ghana | 197.1 |

| Banco Cuscatlan El Salvador | El Salvador | 2022 | Banking | Loans | N/A | El Salvador | 197.1 |

| Ficohsa Honduras | Honduras | 2012 | Banking | Loans | N/A | Honduras | 197.1 |

| Hattha Bank Plc | Cambodia | 2007 | Microfinance | Loans | N/A | Cambodia | 197.1 |

| LAFISE NICARAGUA | Nicaragua | 2014 | Banking | Loans | N/A | Nicaragua | 197.1 |

| Banco Promerica El Salvador | El Salvador | 2015 | Banking | Loans | N/A | El Salvador | 187.3 |

| BDI | Dominican Republic | 2022 | Banking | Equity | 20% | Dominican Republic | 184.3 |

| NMI Fund III | Global | 2013 | Microfinance | Funds | 26% | Norway | 165.6 |

| Prasac Microfinance Institution Plc. | Cambodia | 2013 | Microfinance | Loans | N/A | Cambodia | 157.7 |

| The Co-operative Bank of Kenya Limited | Kenya | 2022 | Banking | Loans | N/A | Kenya | 157.7 |

| Fedecredito | El Salvador | 2016 | Microfinance | Loans | N/A | El Salvador | 149.5 |

| CRDB Tanzania- AFDB CRP | Tanzania | 2022 | Banking | Loans | N/A | Tanzania | 147.9 |

| Ecobank Transnational Incorporated (ETI) | Regional | 2021 | Banking | Loans | N/A | Togo | 147.9 |

| Equity Bank | Regional | 2019 | Banking | Loans | N/A | Kenya | 147.9 |

| Sathapana | Cambodia | 2008 | Banking | Loans | N/A | Cambodia | 147.9 |

| Kandeo Fund 3 Debt | Regional | 2021 | Microfinance | Funds | 8% | Canada | 147.1 |

| Banco BDF | Nicaragua | 2017 | Banking | Loans | N/A | Nicaragua | 135.5 |

| Banco Atlantida S.A. | Honduras | 2022 | Banking | Loans | N/A | Honduras | 132 |

| Quona Inclusion Fund III | Global | 2021 | Investment funds | Funds | 5% | Cayman Islands | 127.3 |

| Wave Mobile Money S.A./Wave Côte d'Ivoire S.A. | Senegal | 2022 | Other financial services | Loans | N/A | Senegal | 126.2 |

| National Development Bank | Sri Lanka | 2021 | Banking | Equity | 10% | Sri Lanka | 120.6 |

| First National Bank Ghana | Ghana | 2020 | Banking | Loans | N/A | Ghana | 118.3 |

| CIFI | Regional | 2004 | Other financial services | Equity | 34% | Panama | 116.2 |

| Banco Ficohsa Nicaragua S.A. | Regional | 2022 | Banking | Loans | N/A | Nicaragua | 98.6 |

| FCMB | Nigeria | 2019 | Banking | Loans | N/A | Nigeria | 98.6 |

| MI BANCO | El Salvador | 2022 | Banking | Loans | N/A | El Salvador | 98.6 |

| Finsocial | Colombia | 2022 | Other financial services | Loans | N/A | Colombia | 98.4 |

| Bayport Mozambique | Mozambique | 2022 | Microfinance | Loans | N/A | Mozambique | 96.8 |

| Evolution Credit Limited | South Africa | 2009 | Other financial services | Loans Equity | 12% | South Africa | 95.9 |

| LOCFUND NEXT, L.P. | Regional | 2020 | Microfinance | Funds | 29% | Canada | 93 |

| Accion Quona Inclusion Fund LP | Global | 2019 | Investment funds | Funds | 5% | Cayman Islands | 84.1 |

| Desyfin | Costa Rica | 2011 | Other financial services | Loans Equity | 23% | Costa Rica | 82.8 |

| ARREND Central America | Regional | 2015 | Other financial services | Loans Equity | 22% | Guatemala | 79.2 |

| Integra Partners Fund II LP | Regional | 2022 | Fintech fund | Equity | 10% | Singapore | 78.8 |

| Softlogic Life | Sri Lanka | 2020 | Other financial services | Loans | N/A | Sri Lanka | 73.9 |

| Banco BCT | Costa Rica | 2019 | Banking | Loans | N/A | Costa Rica | 73.9 |