Growing sustainable scalable enterprises drives industrialisation, economic growth and job creation.

Results in 2022

committed through direct investments and funds

jobs created by companies in the Scalable Enterprises portfolio

increase in revenue* (32% increase)

*direct investments only

Jobs are vital to reducing poverty. Jobs generate income, are a basis for taxation, provide security, and can enable knowledge and skills development. In most countries, private enterprises create the vast majority of jobs. This is especially true in developing countries, where more than 90% of jobs are in the private sector.

While the aftereffects of the COVID-19 pandemic are still lingering, the war in Ukraine has caused further turmoil in many of our markets. Fuel and electricity costs have increased, food inflation is rampant, and accessing capital has become both harder and more expensive. Providing patient capital and contributing to economic growth in developing countries is therefore more important now than ever.

The agribusiness sector is labour intensive and employs a large portion of the Sub-Saharan African population. The sector, however, remains largely underdeveloped in terms of productivity and participation in the most value-adding activities in global value chains. Investing in businesses throughout the agribusiness value chain can thus enable more job creation, increased competitiveness, import substitution and economic growth. Supporting and enabling agricultural production on the African continent is also critical to improving food security.

Manufacturing similarly holds great potential as an enabler of economic growth and transformation in Africa. Few countries have developed their economies without developing a strong manufacturing base.

In Africa, more than 80% of the jobs are within the informal sector. This means that the workers are unregistered, have no insurance or sick leave schemes and have limited access to training. As such, it is crucial to develop formal job opportunities and ensure that these are quality jobs where workers’ rights are protected.

Norfund’s investments in scalable, sustainable businesses help to create jobs, generate government revenue and provide the goods and services that people need.

Lack of finance is a significant obstacle to business growth. The volume of foreign direct investment in developing regions is low. Additionally, the COVID-19 crisis resulted in considerable capital outflows from emerging markets.

Growth capital, sector expertise and investors who are willing to take risks are needed to unlock the potential of scalable enterprises in developing countries.

Norfund invests in businesses both directly and through funds. Our direct investments are focused on scalable enterprises within agribusiness and manufacturing in Sub-Saharan Africa. These investments are always made in collaboration with strong industrial or financial partners.

As a direct equity investor, Norfund acts as a responsible owner. We assist developing businesses in becoming robust and sustainable while supporting their growth strategies. Norfund also provides advice to identify and mitigate environmental and social risks.

Fund investments enable us to reach a broader range of businesses and sectors together with fund managers with local knowledge and business insight than what we have capacity to do on our own. Investments are funnelled through 4 different strategic areas called (1) large-cap funds, (2) SME-funds, (3) venture funds and (4) purpose funds. The large cap funds create jobs and growth through established and well-run companies with a potential to further scale and expand its business activities. SME funds access smaller businesses that traditionally don’t have sufficient access to the capital markets. Venture funds support the establishment of new businesses, most often with a technological approach to their markets which enable them to create new and innovative business models. Lastly, purpose funds target fragile states and areas in developing countries where private capital is most scarce, and where our investments are highly additional.

Strategic ambitions

Norfund’s impact objective for this business area is to foster growth in portfolio companies, both in the form of increased employment and increased revenues.

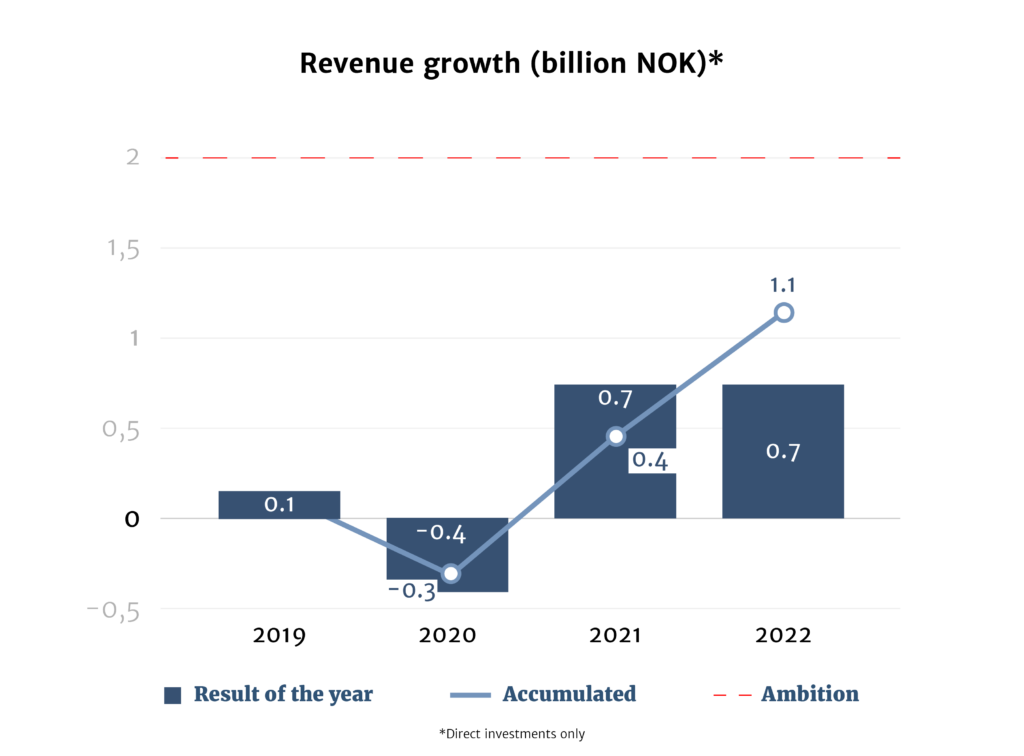

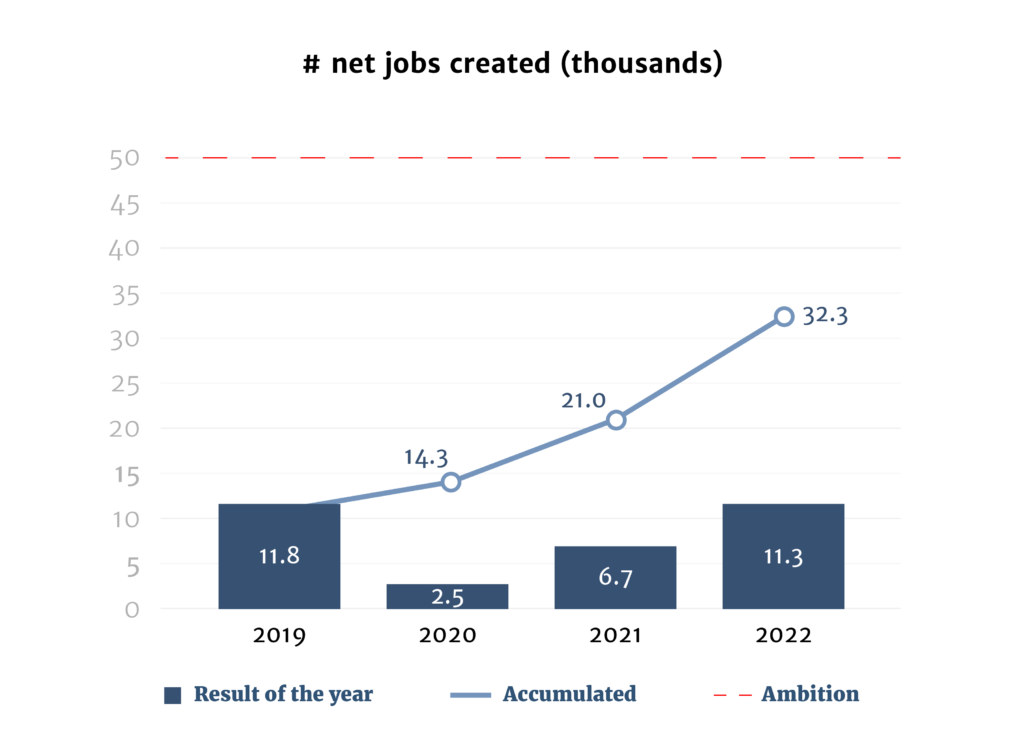

Norfund has defined the following ambitions for the strategy period 2019-2022:

- Create 50,000 jobs through direct investments and funds, whereof 3,000 jobs created in direct investments

- 2 billion NOK revenue increase in direct investments

Accumulated achievements 2019 – 2022

Investments and Results in 2022

Scalable enterprises account for 34% of the Norfund Development Mandate portfolio. By the end of 2022, the portfolio included 37 direct investments and 59 fund investments.

Committed in 2022

Committed in total SE portfolio

Impact 2022

11,300 jobs created

In 2022, the number of jobs in Scalable Enterprises’ direct investments increased by 900. When including the investee companies within our funds portfolio, the total number of new jobs created was 11 300.

The total number of direct jobs in the Scalable Enterprises portfolio (incl. funds) was over 280,000.

32% revenue increase

In 2022, revenues in Scalable Enterprise’s direct investments increased by 731 MNOK (19%). This is a substantial improvement compared to 2020, when revenues decreased by 18%, largely due to the Covid-19 pandemic.

Investments per region

Sub-Saharan Africa is the priority region of direct investments in agribusiness and manufacturing. Norfund’s staff in South Africa, Kenya and Ghana played key roles in identifying and monitoring our direct investments.

Investments per region in 2022

Total portfolio per region

Highlights of 2022

new investee companies

new fund investments

follow-on investments

AgDevCo

In early 2022, Norfund committed 20 million USD in AgDevCo, an investment fund that specializes on investments in early-stage African agribusinesses to deliver jobs, income, and food security. Norfund invested alongside the British (BII) and American (DFC) development finance institutions, who contributed 50m and 20m USD, respectively.

Established in 2009, AgDevCo’s vision is a thriving commercial African agriculture sector that benefits people, economies and the environment. The organisation contributes to this goal by providing investment capital and technical assistance to grow sustainable and impactful businesses across the agricultural value chain. In doing so, it aims to promote resilience, gender equality and the production of better-quality, more nutritious food.

Since establishment, AgDevCo has invested in 80 agribusiness spread across nine countries – Ghana, Cote d’Ivoire, Kenya, Tanzania, Uganda, Rwanda, Zambia, Mozambique and Malawi. This has contributed to the creation of more than 15,000 jobs and increased income for more than 750,000 smallholder farmers.

AgDevCo’s investments range between 2m and 10m USD. The companies are active in a number of sectors and with different types of crops, both export crops such as avocado and macadamia, food industry for domestic markets, and affordable meat protein such as poultry and fisheries. The portfolio companies are in the entire food sector from primary production, via processing to retail.

One example is the company Tropha in Malawi, which deals in macadamia nuts, chillies and peppers in the north of the country and links 2,500 small farmers to the market. To generate income while the macadamia trees grow, Tropha, in collaboration with small farmers, has provided drip irrigation so that small farmers can grow chilies and peppers that are sold to the company. In addition, AgDevCo partnered with Tropha to train farmers in integrated pest management.

CBI

In April of 2022, Norfund announced its investment in the Ghanian cement producer, Continental Blue Investments Ltd (CBI). CBI operates a facility in Tema in Ghana that produces 550,000 tons of cement per year for industrial and residential construction and infrastructure. This was the first direct investment within manufacturing that the department has done.

Cement accounts for about 7% of the world’s CO2 emissions. Most of the emissions come from the production of clinker, the most important input factor in cement. Through proven technology, however, a significant part of the clinker can be replaced with calcined clay.

By building a 405,000 tons per annum clay calcination unit, CBI will significantly reduce CO2 emissions from the production of cement, while also increasing local sourcing. The project will be the world’s largest clay calcination production unit. By replacing 30-40% of the clinker in the final product, it is expected to cut up to 20% of the overall CO2 emissions from the production of the cement compared to current practices, and 30-40% compared to standard production of Ordinary Portland Cement (including the production of imported clinker). This means estimated avoided emissions of 300 000 tCO2e/year.

CBI will be the first company in Ghana to introduce this technology, and the company plans to increase its footprint in underserved markets in Ghana by more than doubling its total cement production capacity from 555,000 tons to 1.4 metric tons per year. CBI is already one of Ghana’s top five producers of cement and directly employs over 120 people. The company has demonstrated strong growth since inception in 2018 and notable resilience during the Covid-19 crisis.

Norfund is investing alongside the Danish Investment Fund for Developing Countries (IFU) and the engineering firm FLSmidth as equity investors, with Société-Générale providing senior debt that is guaranteed by the Danish Export Agency. FLSmidth will also serve as the EPC provider of the calcined clay plant.

Scalable Enterprises direct investments portfolio

| Investment | Country | Investment year | Sector | Instrument | Ownership share | Domicile | Committed (MNOK) |

|---|---|---|---|---|---|---|---|

| Across Forest AS | Nicaragua | 2012 | Forestry and logging | Loans | N/A | Norway | 0.315 |

| Green Resources USD | Regional | 2009 | Forestry and logging | Equity | 51% | Norway | 558.9 |

| European Financing Partners SA | Global | 2006 | Investment funds | Loans Equity | 8% | None | 267.7 |

| AgDevCo | Regional | 2022 | Agriculture, forestry and fishing | Equity | 8% | United Kingdom | 197.1 |

| Phatisa Food Fund 2 | Regional | 2021 | Agriculture, forestry and fishing | Funds | 14% | Mauritius | 189.5 |

| Agrivision | Zambia | 2012 | Agriculture, forestry and fishing | Equity | 24% | Mauritius | 161.6 |

| Lake Harvest Group | Regional | 2013 | Fishing and aquaculture | Loans Equity | 33% | Mauritius | 159.3 |

| Kagera Sugar Limited | Tanzania | 2020 | Crop and animal production, hunting and related service activities | Loans | N/A | Tanzania | 145.3 |

| ASILIA (African Spirit Group Limited) | Regional | 2013 | Tourism | Loans Equity | 32% | Mauritius | 140.4 |

| Hela Investment Holdings | Regional | 2022 | Manufacture of textiles | Loans | N/A | Mauritius | 138 |

| FES Limited | Regional | 2020 | Agriculture, forestry and fishing | Loans Equity | 23% | Mauritius | 126.3 |

| SAMANU | Ethiopia | 2022 | Manufacturing | Equity | Mauritius | 108.4 | |

| Valency International Trading SARL | Ivory Coast | 2022 | Agriculture, forestry and fishing | Loans | N/A | Singapore | 98.6 |

| Lilongwe Dairy (2001) Limited | Malawi | 2020 | Crop and animal production, hunting and related service activities | Loans | N/A | Malawi | 96.6 |

| Neofresh | Regional | 2017 | Crop and animal production, hunting and related service activities | Loans Equity | 34% | Mauritius | 94.2 |

| Marginpar Group | Regional | 2018 | Crop and animal production, hunting and related service activities | Equity | 26% | Mauritius | 93.3 |

| Continental Blue Investment (CBI) Ltd. | Ghana | 2022 | Manufacture of other non-metallic mineral products | Equity | Ghana | 70.3 | |

| Redsun Raisins and Nuts | South Africa | 2022 | Manufacture of food products | Equity | 23% | South Africa | 70 |

| Vertical Agro (Sunripe & Serengeti Fresh) | Regional | 2014 | Crop and animal production, hunting and related service activities | Loans | N/A | Mauritius | 59.9 |

| Mars Investment Holdings | Mozambique | 2022 | Wholesale trade, except of motor vehicles and motorcycles | Equity | Mauritius | 57.9 | |

| Freight in Time | Regional | 2015 | Transportation and storage | Loans Equity | 24% | Mauritius | 55.6 |

| Seba Foods | Zambia | 2021 | Manufacture of beverages | Loans | N/A | Zambia | 49.3 |

| Lona Group | South Africa | 2022 | Crop and animal production, hunting and related service activities | Equity | 17% | Mauritius | 48.6 |

| Synercore Holdings Proprietary Limited | South Africa | 2022 | Manufacture of food products | Loans | N/A | South Africa | 46.5 |

| Basecamp Explorer | Kenya | 2010 | Tourism | Equity | 34% | Kenya | 36.4 |

| African Century Infrastructure Services Ltd. | Regional | 2014 | Other service activities | Loans Equity | 20% | Mauritius | 35.1 |

| African Century Real Estates Ltd. | Mozambique | 2015 | Construction of buildings | Loans Equity | 21% | Mauritius | 33.9 |

| Nyama World Malawi Ltd | Malawi | 2017 | Crop and animal production, hunting and related service activities | Loans | N/A | Malawi | 32.5 |

| Afrinord Hotel Investments | Regional | 2005 | Tourism | Loans Equity | 20% | Denmark | 24.4 |

| Associated Foods Zimbabwe (AFZ) | Zimbabwe | 2016 | Manufacture of food products | Loans Equity | 0% | Zimbabwe | 14.8 |

| Africado Ltd. | Tanzania | 2009 | Agriculture, forestry and fishing | Equity | 33% | Mauritius | 7.1 |

| African Century Nampula | Mozambique | 2017 | Real estate activities | Equity | 32% | Mozambique | 5.1 |

| UAP Properties Limited | South Sudan | 2013 | Real estate activities | Loans | N/A | South Sudan | 3.3 |

| TPS Dar es Salaam | Tanzania | 2011 | Tourism | Loans | 29% | Kenya | 3 |

| Sundry Foods | Nigeria | 2019 | Manufacture of food products | Equity | 33% | Nigeria | 80.8 |

Scalable Enterprises funds portfolio

| Investment | Country | Investment year | Sector | Instrument | Ownership share | Domicile | Committed (MNOK) |

|---|---|---|---|---|---|---|---|

| Development Partners International III | Regional | 2019 | Investment funds | Funds | 4% | Guernsey | 385.3 |

| AfricInvest Fund IV | Regional | 2020 | Investment funds | Funds | 7% | Mauritius | 286.5 |

| Helios IV | Regional | 2021 | Investment funds | Funds | 8% | Guernsey | 241.3 |

| ECP Africa Fund IV | Regional | 2018 | Investment funds | Funds | 8% | Mauritius | 237.3 |

| Navis CLMV | Regional | 2020 | Investment funds | Funds | 17% | Cayman Islands | 237 |

| Vantage Mezzanine Fund IV - USD | Regional | 2021 | Sector-agnostic fund | Funds | 10% | South Africa | 235.8 |

| Meridiam Africa Fund II | Regional | 2021 | Investment funds | Funds | 4% | France | 209 |

| Adenia Capital V | Regional | 2022 | Investment funds | Funds | 8.8% | Mauritius | 197.2 |

| Alterra Africa Accelerator Fund | Regional | 2022 | Investment funds | Funds | 16.7% | Mauritius | 197.1 |

| Verod Capital Growth Fund III | Regional | 2019 | Investment funds | Funds | 11% | Mauritius | 190.8 |

| FIPA II | Regional | 2016 | Investment funds | Funds | 38% | Luxembourg | 155.5 |

| KV Asia Fund II | Regional | 2022 | Investment funds | Funds | 8% | Cayman Islands | 147.9 |

| Vietnam Investments Fund IV | Vietnam | 2021 | Investment funds | Funds | 19% | Cayman Islands | 147.7 |

| CASEIF IV | Regional | 2020 | Investment funds | Funds | 26% | Canada | 145.4 |

| Cepheus Growth Capital Fund | Ethiopia | 2018 | Investment funds | Funds | 20% | Mauritius | 144.1 |

| Openspace Ventures III | Regional | 2020 | Investment funds | Funds | 8% | Cayman Islands | 142.2 |

| African Rivers Fund III | Regional | 2021 | Investment funds | Funds | 19% | Mauritius | 140.8 |

| Excelsior Vietnam | Vietnam | 2020 | Investment funds | Funds | 19% | Singapore | 140.2 |

| Agri-Vie II | Regional | 2017 | Investment funds | Funds | 11% | Mauritius | 136.3 |

| GroFin SGB Fund Limited Partnership | Regional | 2015 | Investment funds | Funds | 19% | Mauritius | 125.6 |

| Fanisi Capital Fund II | Regional | 2017 | Investment funds | Funds | 43% | Mauritius | 116.1 |

| AFMF: ASEAN Frontier Markets Fund | Regional | 2021 | Investment funds | Funds | 19.8% | Singapore | 98.6 |

| Ascent Rift Valley Fund II | Regional | 2020 | Investment funds | Funds | 9% | Mauritius | 96.3 |

| Cambodia Laos Myanmar Development Fund II | Regional | 2015 | Investment funds | Funds | 16% | Singapore | 94.5 |

| Ascent Rift Valley Fund Ltd | Regional | 2013 | Investment funds | Funds | 13% | Mauritius | 85.1 |

| Novastar Ventures East Africa Fund | Regional | 2013 | Investment funds | Funds | 13% | Mauritius | 83.3 |

| Novastar Ventures Africa Fund II | Regional | 2020 | Investment funds | Funds | 7% | Mauritius | 74.1 |

| Myanmar Opportunities Fund II | Myanmar | 2018 | Investment funds | Funds | 14% | Cayman Islands | 73.4 |

| CASEIF III | Regional | 2014 | Investment funds | Funds | 24% | Canada | 73.2 |

| CORECO | Regional | 2012 | Other financial services | Funds | 22% | Delaware | 73.1 |

| TNB Aura Fund II | Regional | 2022 | Investment funds | Funds | 11% | Singapore | 72.3 |

| Neoma Africa Fund | Regional | 2008 | Investment funds | Funds | 11% | Mauritius | 71.9 |

| Kinyeti Capital Ltd | South Sudan | 2012 | Other financial services | Loans Equity | 50% | South Sudan | 71.4 |

| Spear Africa Holding II | Regional | 2017 | Manufacturing | Funds | 19% | Mauritius | 69.3 |

| Fundo de Investimento Privado-Angol | Angola | 2009 | Investment funds | Funds | 26% | Luxembourg | 61.9 |

| EcoEnterprises Partners III, LP | Regional | 2018 | Investment funds | Funds | 5% | Ireland | 56.9 |

| Vantage Mezzanine Fund IV - ZAR | Regional | 2021 | Investment funds | Funds | 6% | South Africa | 52.2 |

| BPI East Africa LLC | Regional | 2015 | Investment funds | Funds | 17% | Mauritius | 51 |

| Frontier Fund | Bangladesh | 2010 | Investment funds | Funds | 11% | Cayman Islands | 49.5 |

| Africa Health Fund (Aureos) | Regional | 2011 | Investment funds | Funds | 9% | South Africa | 42.7 |

| Oasis Africa Fund | Regional | 2017 | Investment funds | Funds | 10% | Ghana | 42.2 |

| Aureos South Asia Fund (Holdings) | Regional | 2006 | Investment funds | Funds | 24% | Mauritius | 42.1 |

| ACI Motors Ltd | Bangladesh | 2021 | Manufacture of motor vehicles, trailers and semi-trailers | Equity | 5% | Netherlands | 41.5 |

| GroFin Africa Fund | Regional | 2008 | Investment funds | Funds | 9% | Mauritius | 40.2 |

| Solon Capital Holdings | Regional | 2020 | Investment funds | Funds | 30% | Mauritius | 35.8 |