Climate change is one of the most pressing challenges of our time, with severe consequences for both people, nature and economies. The impact disproportionally affects developing countries and is a major threat to the goal of eradicating poverty. Norfund is committed to supporting a just transition towards net zero in developing countries, in line with the Paris agreement.

Our work on biodiversity and nature is core to our work on environmental and social risks, integrated in the investment process.

Norfund’s climate position outlines the way in which Norfund intends to invest in a clean and climate resilient future in developing countries. It is built on three pillars: resilience, reduction, and risk.

By resilience, we mean the capacity of individuals, economies and societies to cope with the effects – physical and economic – of climate change. Job creation and economic development enables such resilience.

Norfund’s contribution:

-Building climate resilience by prioritizing investments and job creation in the Least Developed Countries (LDCs) and Sub-Saharan Africa

-Increasing resilience in Norfund’s existing investments by implementing risk reducing measures

-Exploring opportunities to enhance adaptation and build resilience in the countries where we operate by investing in adaptation and resilience solutions

By reduction, we mean reducing or avoiding emissions to enable the transition to an energy system aligned with the Paris Agreement.

Norfund’s contribution:

-Managing the Climate Investment Fund on behalf of the Norwegian Government, with the primary goal of avoiding and reducing greenhouse gas emissions

-Investing in climate solutions such as large-scale renewable energy (where the Climate Investment Fund is the most important vehicle), transmission, waste management and water solutions to help avoid emissions and facilitate the transition to a low-carbon economy.

-Aligning all new investments with the objectives of the Paris Agreement, in line with the EDFI Statement on Climate and Energy Finance)

-Charting a path to achieve net zero portfolio emissions by 2050, in line with the EDFI Statement on Climate and Energy Finance. This path must balance the need for rapid decarbonization at the global level with the needs for development and growth in emerging economies. Further, it will be a stepwise process, reflecting uncertainties, lack of data and our investees´ capacity for implementation.

-Avoiding fossil fuel investments in line with our fossil fuel exclusion list (with exemptions for Paris-aligned gas-fired power until 2030)

By risk, we mean the physical risks, such as flooding, drought and cyclones, and transition risks, such as policy, technology and reputational risk, that impact companies. These risks can also be turned into opportunities.

Norfund’s contribution:

-Assessing material climate risks (physical and transition) for sectors, geographies, and investees

-Using our role as owner to build capacity and support our investees to manage climate impacts, reduce financial risk and seize climate-related business opportunities where relevant

-Disclosing information in line with the Task force on Climate related Financial Disclosures (TCFD) recommendations

-Integrating climate risk in our Enterprise Risk Framework

Norfund’s 2022 key climate contributions

New electricity capacity

New capacity financed in 2022, 100% renewable

Climate finance

Committed climate finance in 2022*

Avoided emissions

estimated avoided emissions in 2022**

*Norfund uses the OECD DAC Rio Markers for Climate to define climate finance. By evaluating projects against the Rio Markers, Norfund identifies activities targeting the Rio convention objectives for climate change on adaptation and mitigation.

**Avoided emissions are estimated using the harmonized IFI approach “GHG Accounting for Grid Connected Renewable Energy Projects” (see more about the calculation of the emissions factors in the document: ‘Methodological Approach for the Common Default Grid Emission Factor Dataset’ (2022)). The estimation includes all operational renewable power producers where Norfund has an ownership share or has extended a loan, that are providing electricity to the grid (such as large-scale solar power plants), or substituting power from the grid (such as “captive power” solutions that provide power directly to a consumer, for instance rooftop solar). It does not include companies providing pure off-grid solutions such as Solar Home Systems. The figures are not attributed to Norfund’s share.

Norfund’s portfolio companies have, since the fund was established in 1997, installed around 8,900 MW new renewable energy capacity (incl. capacity under construction) under the development mandate. These portfolio companies contribute to avoiding an estimated 10 million tonnes of CO2 emissions annually. This is equivalent to twice the capacity of the Norwegian government’s CCS project Langskip, which will be able to store 5 mill tonnes CO2e (once fully operational).

TCFD (Task force on Climate related Financial Disclosures) report summary

Norfund’s 2022 report, in line with the TCFD recommendations, can be found at the link below. We recognize that managing climate-related risks and opportunities is an ongoing process and we remain committed to enhancing our practices and processes.

Norfund’s climate footprint

Norfund aims to report on absolute emissions scope 1, 2, and 3 in line with PCAF and the GHG protocol. Norfund’s climate footprint consists of emissions from Norfund’s own operations, but most importantly, financed emissions – emissions from the companies in Norfund’s investment portfolio. The latter is by far the largest and also the most challenging to measure.

Financing a just transition to net zero in developing countries will require us to not only invest in already low-emitting sectors, but also sectors that are key to economic development with high initial emissions and contribute to their decarbonization path. These investments will add to our portfolio carbon footprint in the short to medium term.

What is scope 1, 2 and 3?

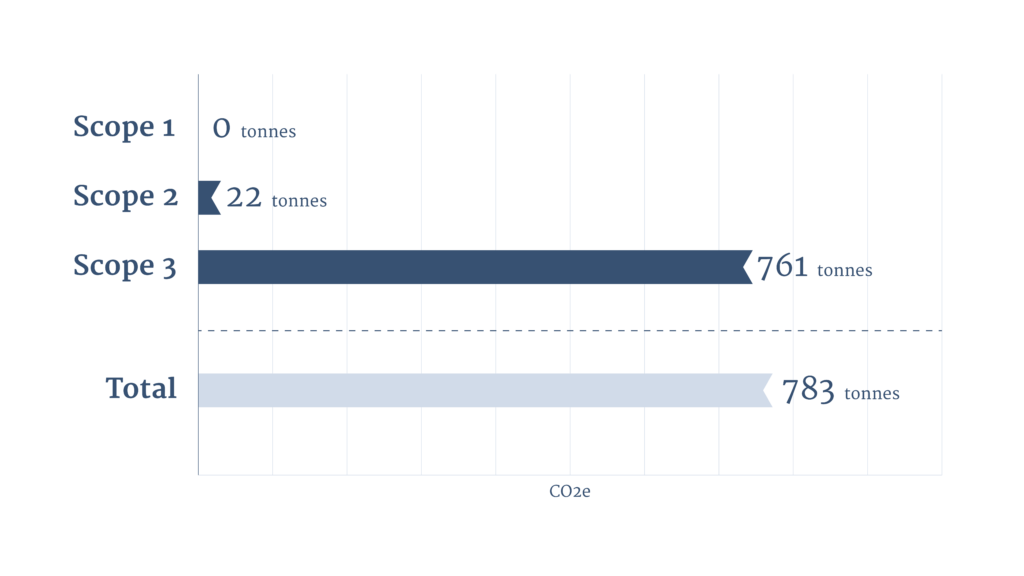

Scope 1 emissions refer to the direct greenhouse gas emissions that result from an organization’s activities or are within its control (e.g. emissions associated with fuel combustion in boilers, furnaces, or vehicles). Scope 2 emissions refer to the indirect emissions resulting from an organization’s consumption of energy (e.g., purchase of electricity, steam, heat, or cooling). Scope 3 emissions refer to all other indirect emissions that occur throughout an organization’s value chain, such as those resulting from business travel, the purchase or sale of goods and services, the disposal of waste, or a company’s investment portfolio.

GHG emissions from Norfund’s own operations

As an investor, the activities in our investment portfolio constitute the majority of Norfund’s emissions, while emissions from own operations are primarily office related. Nonetheless, Norfund requires companies to have strong environmental management, and we believe it is important to start with ourselves by working to minimise our own footprint and continuously improve our operations.

Norfund’s 2022 emissions in tonnes Co2e per scope

Norfund has no scope 1 emissions. Emissions in scope 2 indirect upstream activities are from electricity and heating for the Oslo office, but for now excluding the regional offices. Within scope 3 indirect upstream activities, emissions are from business travels and waste. Emissions from business travels via air travel are from all Norfund offices, whereas emissions from waste are only from the Oslo office.

Norfund’s Oslo office was certified as an Eco-Lighthouse (Miljøfyrtårn) in 2022 and uses this framework to improve our internal environmental performance. As part of the framework, Norfund reports GHG emissions from its own operations annually.

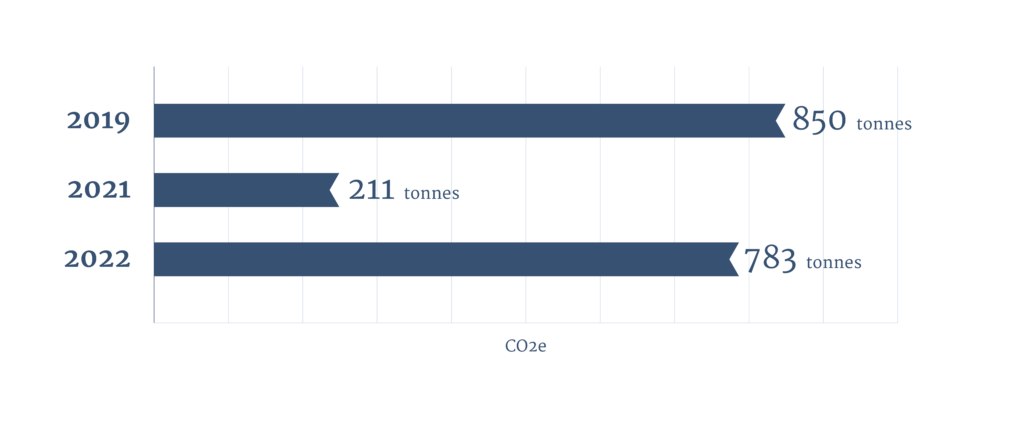

Norfund’s emissions in tonnes Co2e per year

Covid-19 affected the activity and thereby GHG emissions for Norfund in 2021, and there is reason to believe that Covid-19 has affected the result for 2022 in the same way, especially affecting travel activity in Q1 and Q2. For 2022, we reported emissions from air travel for all Norfund offices, while for 2019 and 2021 the report covers the Oslo office only. As Norfund obtained the Eco-Lighthouse certification in 2022, we calculated emissions for 2019 in addition to 2021, in order to have a baseline with pre-covid data, hence no report for 2020.

Air travel accounts for more than 95% of Norfund’s emissions from own operations, and this is an indication of where Norfund should focus efforts to reduce emissions. According to Norfund’s business travel guidelines, we always assess the need for physical meetings, and if digital meetings could be a suitable option. In 2023, we aim to report GHG emissions for more activities and define goals per scope 1,2, and 3.

We work continuously to create more environmentally friendly operations and better working environments, and we have identified approximately 25 measures to be implemented and followed up within the organisation in 2023, covering travel, energy, waste management, procurement, working environment and canteen.

Eco-Lighthouse certification

Eco-lighthouse is Norway’s most widely used certification scheme for enterprises seeking to document environmental efforts and demonstrate social responsibility. The certification has been approved by the European Commission and is valid in the EU. As an integral part of the certification, an annual climate and environmental report is submitted. The GHG emission calculations in the Eco-Lighthouse portal correspond to the GHG protocol. The portal also includes a holistic environmental management system with a valuable tool to monitor progress or regression in our work to create more environmentally friendly operations and safer work environments. As an Eco-Lighthouse, Norfund works towards satisfying requirements and implementing environmental measures on a systematic and ongoing basis.

Norfund’s financed emissions

Financed emissions are emissions from the activities of companies and projects in which Norfund is invested. This is where Norfund’s largest share of emissions are, and estimating these is a priority for us.

During 2022, we have made significant progress on collecting and mapping the availability and quality of data as well as the tools available for estimating emissions. But data availability and quality are a challenge in ours markets: only around 10% of portfolio companies were able to report some GHG emission data, most of it unverified by an external party. We have been testing the Joint Impact Model (JIM) to estimate GHG emissions from our portfolio companies (scope 1, 2 and 3) and attribute them to Norfund, but it turned out to be more difficult than we thought. We were therefore not able to estimate our financed emissions from our investment portfolio as we aspired to do this year. We do report on scope 1, 2 and 3 for own operations. Going forward we will continue to work on our methodologies and data capturing to be able to report on financed emissions.

Use of the Joint Impact Model (JIM) to estimate GHG emissions

Since 2020, Norfund uses the Joint Impact Model (JIM) to estimate the indirect job effects of our portfolio companies. In 2022, we have assessed how this can also be used to estimate greenhouse gas emissions from the companies in Norfund’s portfolio. The JIM is a publicly accessible tool developed as a result of a collaboration between several development finance institutions (DFIs) and multilateral development banks (MDBs). The JIM and its methodology for attribution is fully aligned with the Partnership for Carbon Accounting Financials (PCAF) Global Standard for the Financial Industry.

However, as with any model, the JIM has its limitations. Estimates of indirect impact are based on industry averages, which may differ from individual company characteristics – and so company specific (rather than industry wide) GHG emissions reductions will not be captured. It relies on data that may be incomplete or inaccurate, and it does not account for indirect emissions from changes in land use. Despite these limitations, we believe the JIM will provide valuable insights into where the emissions in the portfolio are, including scope 1, 2 and 3 and will seek to apply the model for 2023.