Norfund invests to create jobs, improve lives and support the transition to net zero.

To fulfil our mandates effectively, we focus on countries and investment areas in which capital is scarce and our development impact is likely to be strong. Capital is scarce where other investors are reluctant to invest because of high levels of real or perceived risk. The extent to which an investment contributes to an outcome that would not have happened otherwise is often referred to as ‘additionality’. These two criteria – additionality and impact – constitute the backbone of our strategy.

Read about Norfund’s Development Mandate and Climate Mandate

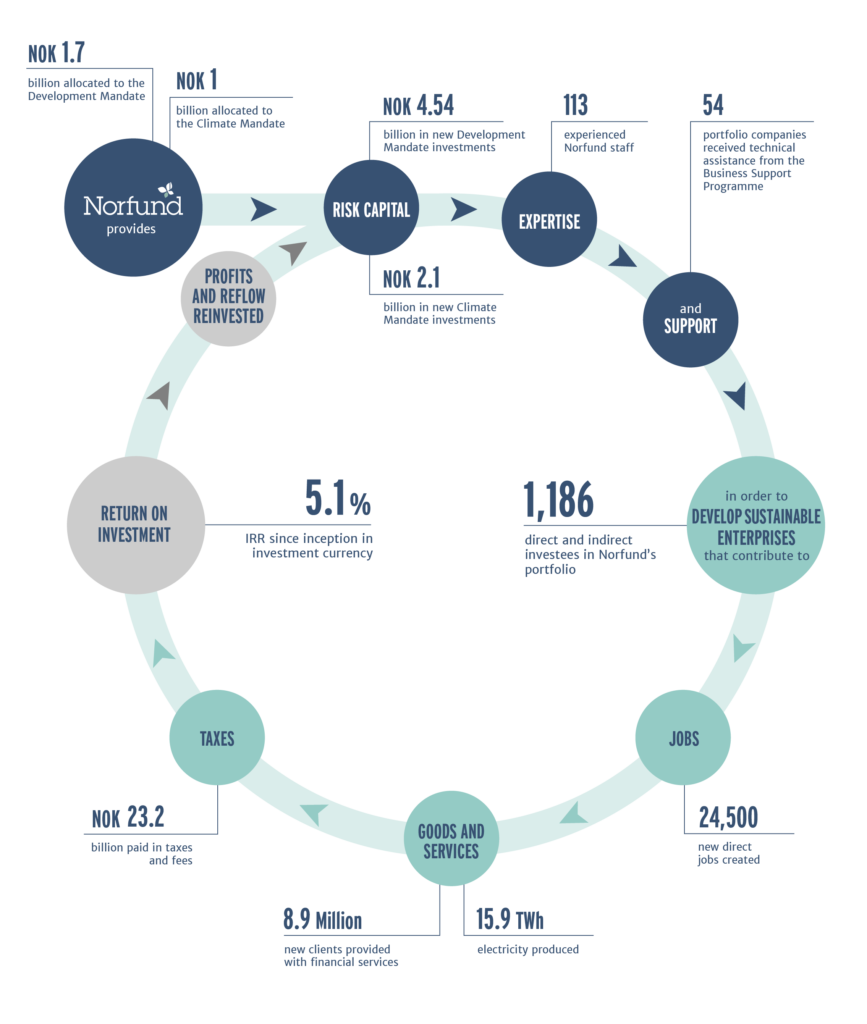

The illustration below shows how Norfund works and how investments in 2022 contributed to creating jobs, increasing energy access and supply and strengthening financial inclusion. When Norfund is no longer considered additional, the investments are exited. The proceeds are then reinvested in new enterprises with greater need for risk capital.

A responsible and active investor

Norfund is a responsible owner of our portfolio companies, contributing expertise and sound corporate governance – helping our investees to improve their environmental and social performance.

If environmental and social risks are not addressed appropriately, harm can be caused both to people and to the environment. The management of environmental and social risks is therefore an integral part of Norfund’s investment process. Norfund uses the Environmental and Social Sustainability Performance Standards of the World Bank’s International Finance Corporation (IFC). This framework covers eight standards that form the basis for our assessments and follow-up interventions.

Norfund requires high standards of business integrity from employees and business partners and communicates its no-tolerance approach to all stakeholders.

More about Norfund’s business integrity policy and other governing documents at norfund.no

Principles for Responsible Investments (PRI)

Since 2017, Norfund has been a signatory to the Principles for Responsible Investment (PRI) initiative. The PRI outlines six principles for responsible investment that Norfund has committed to and report on annually. The six principles reflect the increasing relevance of environmental, social and corporate governance issues to investment practices.

Operating Principles for Impact Management

The “Operating Principles for Impact Management” is a new investment tool that has established a market consensus for the management of investments for impact. The principles were developed by the International Finance Corporation (IFC), in consultation with a core group of stakeholders and draw on emerging best practices. They provide a reference point against which the impact management systems of funds and institutions may be assessed.

Norfund was among the first founding signatories. Since 2020, Norfund has annually published a Disclosure Statement describing how Norfund is working to align its investments and operations with the Impact Principles. In 2022, the statement and Norfund’s impact management approach was verified by BlueMark.

Norfund Disclosure Statement Operating Principles for Impact Management

A minority investor

Norfund invests jointly with other partners, and always as a minority investor. By being a significant minority investor, Norfund has influence, while supporting local ownership and encouraging other investors to invest in developing countries. Equity is our preferred instrument, and we often take up Board positions in our portfolio companies.

Strategic partners and co-investors

Norfund’s ownership will normally not exceed 35 percent of a company. This means we always depend on competent and trusted partners. Norfund has clear guidelines for how to analyse and evaluate potential partners. The partner’s areas of expertise and knowledge, previous and existing positions and relationships, other roles in the society and reputation are among the factors that are carefully considered.

Being a minority investor is a principle that is defined in Norfund’s mandate. This can enable other international investors to invest in developing countries and supports local ownership.

Co-investing this way enables Norfund to leverage additional capital and to provide the industrial and local knowledge needed for each investment.

Overview of Norfund partners at norfund.no

Responsible Tax Policy

Norfund’s Responsible Tax Policy, adopted by the Board of Directors in 2019, sets out the principles that guide our approach to tax-related issues and what we expect from our portfolio companies and co-investors. The guidelines are based on internationally agreed principles and were drawn up with input from civil society. It consists of seven fundamental principles. They include requirements regarding transparency, that Norfund’s investees shall pay taxes to the countries in which they operate and where the income occurs, and that third countries must only be used when necessary to meet the fund’s development priority of investing in high-risk markets and to protect the fund’s capital.

Business Support

Norfund’s Business Support facility aims to enhance the sustainability and development effects of our investments.

By leveraging Business Support, we can exercise responsible ownership and create value additionality for our investments in high-risk sectors and segments.

Following the Norfund Development Mandate strategy, Business Support projects actively target human rights, anti-corruption, climate and environment, and gender equality.

Frontier Facility

The Frontier Facility (formerly known as the Project Development and Risk Mitigation Facility) is funded by the Norwegian Ministry of Foreign Affairs.

The facility serves two purposes:

- Enabling early phase project development within Norfund’s investment areas

- Risk mitigation for commercial investors that wish to invest in Norfund funded projects, throughout the project cycle

The Frontier Facility is primarily used for projects that have a risk level which is higher than other investments in Norfund’s core portfolio and to be used in our most demanding markets – in particular fragile states and Least Developed Countries (LDCs). These projects are therefore managed as a separate facility and are not included in Norfund’s overall portfolio valuation.